Mass affluent customers represent a significant opportunity for financial institutions. They demand more than just basic banking; they seek a sophisticated, seamless, and personalized banking experience.

To create a bespoke banking experience for mass affluent clients that combines personalized service with advanced digital features, driving customer satisfaction and loyalty.

In Phase 1, the discovery research consisted of conducting up to four rounds of ad hoc research activities. These activities were centered around validating feature prioritization, exploring user experience design in a co-creative manner, testing various concepts, and diagnosing the results of different experiments. This phase was instrumental in laying the groundwork for subsequent development and design efforts.

During Phase 2, the delivery research incorporated up to ten rounds of a rapid and iterative process known as "Cadence." This methodical approach was particularly effective in identifying and addressing usability issues, with each round uncovering approximately 80% of existing problems. This phase was crucial for refining the user experience and ensuring the delivery of a well-crafted final product.

A quantitative analysis was aimed at capturing a comprehensive understanding of this customer segment to inform strategic decisions. It involved conducting surveys and analyzing financial behavior data to gain insights into the demographics, preferences, and pain points of mass affluent clients.

Through qualitative insights gathered from in-depth interviews and day-in-the-life studies, a nuanced understanding of the expectations held by clients for premium banking services was developed. These methods offered a detailed perspective on the unique needs and desires of customers seeking a superior banking experience.

Three distinct personas were crafted to represent the varying customer profiles within the target market:

Each persona encapsulated unique banking behaviors and service expectations, aiding in the development of tailored banking experiences.

Challenges were evident in the current banking experience, marked by a distinct lack of personalized investment advice tailored to individual financial goals. Customers also faced inefficiencies in accessing priority customer service, leading to potential dissatisfaction. Furthermore, the digital banking tools available were not as intuitive as needed, complicating the user experience. Lastly, the rewards and loyalty programs in place failed to meet the expectations of customers, reflecting an inadequacy in acknowledging and valuing customer loyalty.

To deliver valuable services to our mass affluent customers, we needed to understand their characteristics, the pains they experienced, and the opportunities for these pains to be alleviated digitally. We identified key deliverables over the past 3 months:

Brainstorming sessions with stakeholders were pivotal in developing a suite of exclusive features aimed at enhancing the banking experience.

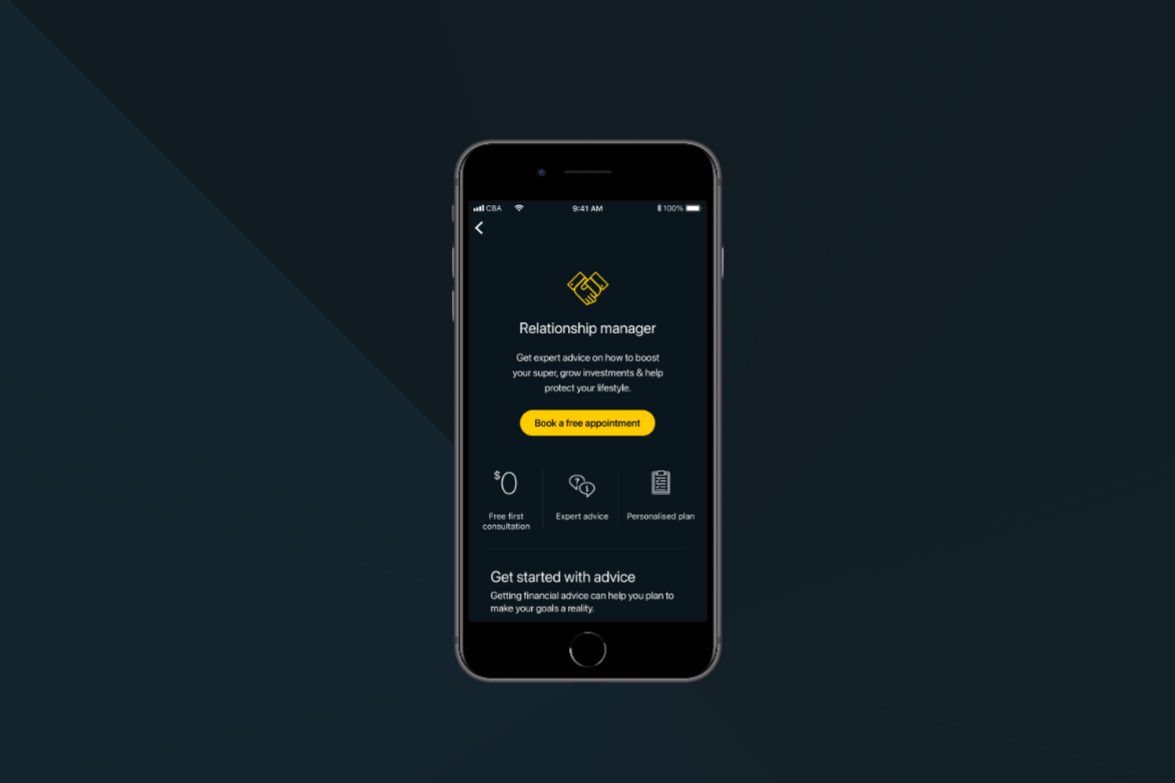

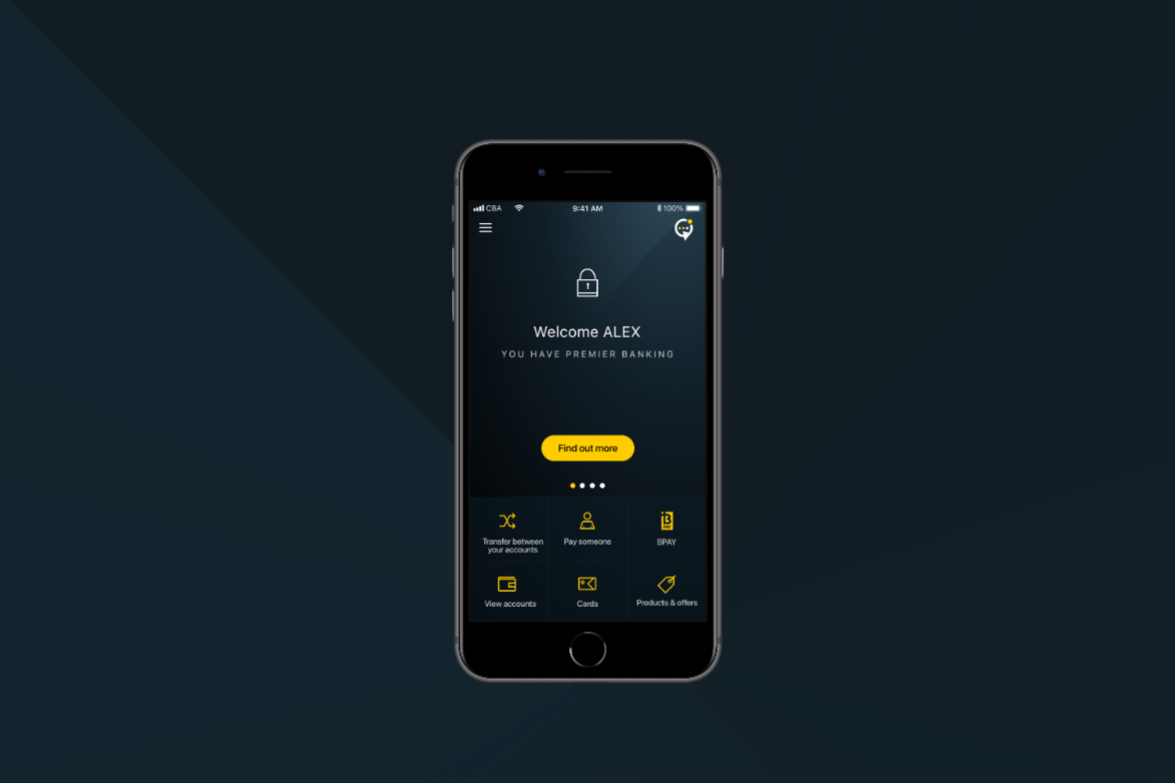

These sessions yielded the conceptualization of personalized wealth management dashboards that provide a tailored overview of finances and concierge-style customer service for a more bespoke interaction.

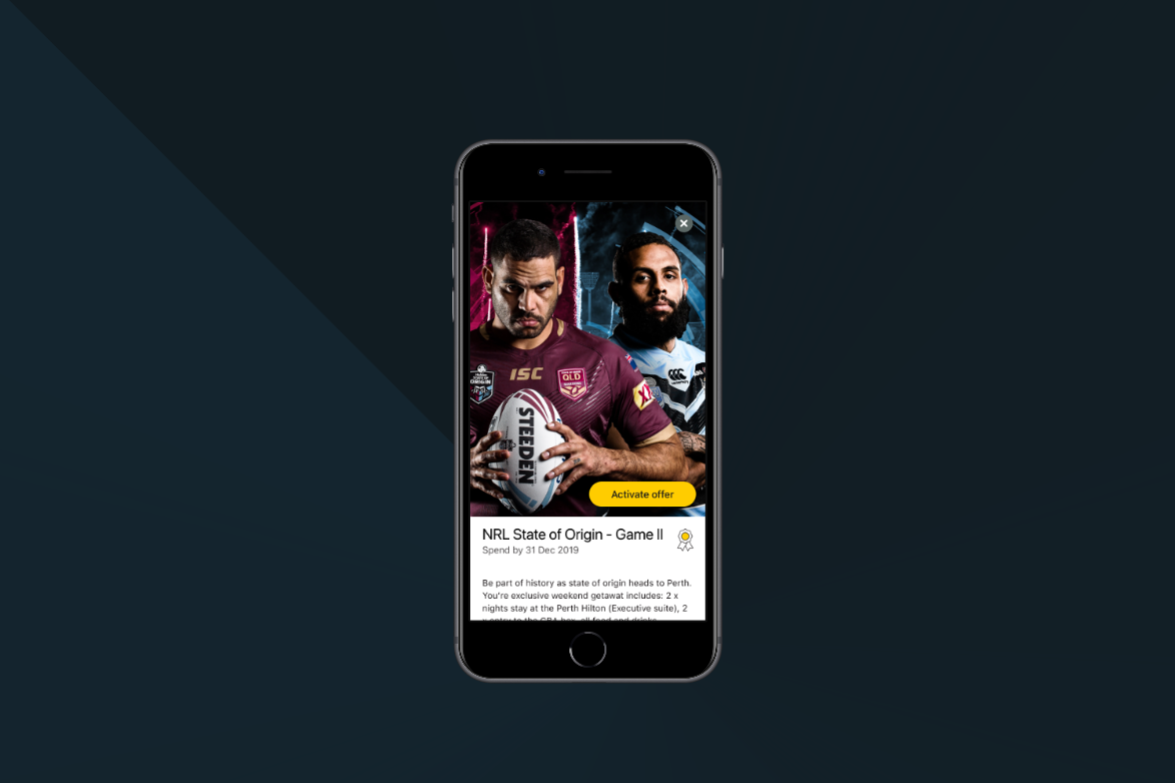

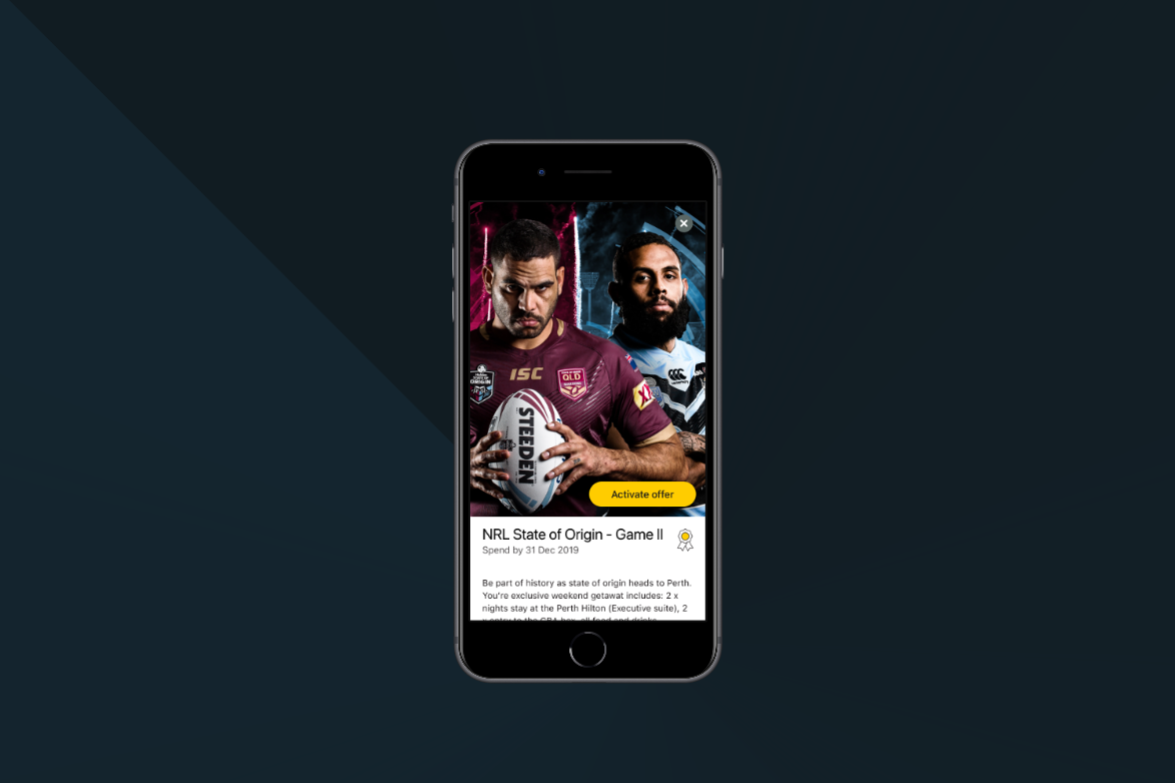

Advanced security protocols were proposed to fortify the protection of customer data, along with an array of rewards and offers to enrich the banking relationship.

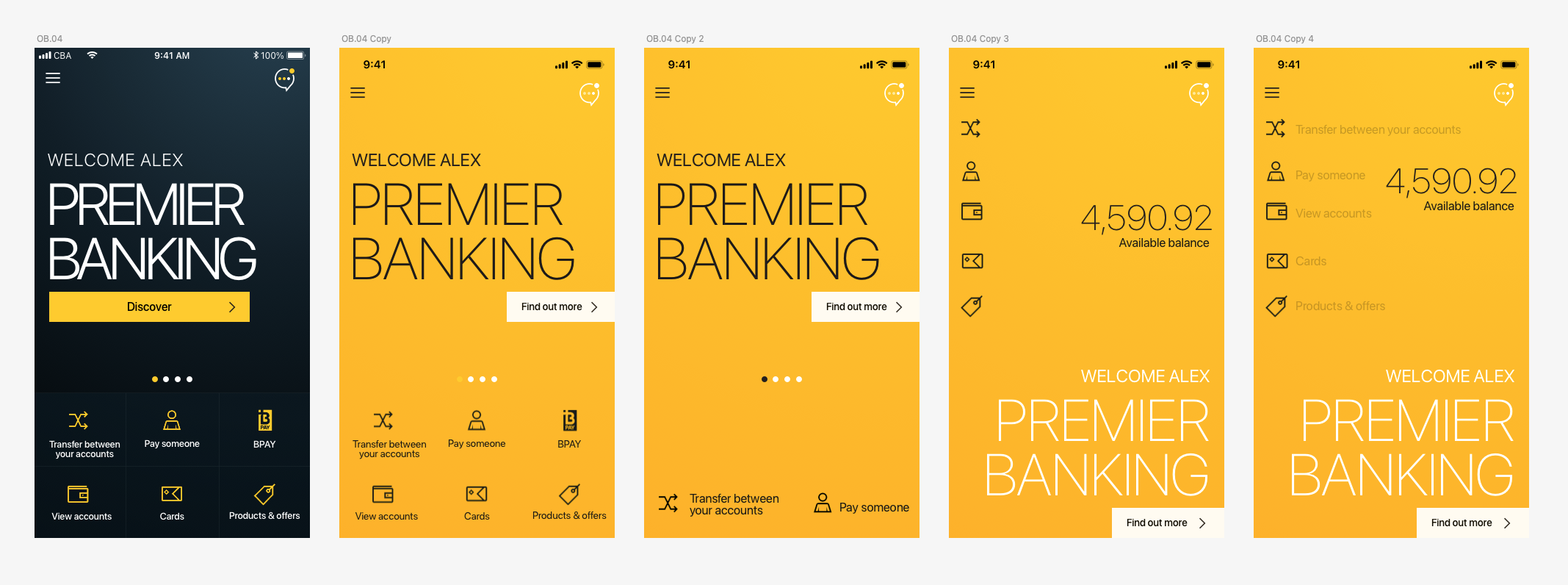

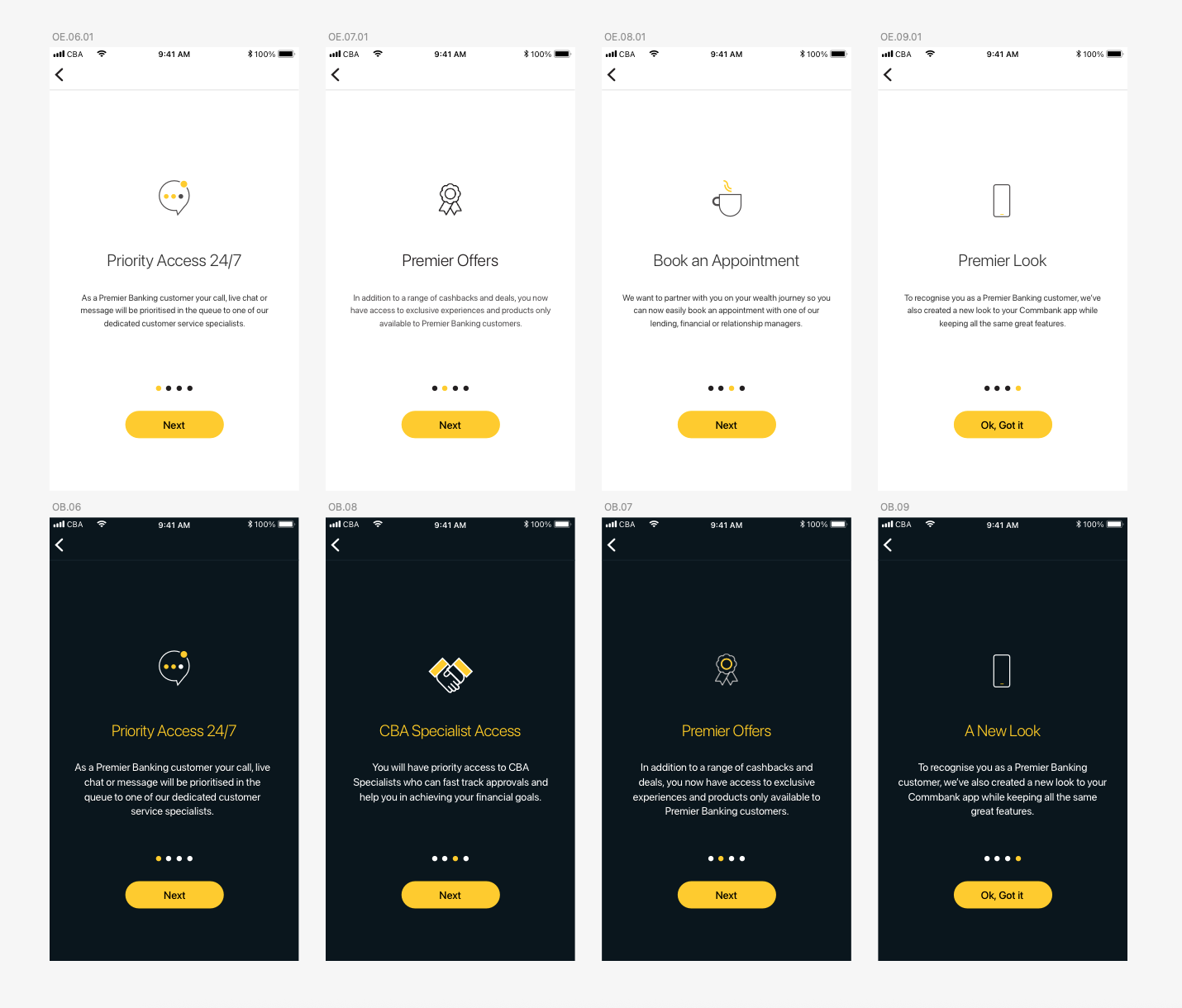

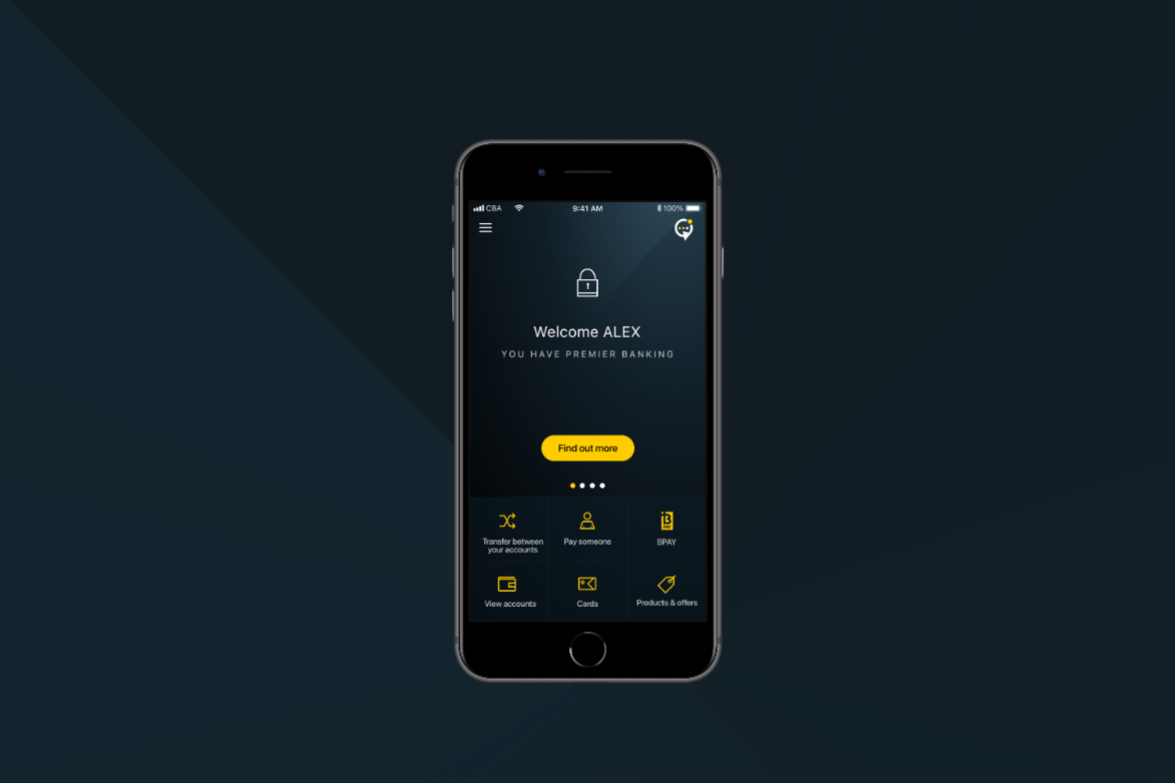

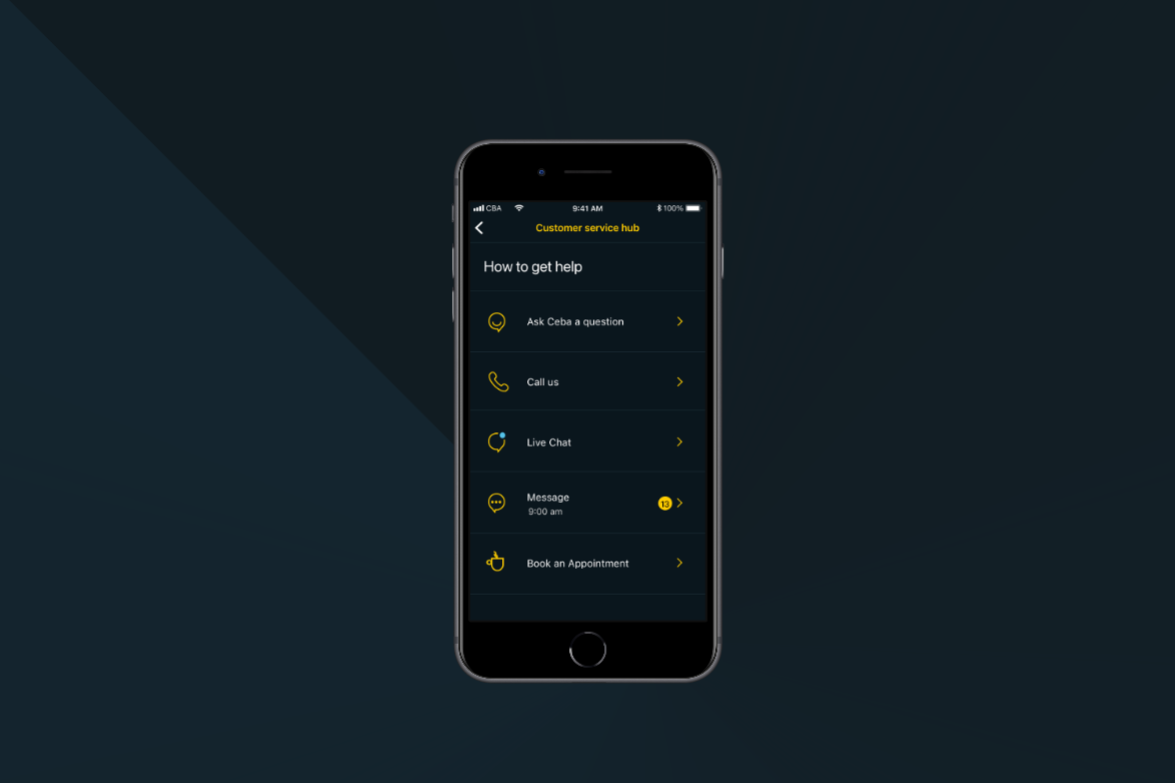

The ideas extended to a complete reskin of the digital interface, introduction of a world debit card, and the prioritization of the customer's preferred "Channel of choice" for interactions.

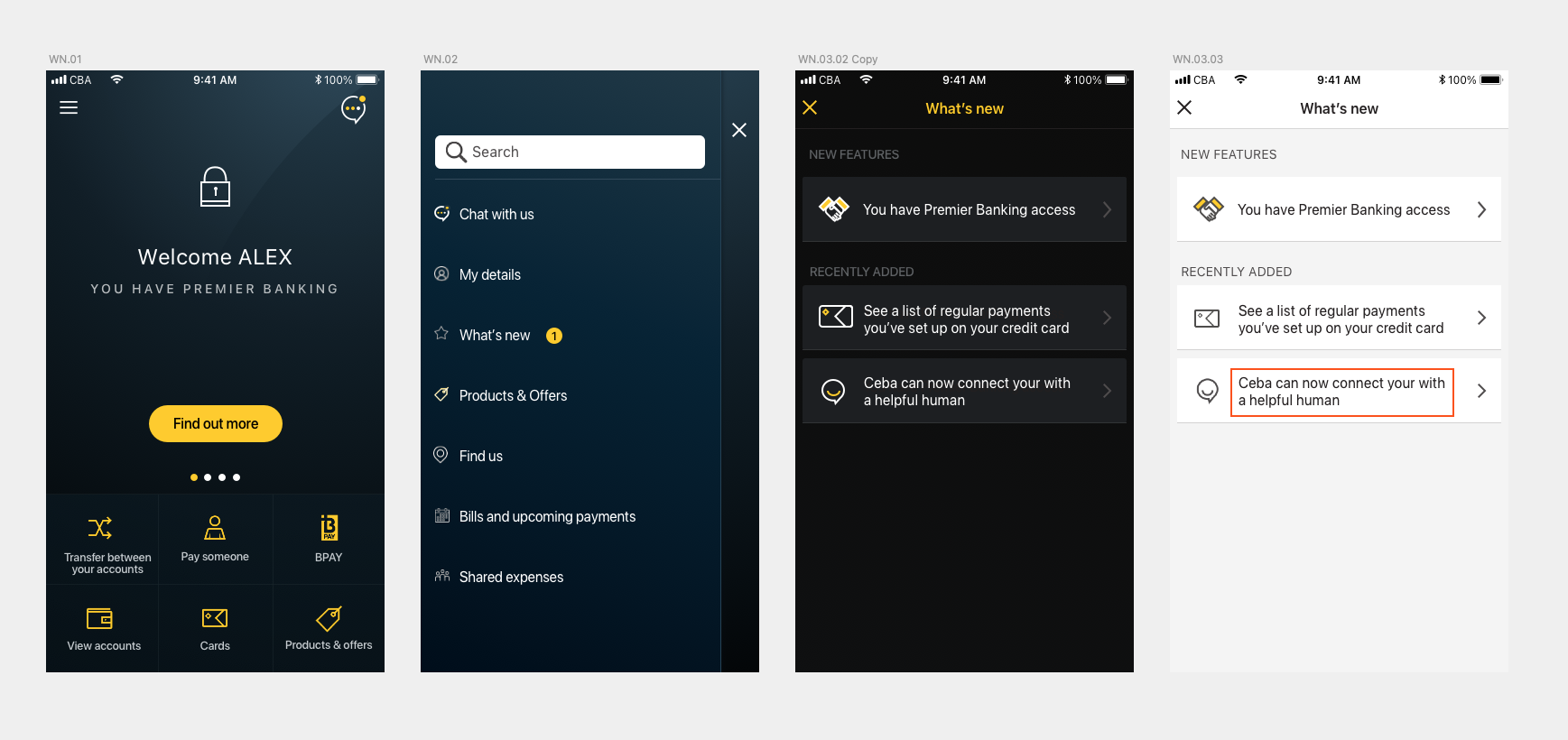

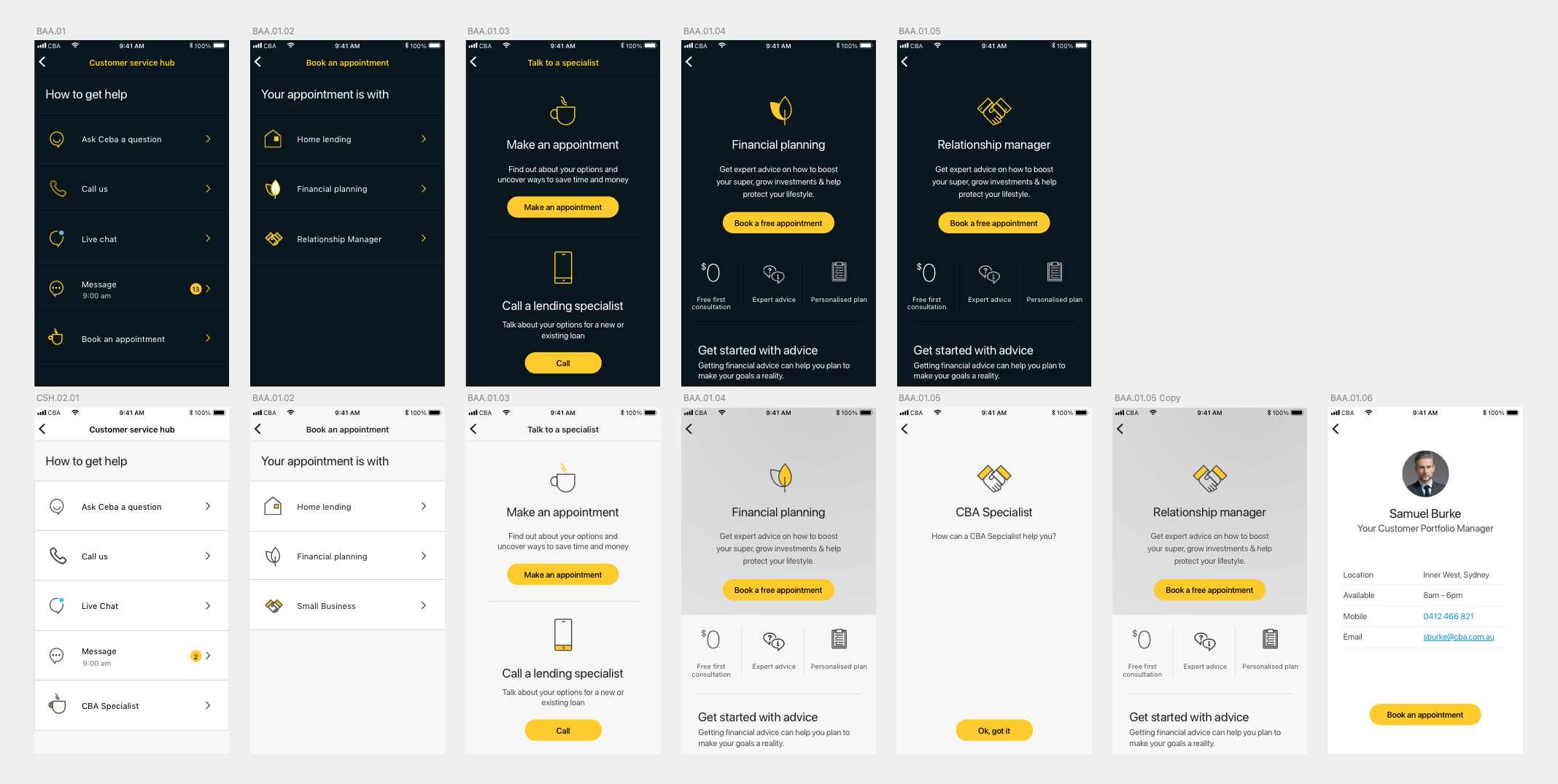

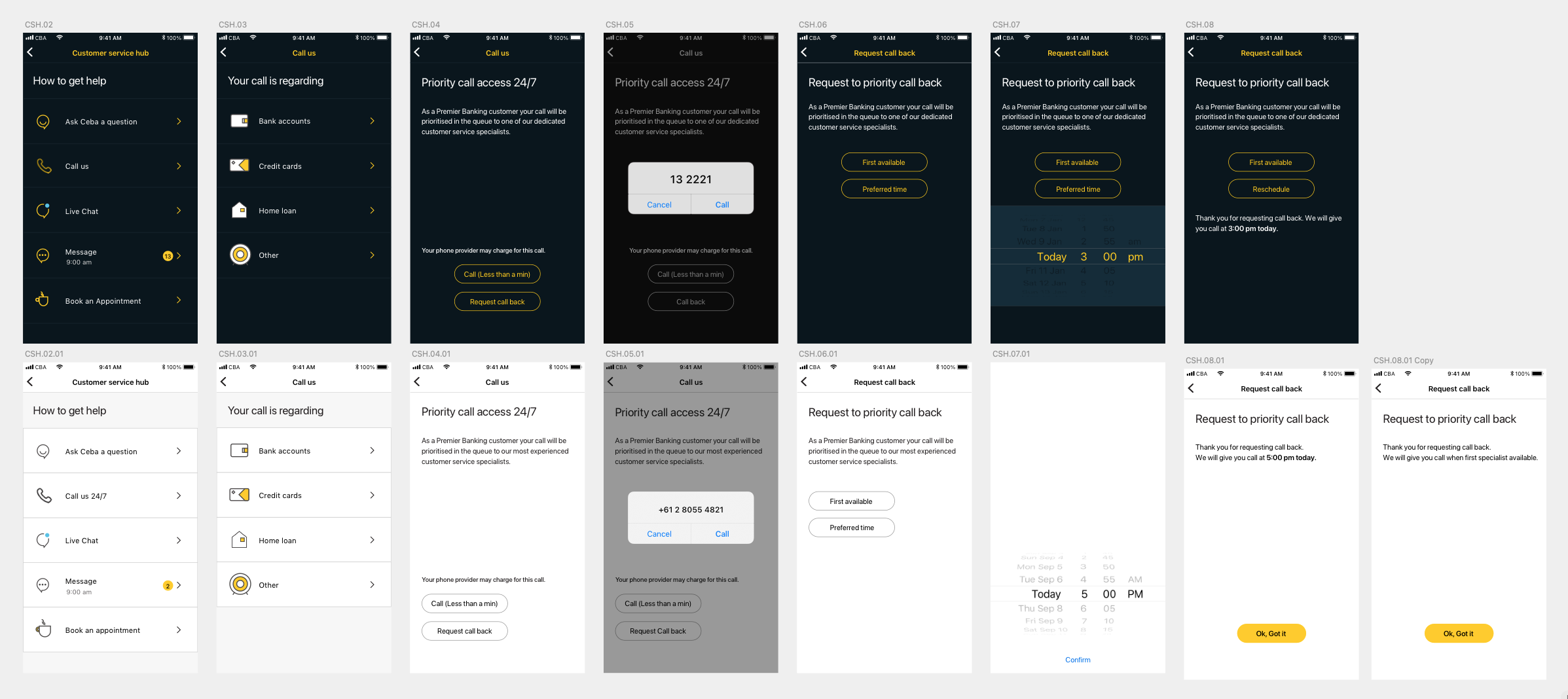

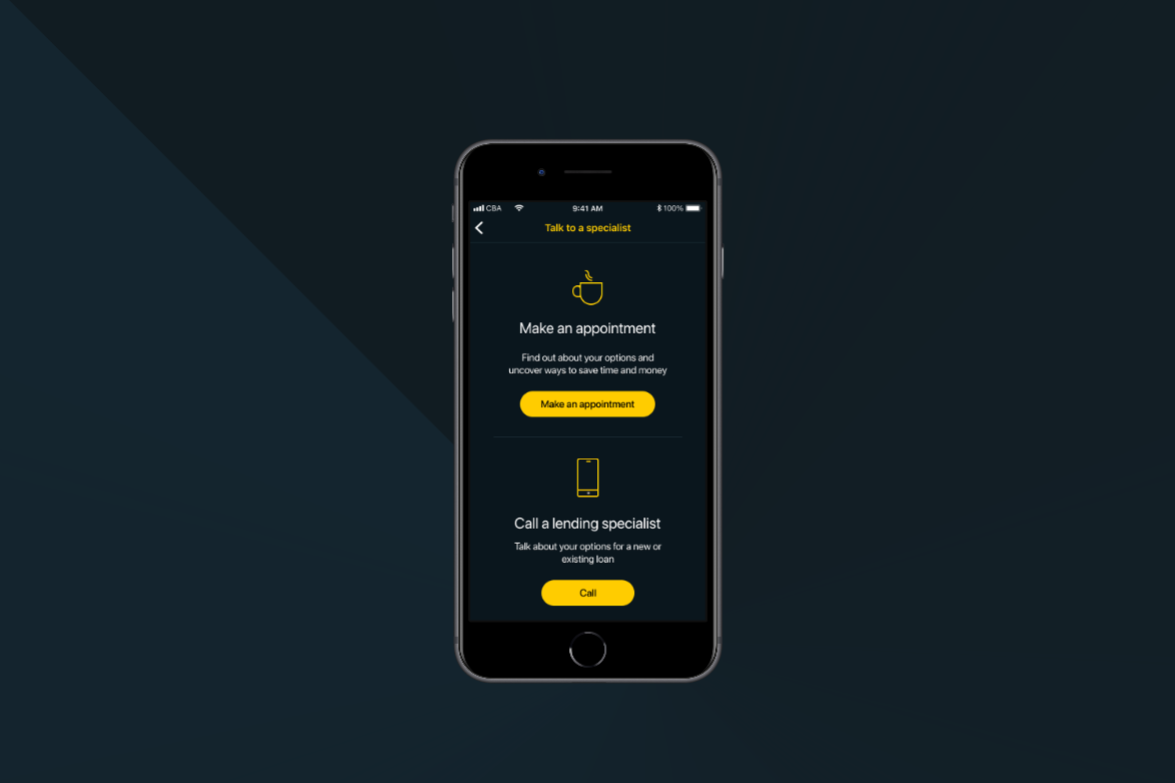

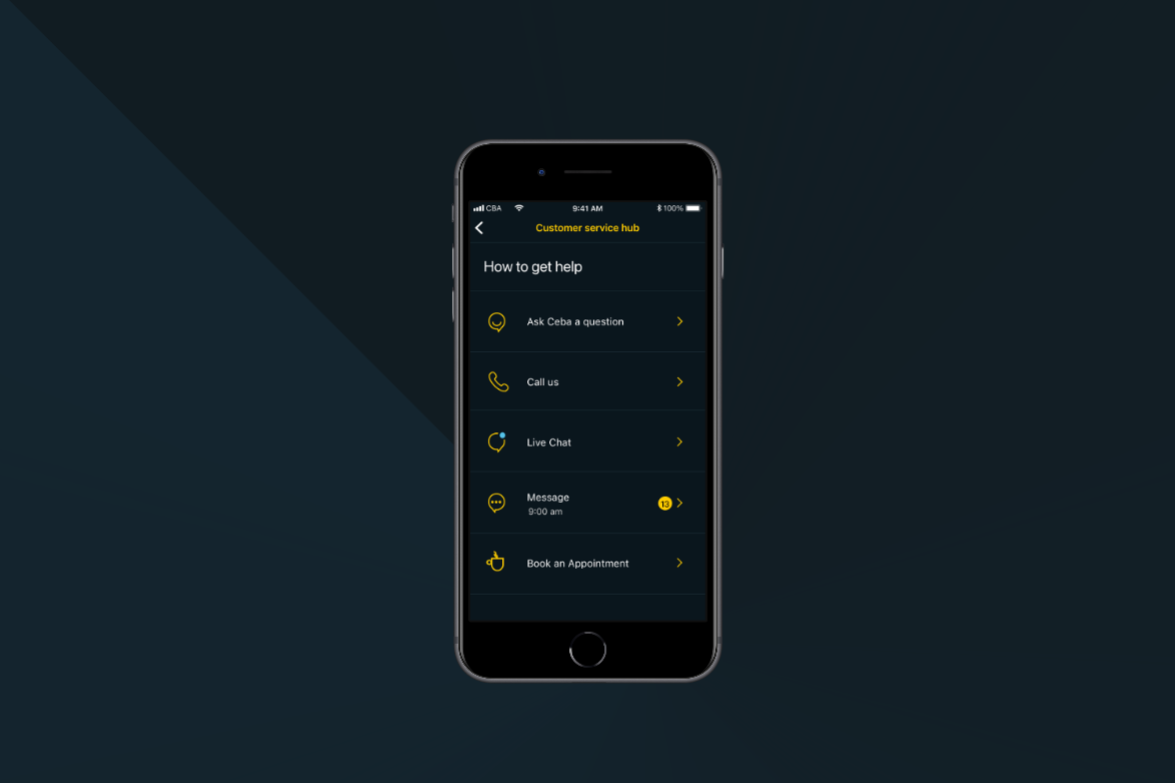

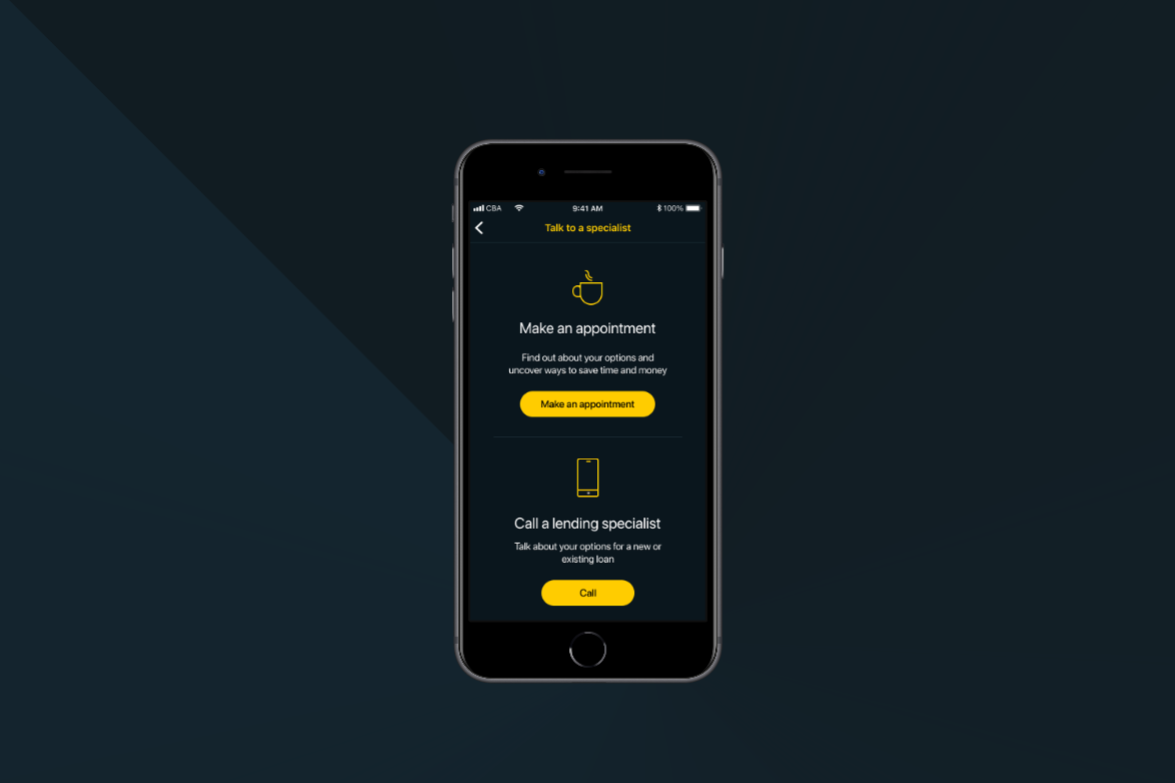

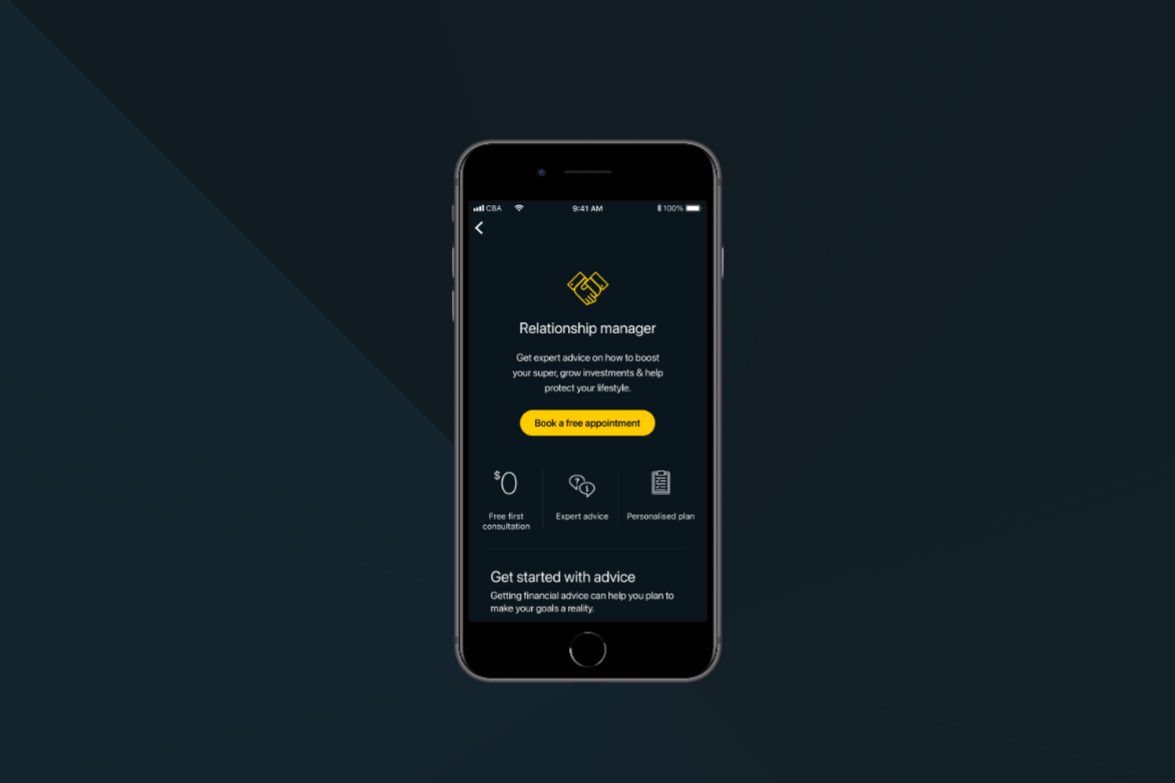

The team also envisioned an efficient onboarding process, a priority contact hub, and access to specialist contacts for expert advice.

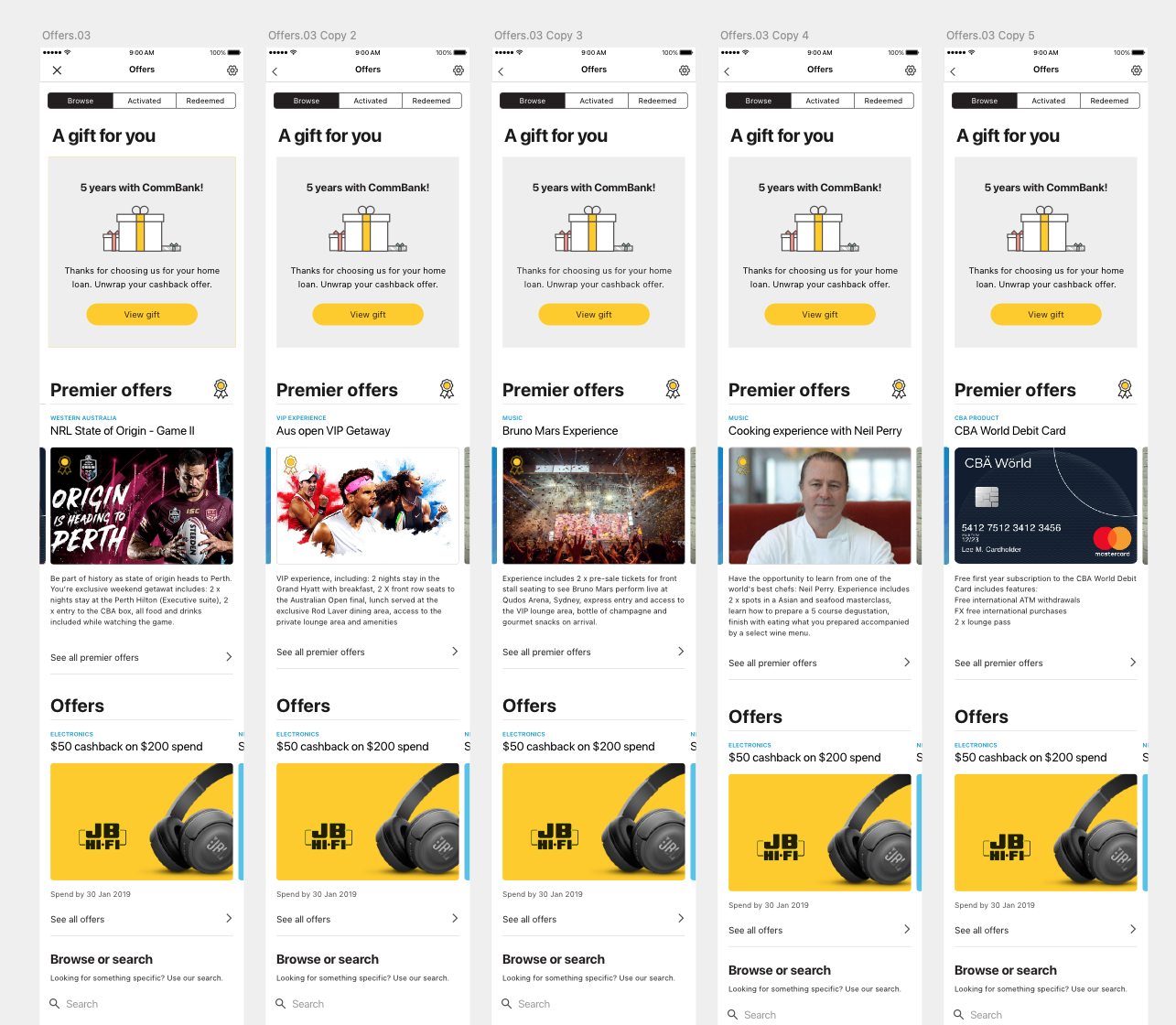

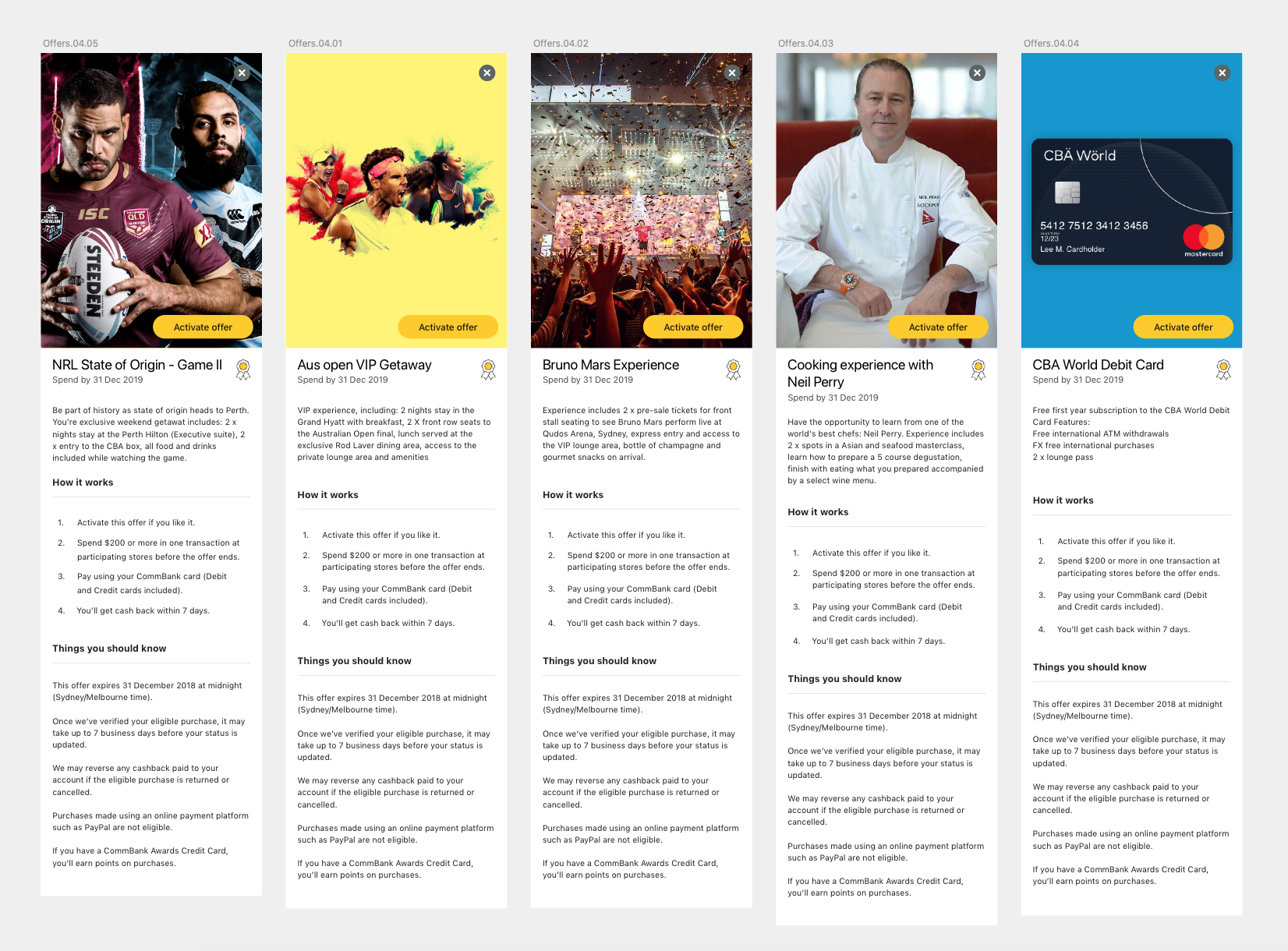

Premier offers, tailored financial education, and investment tools were considered to support family financial growth and the Grow wealth framework.

A Goal mindset was promoted to encourage financial planning, complemented by Digital engagement strategies like smart notifications to keep customers informed and engaged.

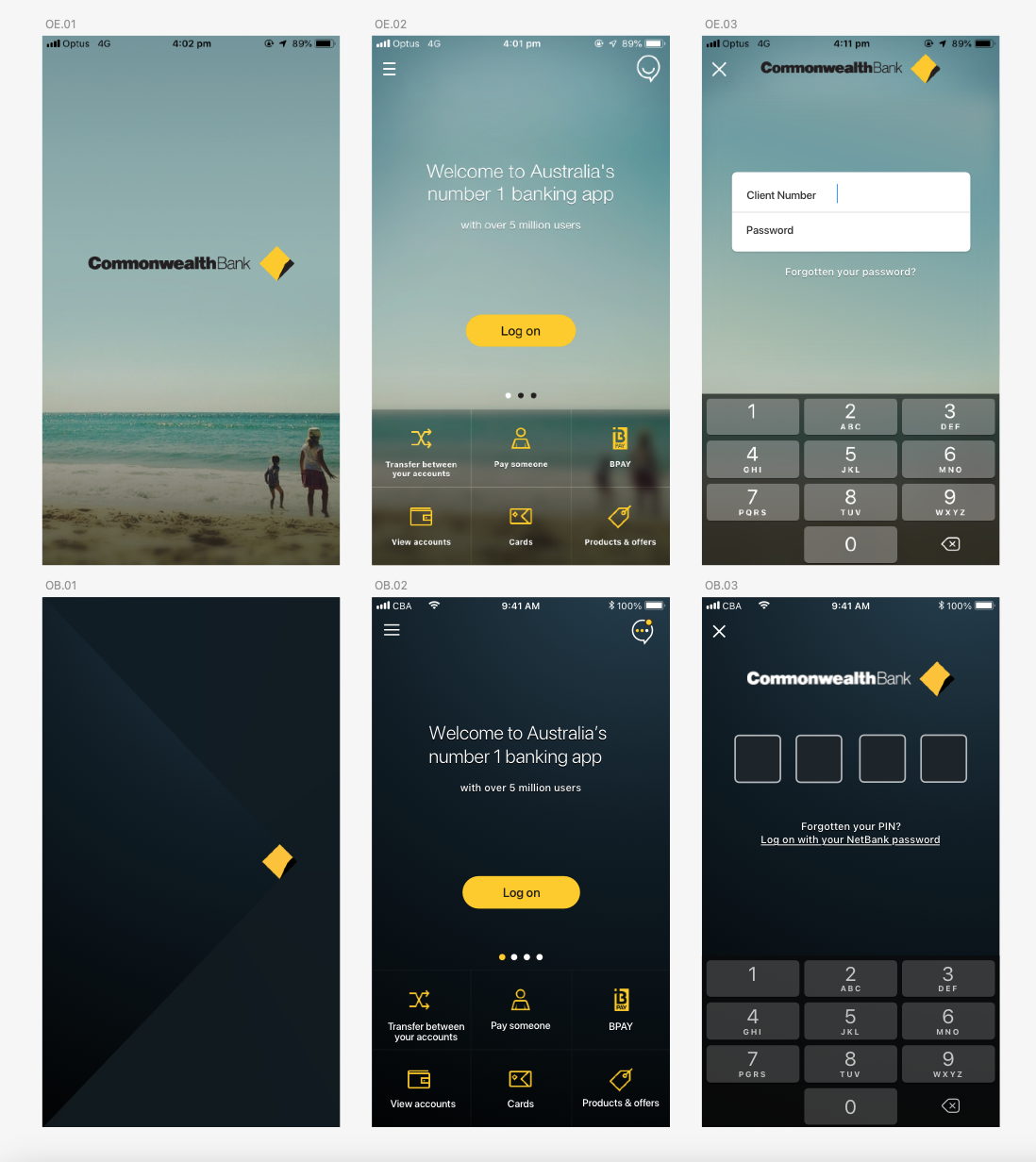

An iterative design process was employed, starting with low-fidelity sketches and evolving into high-fidelity, interactive prototypes.

10 rounds of user testing were conducted to refine the interface, the interaction, and the overall user journey.

These enhanced features are meticulously crafted to provide an enriched, tailored, and sophisticated banking experience that caters to the distinct needs of premier banking clientele, fostering loyalty and facilitating financial prosperity.

Each feature is aimed at providing a comprehensive, engaging, and personalized banking experience for mass affluent customers, encouraging loyalty and long-term financial growth.

Personalization is an essential aspect of catering to the needs and expectations of mass affluent customers, who often seek services and products that align with their individual preferences and lifestyles. Similarly, the incorporation of continuous user feedback plays a pivotal role in the iterative design process, ensuring that products evolve in a way that is responsive to user needs and preferences. This approach to design refinement and enhancement is crucial for the development of successful products.

The momentum was to be sustained through a series of recommendations: Firstly, the introduction of machine learning was proposed to tailor financial advice more personally to the clients' needs. Secondly, it was suggested to broaden the concierge services to encompass lifestyle management, thus providing a more holistic service experience. Lastly, the creation of an exclusive community platform was advised to facilitate networking and the sharing of financial insights among members.