Uplifting customer confidence to find the best value service that meets their needs.

With the global shift towards more transparent and customer-centric banking practices, Westpac has been at the forefront of the open banking movement in Australia.

Beginning on 1st July 2020, eligible Westpac customers were given the ability to share their credit and debit card data, along with deposit and transaction account data, with accredited third parties. The types of data that were made available for sharing included personal customer information, transaction details, and usage data.

With a history spanning over 200 years, Westpac has consistently leveraged technology to enhance its banking services, catering to a wide range of customers including individuals, SMEs, and large corporations.

Open Banking vision and strategy at Westpac

Westpac's approach to open banking is centered around leveraging its storied history and trust with customers to build a future-ready banking framework that prioritizes secure data sharing and customer-centric solutions. Their strategy involves a multi-pronged approach:

- Customer-centric services: Developing services that are tailored to the needs and preferences of individual customers, enhancing their banking experience and financial well-being.

- Collaborative ecosystems: Creating an ecosystem where fintechs and other financial service providers can collaborate, innovate, and contribute to a diverse range of products that benefit consumers.

- Data security and privacy: Upholding stringent data security and privacy standards to protect customer data as it is shared across platforms and services.

- Regulatory alignment: Ensuring that all open banking practices are in compliance with the CDR and other relevant regulations, demonstrating Westpac's commitment to ethical and responsible banking.

Objectives

The primary goals were to enhance trust through robust security measures, simplify the data sharing process, and empower customers with clear information for informed decision-making. Westpac was committed to ensuring accessibility for all users, delivering a consistent experience across all platforms, and offering personalized services.

Goals

- Deliver personalized banking experiences by leveraging shared data to meet individual customer needs.

- Provide customers with transparent information to enable informed consent and control over their data.

- Establish a high level of trust by ensuring robust security and privacy protections.

- Create a streamlined and accessible user interface that provides a consistent experience across various devices and platforms.

Research and conceptualization

We began by studying the UK open banking standards and cross-referencing them with the Australian banking standards to identify key differences and necessary adaptations. Concurrently, an exhaustive analysis of Australian regulatory requirements was undertaken to ensure that the proposed framework not only complied with local legislation but also met the stringent expectations of Australian customers in terms of data privacy and security.

Strategy workshops

We organized a series of collaborative workshops with UK Fintech experts, security consultants, and our experience design team to exchange ideas and best practices. These workshops served to align the various stakeholders on the goals and priorities for the consent portal, ensuring a cohesive approach to managing customer consents and data sharing.

Customer personas

We created three personas that illustrate a range of potential users.

- Persona 1: The tech-savvy millennial

- Persona 2: The small business owner

- Persona 3: The retired baby boomer

Each persona has different needs and priorities, which Westpac would need to address through its UX design to ensure the Open Banking platform is inclusive and meets a broad range of customer requirements.

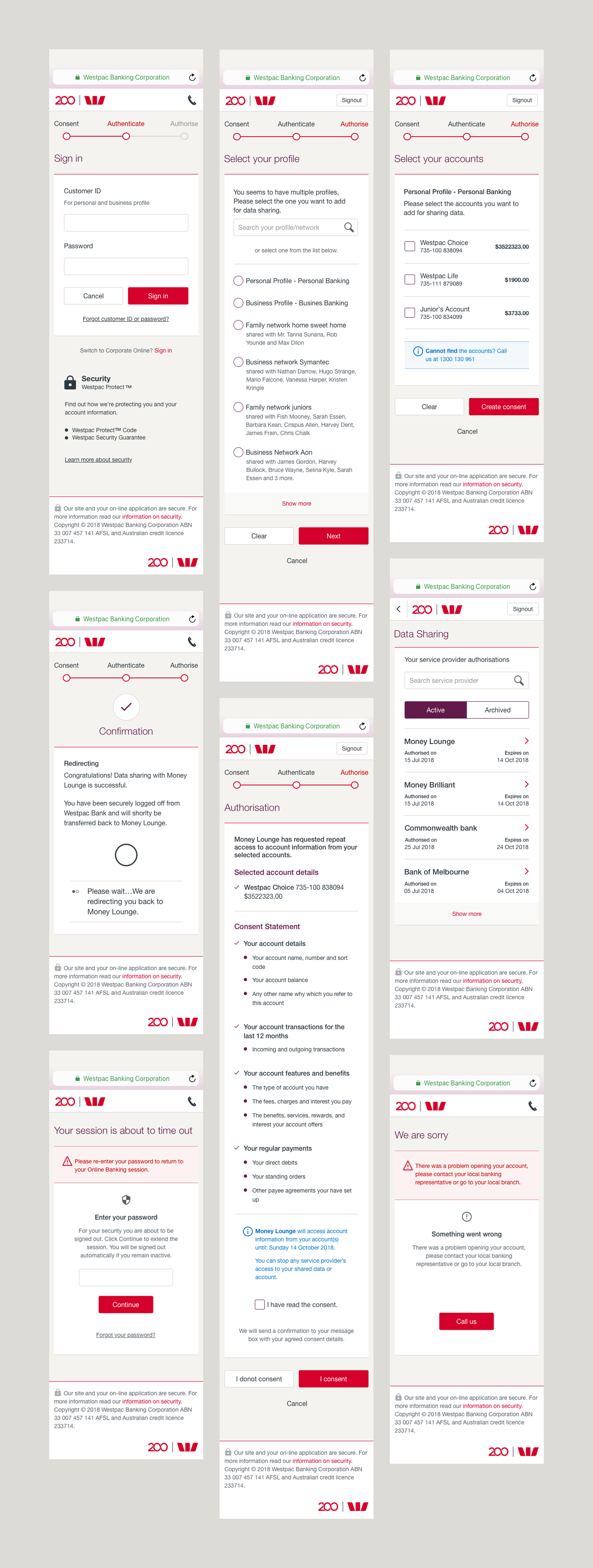

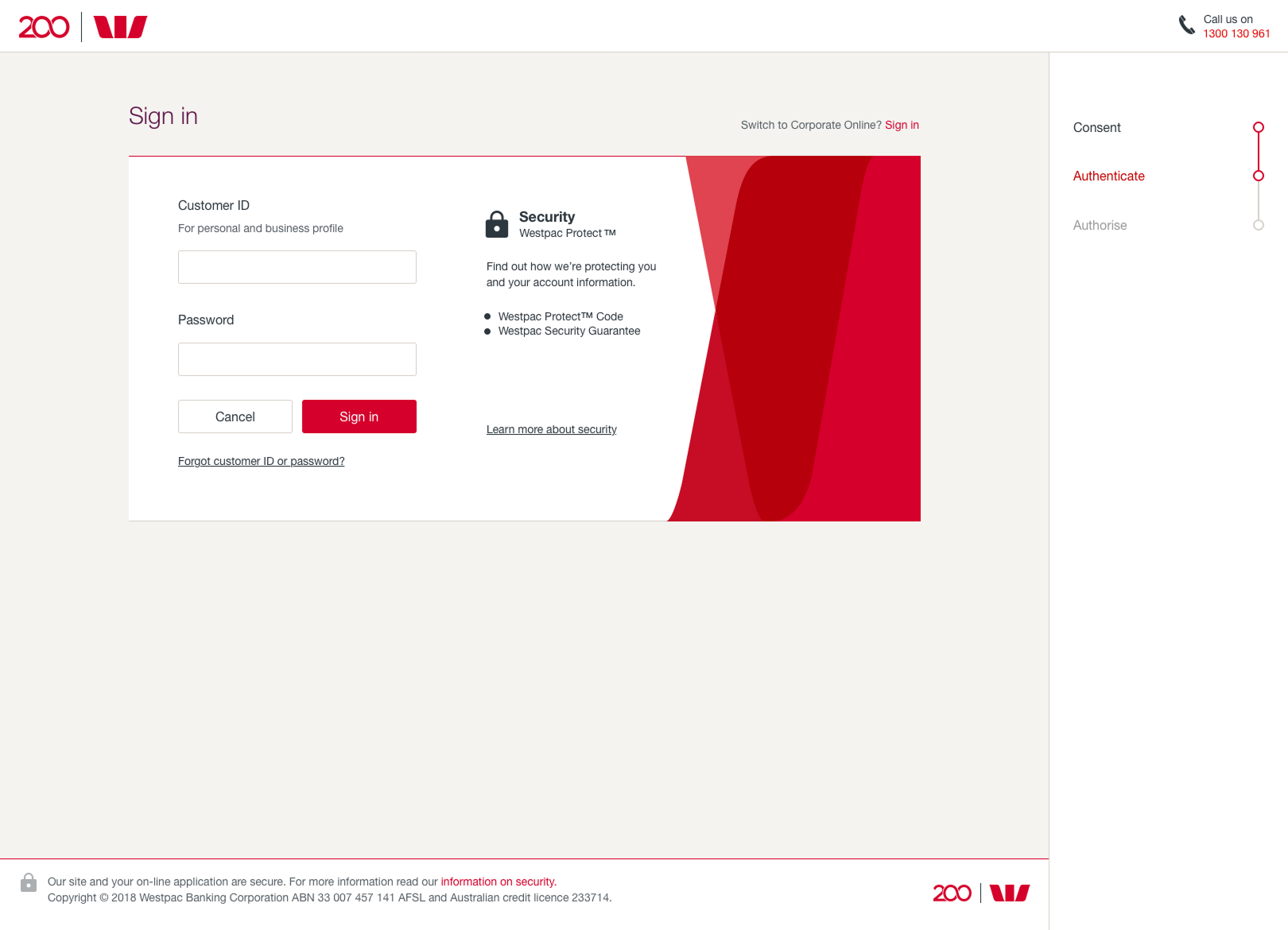

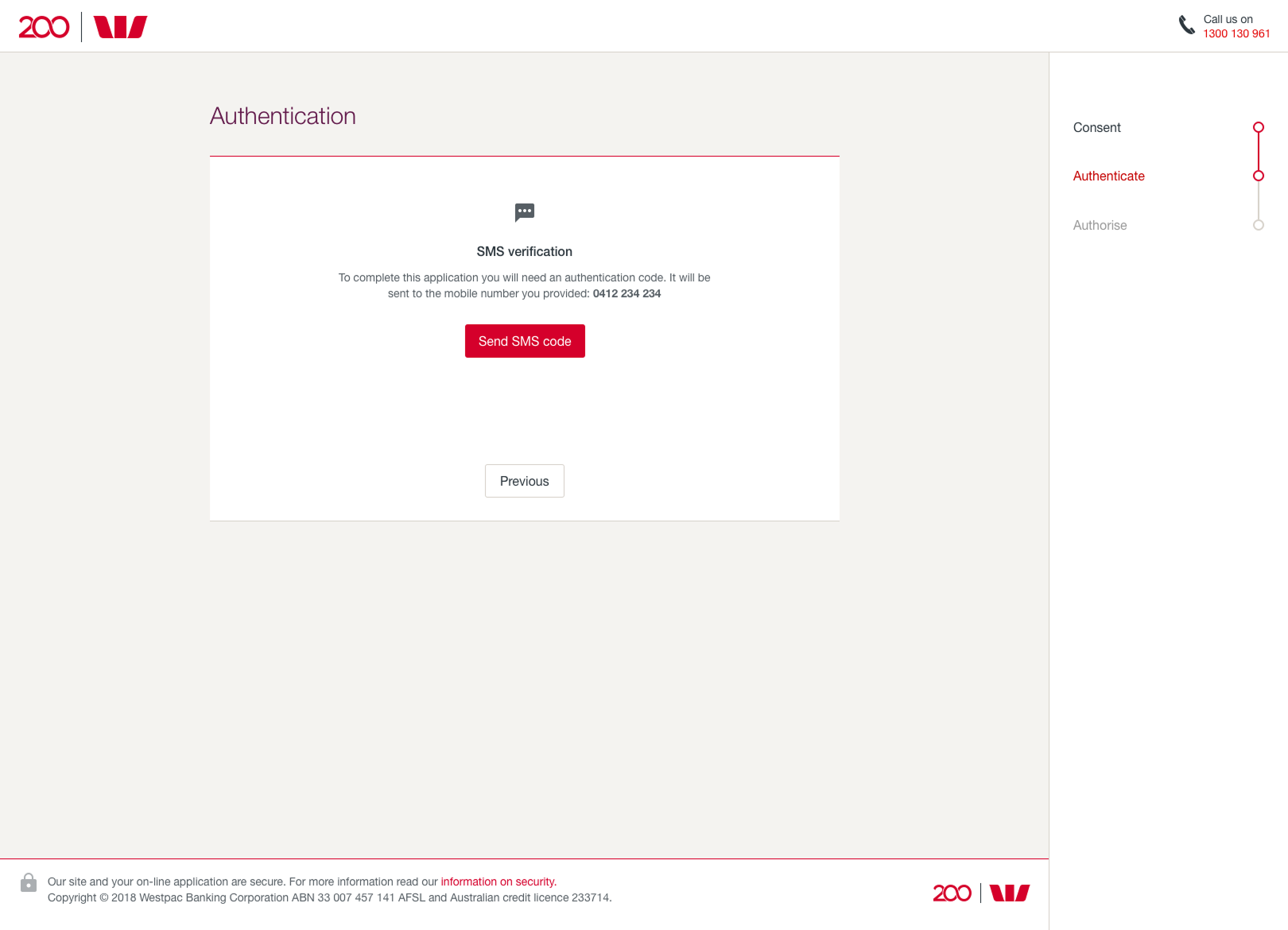

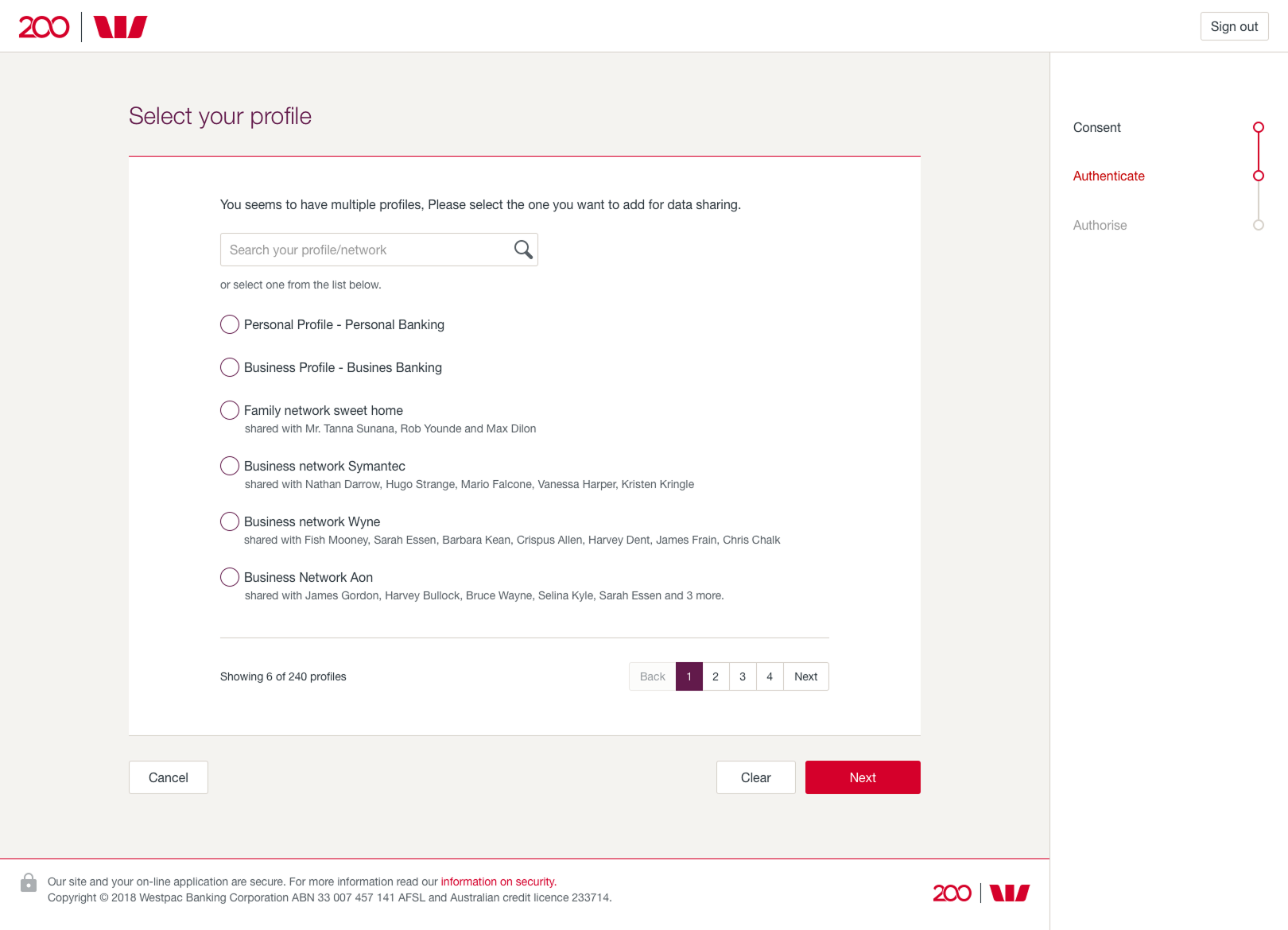

Customer experience journey

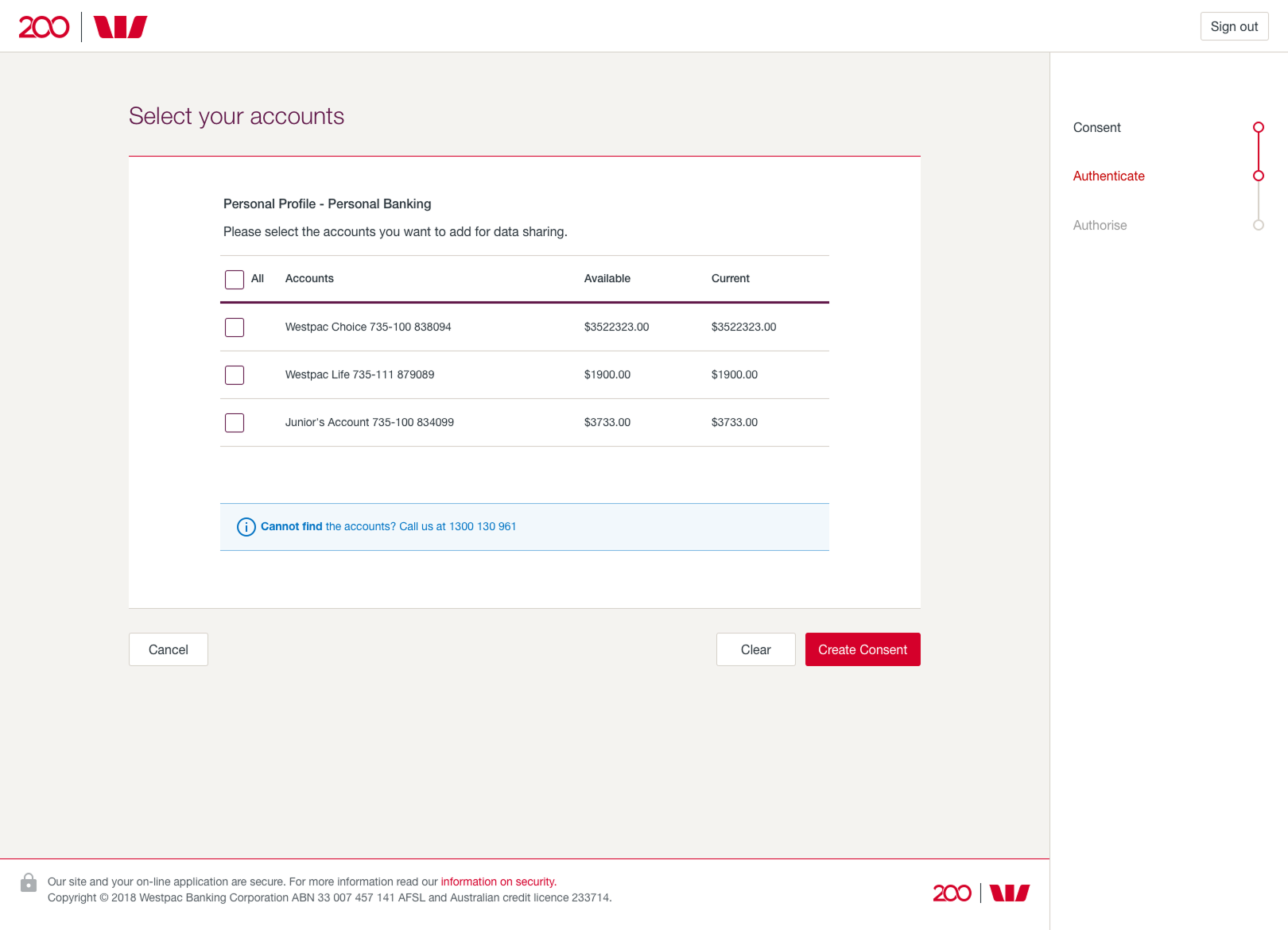

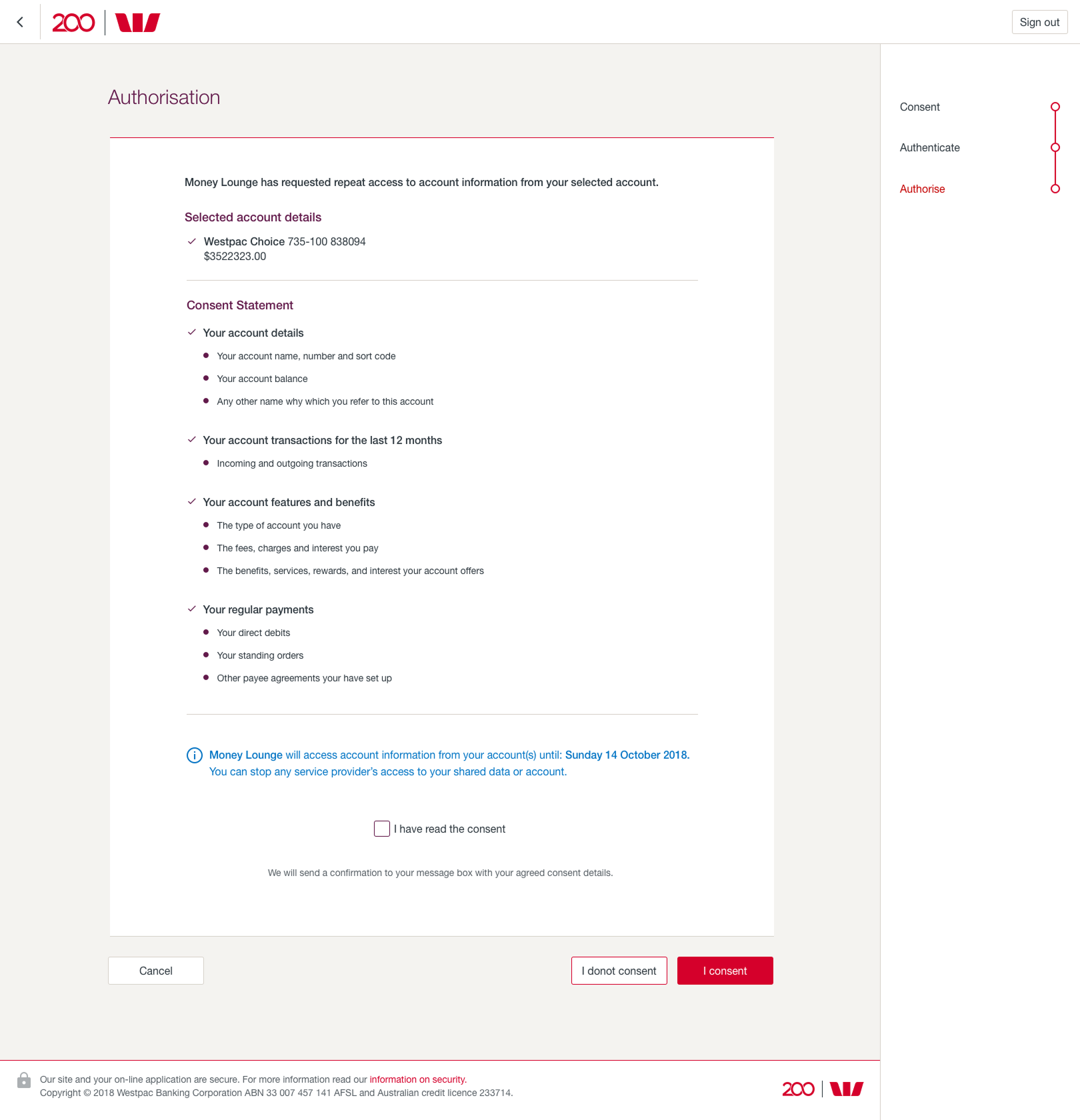

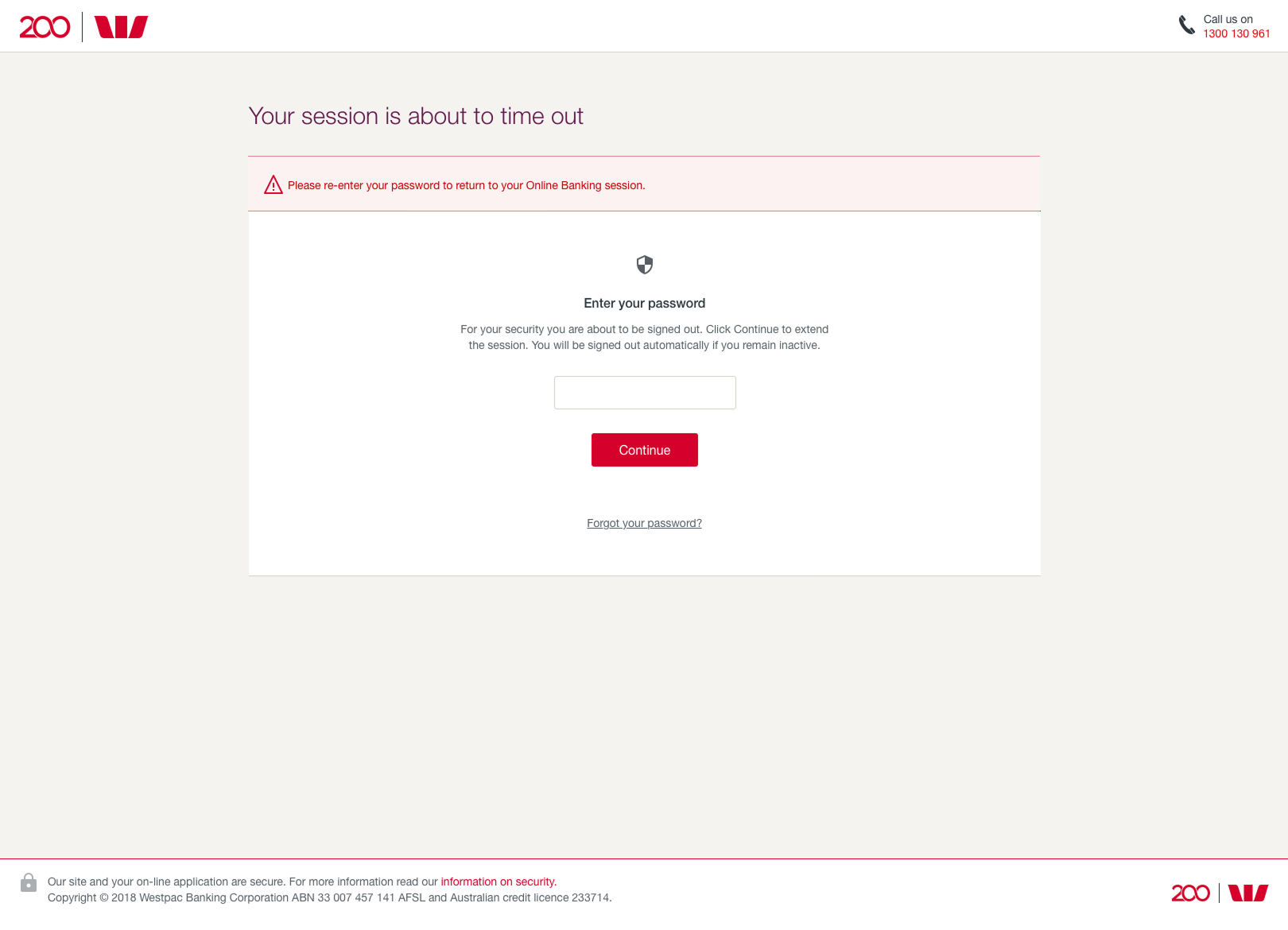

In Westpac's Open Banking journey, the initial step was consent initiation, designed for simplicity and clarity, informing customers succinctly about the process and merits of data sharing. This was followed by a critical authentication step, balancing top-tier security with user-friendliness to ensure robust protection without deterring usage. Upon successful authentication, customers were empowered to grant, manage, or revoke their consent, thus offering them transparent control over their financial data, all within a streamlined and intuitive framework.

Leveraging the diverse expertise of Fintechs and consultants, we brainstormed features, interfaces, and processes that would make the consent journey intuitive and secure. It was designed not just as a point of consent exchange but also as a hub for managing ongoing services and third-party interactions.

We emphasized giving users the ability to manage their consents comprehensively, including setting durations for consent and specifying the types of data shared. The service management component was designed to facilitate ongoing communication between the bank, third-party providers, and customers, ensuring transparency and trust.

UX principles

Recognizing that the user's interaction with open banking platforms is a critical touchpoint, Westpac has committed to a design philosophy that makes data sharing not just safe and compliant, but also intuitive and engaging for the user.

- Simplicity: Streamlining processes to ensure that users can share their data without navigating through complex systems.

- Transparency: Clearly communicating what data is being shared, with whom, and for what purpose.

- Control and consent: Providing users with straightforward mechanisms to control their data sharing consents.

- Engagement: Crafting engaging interfaces that encourage users to explore and take advantage of new financial products and services made available through open banking.

Westpac's engagement with open banking is a significant step in their digital transformation journey. By integrating advanced technologies with a strong emphasis on user experience, Westpac aims to redefine the banking landscape, making it more inclusive, innovative, and responsive to the needs of modern consumers.

Information architecture

The Information Architecture (IA) for Westpac's Open Banking Framework is designed to provide a user-friendly and intuitive structure, focusing on consent management and data sharing.

- The home dashboard serves as the central hub, displaying an overview of connected services and consent statuses.

- The consent management section allows users to initiate, view, and modify their consent for data sharing in a transparent manner.

- Data sharing profiles offer granular control over personal and financial information, allowing users to specify what data is shared.

- Security settings ensure robust authentication processes and customizable privacy controls.

- Lastly, the support and education center provides resources to help users understand open banking, and the administrative and legal section contains all necessary compliance and policy documentation.

This architecture is built to empower users with control and clarity over their financial data sharing.

Wireframes and interactive prototype

The wireframes were developed with a keen eye on clarity and navigational ease, adhering to the principles of the Global Experience Language (GEL) to maintain consistency across the brand's digital offerings. They incorporated fundamental elements such as navigation bars, consent status widgets, and various list views essential for consent management.

As the project progressed, these wireframes were evolved into interactive prototypes, bringing the static designs to life in accordance with GEL standards. These prototypes offered a dynamic experience, allowing users to interact with the dashboard, navigate through the consent management process, toggle data sharing preferences, and configure security settings in a simulated environment. This interactive phase was crucial for validating the user experience, ensuring that the interface was not only functional but also resonated with Westpac's commitment to a seamless and user-centric design.

Usability testing

Usability testing for Westpac's Open Banking framework involved evaluating the user interface with actual users to assess its ease of use, efficiency, and satisfaction. Participants were asked to complete tasks related to consent management and data sharing while observers recorded their interactions, noting any usability issues. It had metrics on success rates, error rates, and user satisfaction.

Performance metrics

Key performance indicators (KPIs) for Westpac's Open Banking framework include the adoption rate, indicating customer uptake; engagement metrics, showing the frequency and depth of feature use; customer trust, derived from confidence in data security and privacy; consent conversion rate, reflecting the effectiveness of the user interface; error rate, to identify usability issues; customer support queries, which signal the clarity of the system; retention rate, showing long-term user engagement; Net Promoter Score (NPS), gauging customer satisfaction and likelihood to recommend; and data breaches, monitoring the security integrity of the framework. These KPIs are crucial for assessing the framework's success and areas for enhancement.

Outcomes and achievements

The implementation of Westpac's Open Banking framework marked a significant milestone in the bank's digital transformation journey. The key achievements included a high adoption rate among customers, reflecting the market's positive reception. User engagement metrics indicated that customers were actively utilizing the data-sharing features, demonstrating the framework's practical value. Most notably, the strong customer trust scores suggested that the security and privacy measures met customer expectations effectively.

Learnings

Throughout the project, several lessons emerged. The importance of clear communication was underscored, highlighting that users must understand the benefits and operations of data sharing to engage with it fully. The iterative design process reaffirmed the value of user feedback in refining the UX, with each iteration leading to reduced error rates and improved consent conversion rates.

Future directions

Looking forward, Westpac plans to build on this foundation, focusing on continuous improvement. This will involve staying abreast of technological advancements, further personalizing the user experience, and enhancing data security in line with evolving threats. Additionally, the bank will continue to seek customer feedback to refine and adapt the framework, ensuring it remains at the forefront of the open banking sector..