Helping customers choose credit cards based on their financial goals and lifestyles.

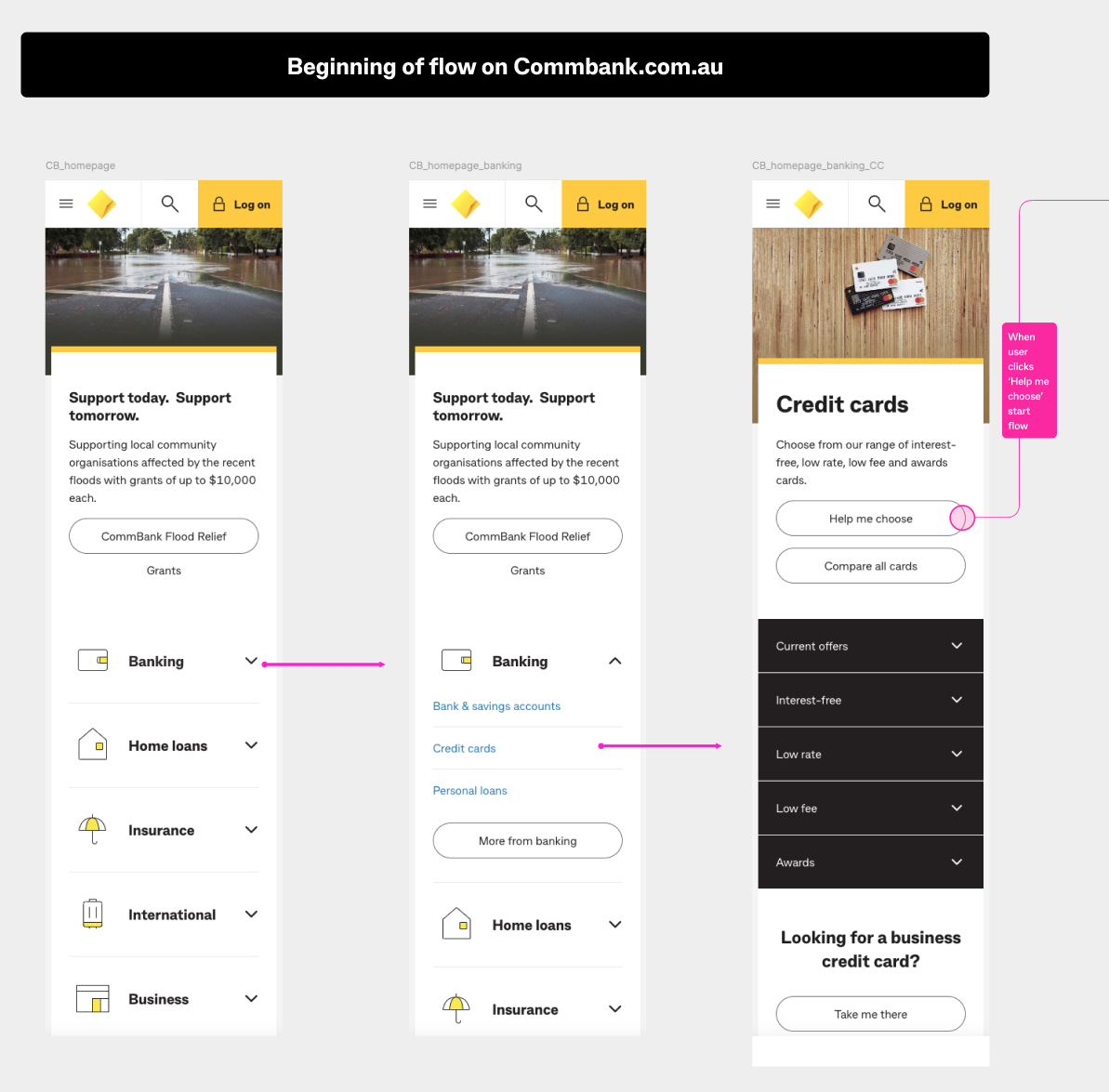

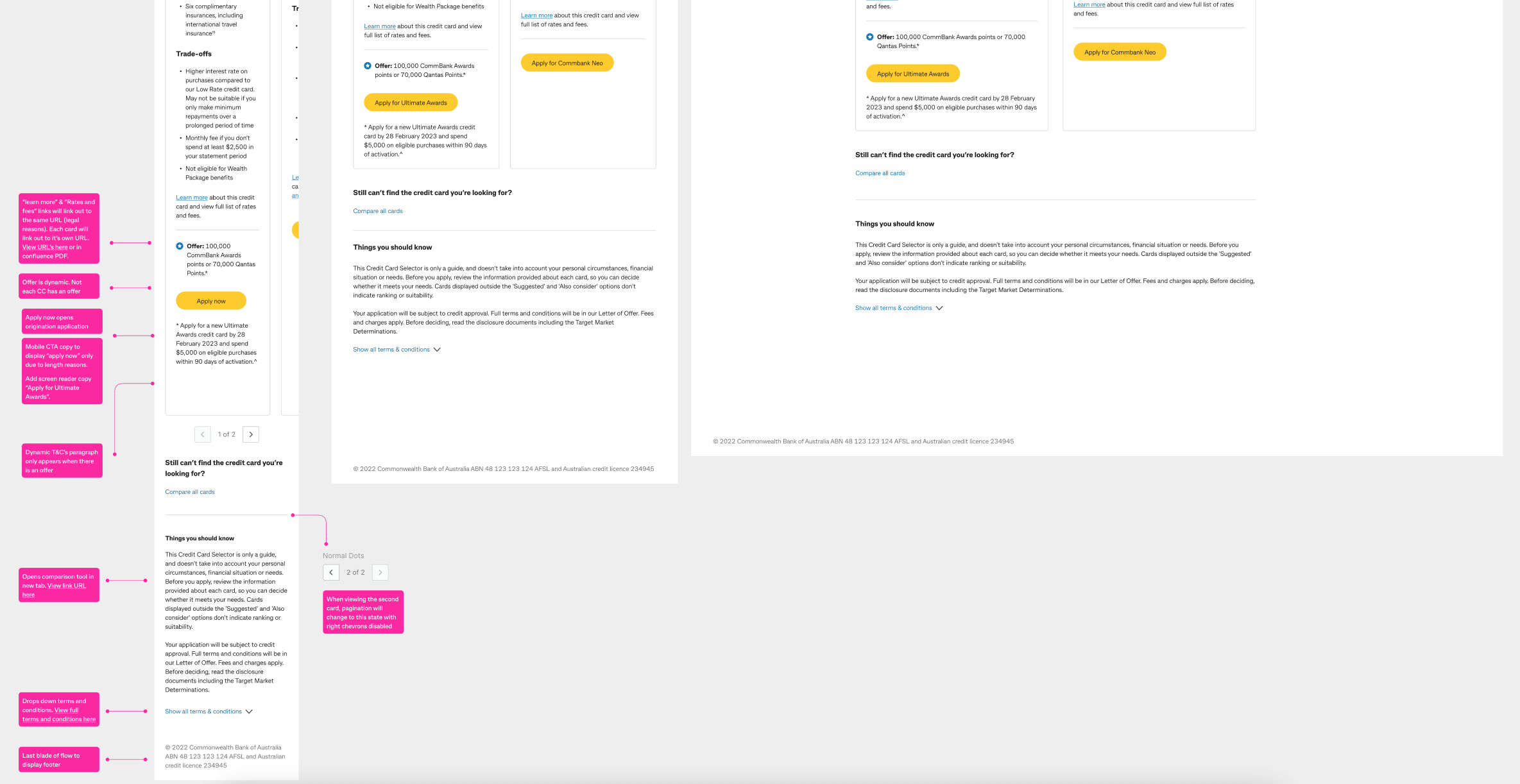

Commonwealth Bank offers a diverse range of credit cards featuring rewards programs, low-interest rates, and travel benefits. The existing credit card selector tool primarily promotes these product features. However, to provide a truly customer-centric experience, it is essential to prioritize users' needs, preferences, and financial goals.

Objectives

The key objectives of the redesign are to:

- Enhance customer experience by aligning the tool with users’ financial goals and lifestyles.

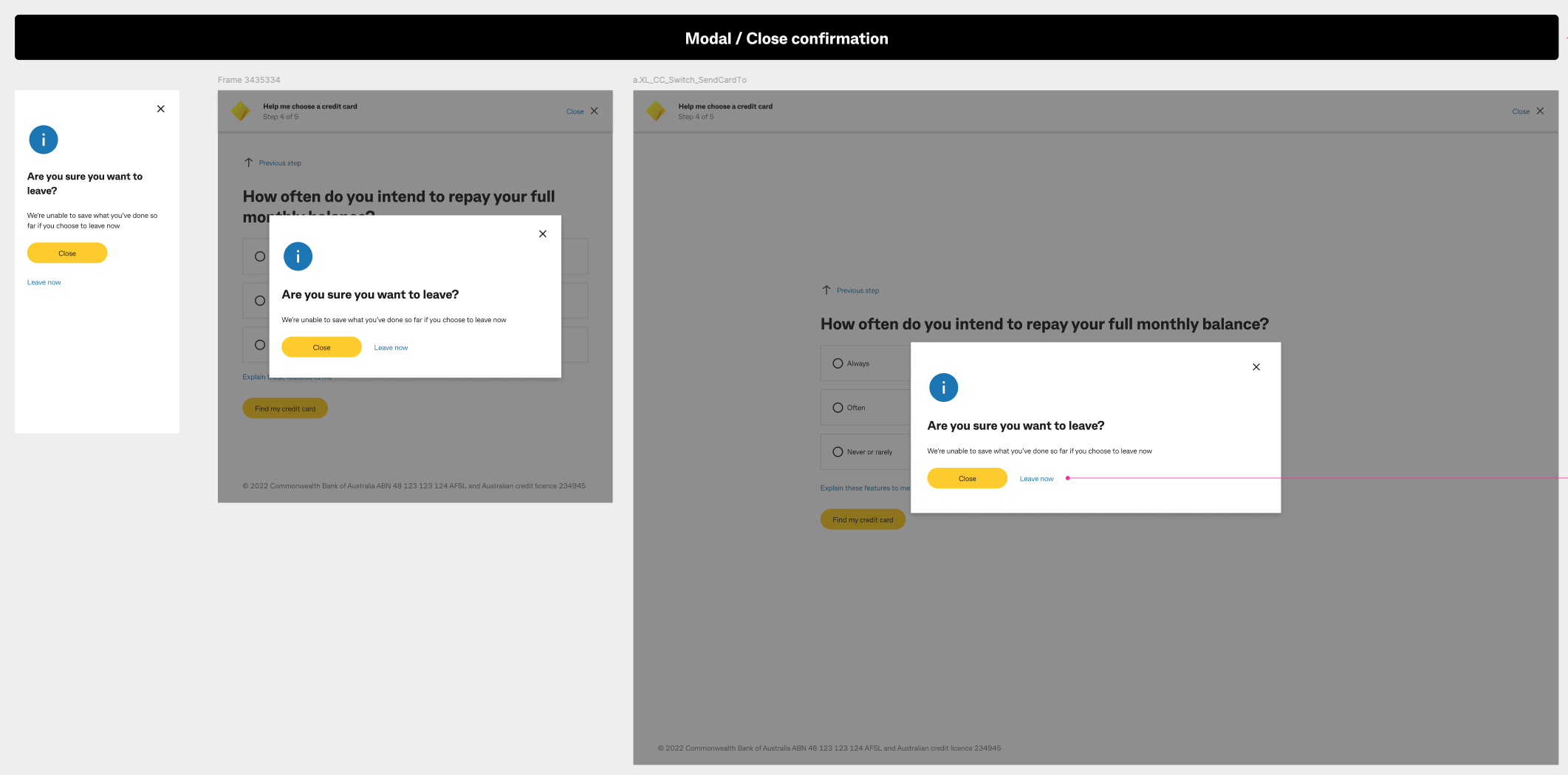

- Improve user engagement and satisfaction by simplifying the decision-making process.

- Ensure up-to-date product information is available for both customers and staff within the Credit Card Selector tool.

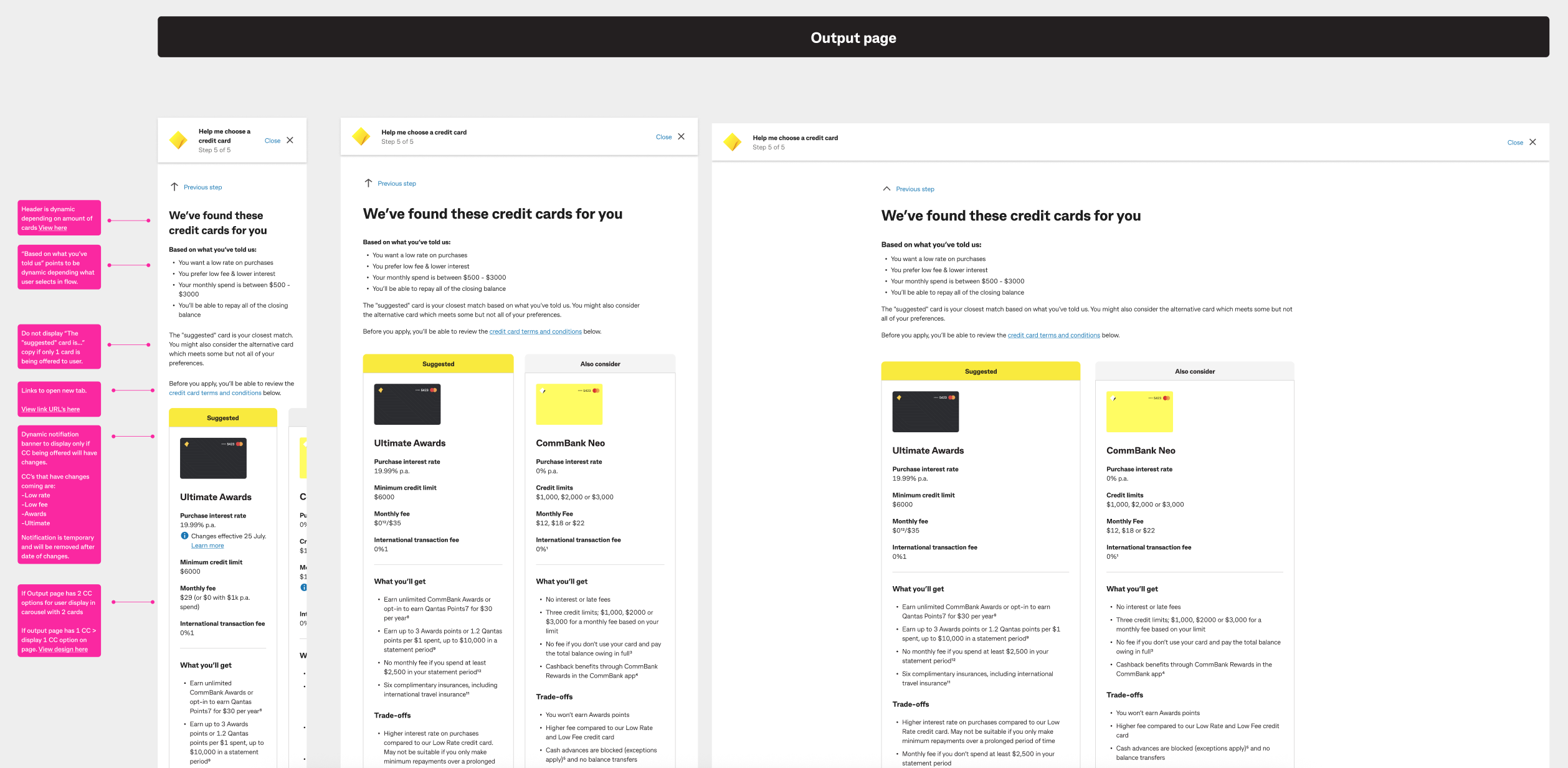

- Increase the likelihood of customers selecting a credit card that best suits their needs.

Customer problem

The current credit card selector tool may not be helping customers choose the most suitable credit card for their needs, leading to suboptimal financial decisions.

Research approach

First, we must understand what our customers need, what competitors are doing and what we can learn (pain points, delights, opportunity areas).

Desktop research on a credit card selector tool involves gathering information and insights about existing tools, best practices, and key considerations in the field of credit card selection and comparison.

The desktop study involved reviewing existing research materials to identify gaps, examine cardholder segments, analyze credit card switching reports, conduct literature reviews on credit cards, explore behavioral factors influencing credit card selection, and investigate product funneling.

The competitor analysis report assessed various aspects of the tool, including user experience, features, functionality, and customer benefits. To maintain a competitive edge, Commbank should focus on enhancing user experience, being transparent, and improving mobile optimization. Additionally, offering clear, detailed explanations for card recommendations can help users make more informed decisions.

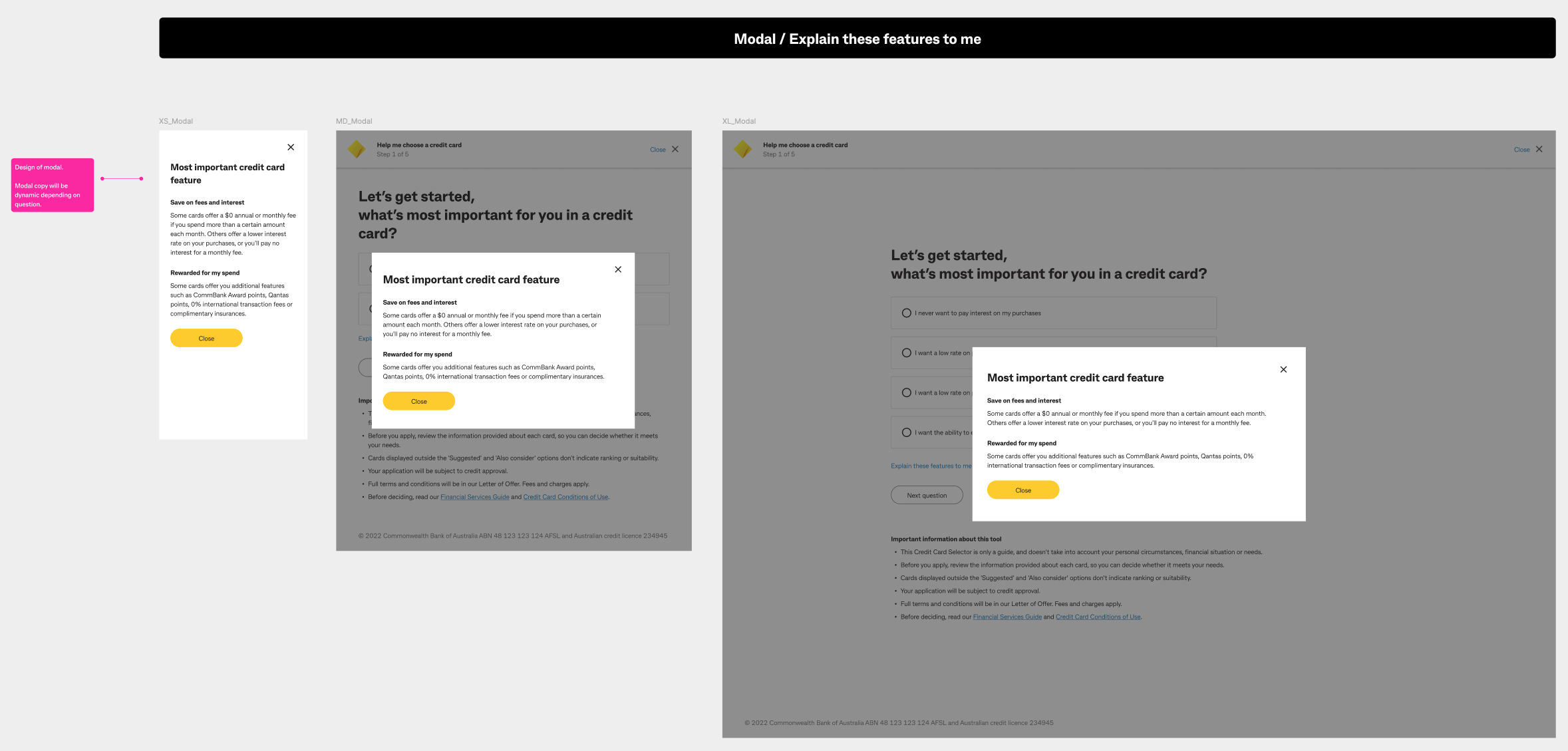

A heuristic evaluation demonstrated several positive aspects, such as clear visibility of the system's status, user control, and the prevention of errors. However, there is room for improvement, particularly in simplifying language, enhancing the visual design, and providing more guidance and control options for users. Usability testing with real users can further validate these heuristic findings and help refine the tool.

User testing

We conduct usability tests with the existing credit card selector tool to identify specific pain points and areas where users struggle to find information or make decisions.

Data analysis

We analyze the data collected from user interviews, desktop research, competitor analysis, heuristic evaluation and usability tests to identify common themes, pain points, and customer preferences. Those insights guided the redesign process.

Redesign approach

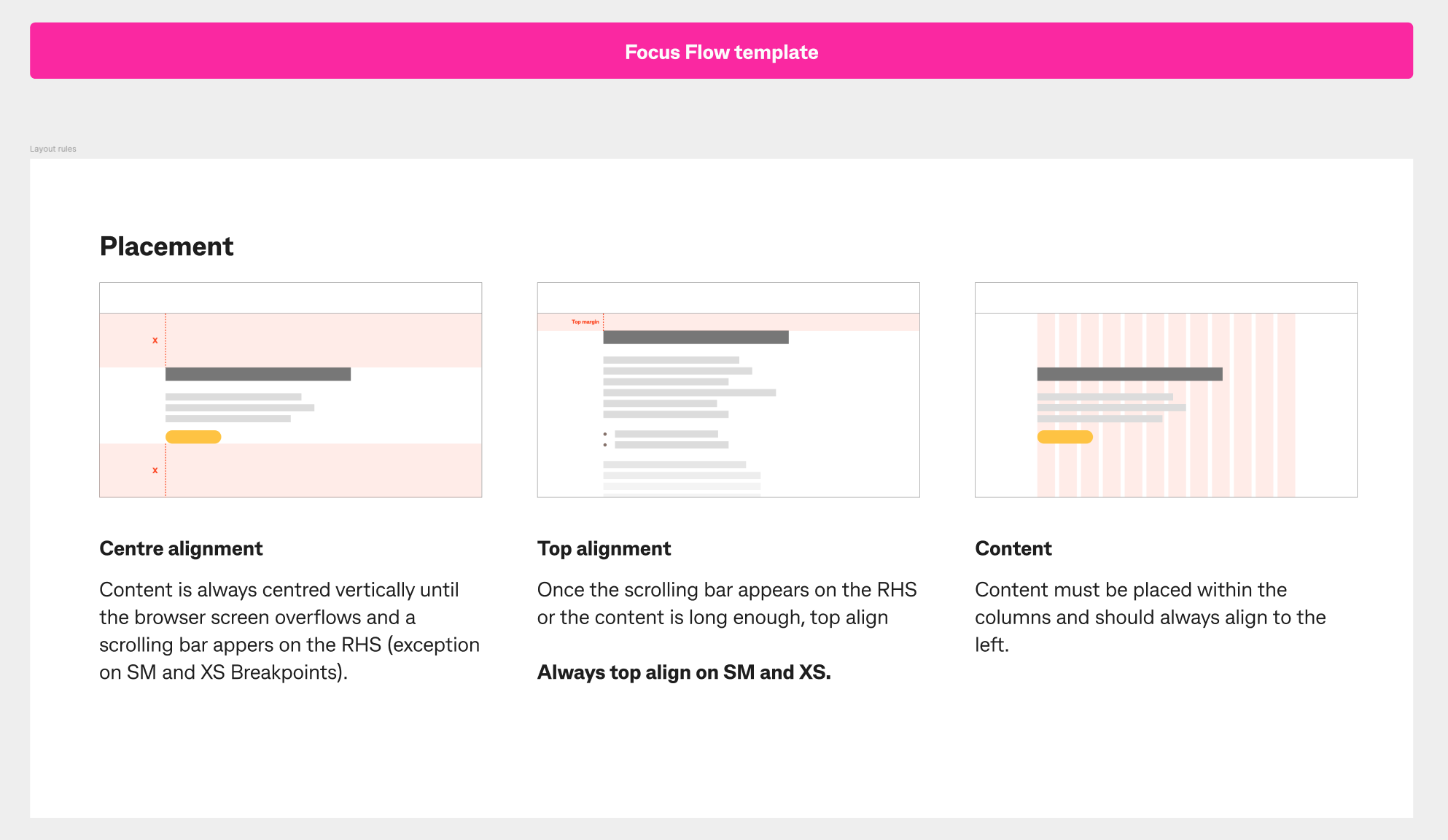

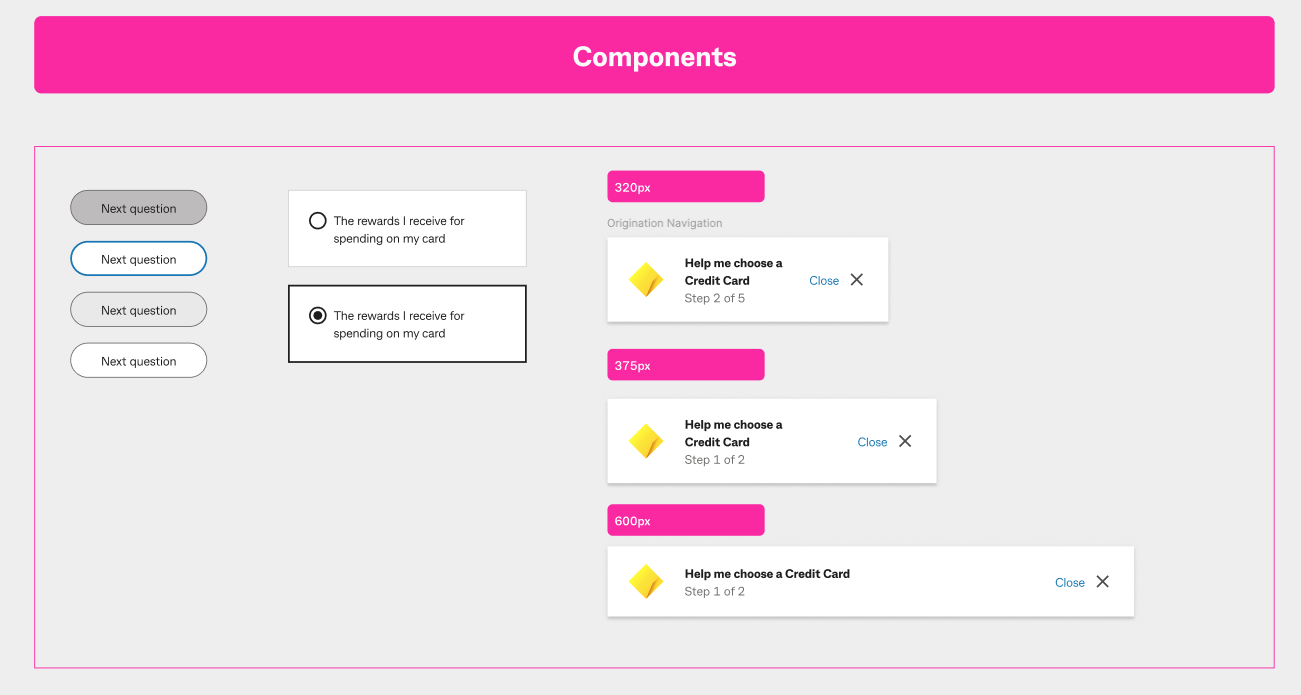

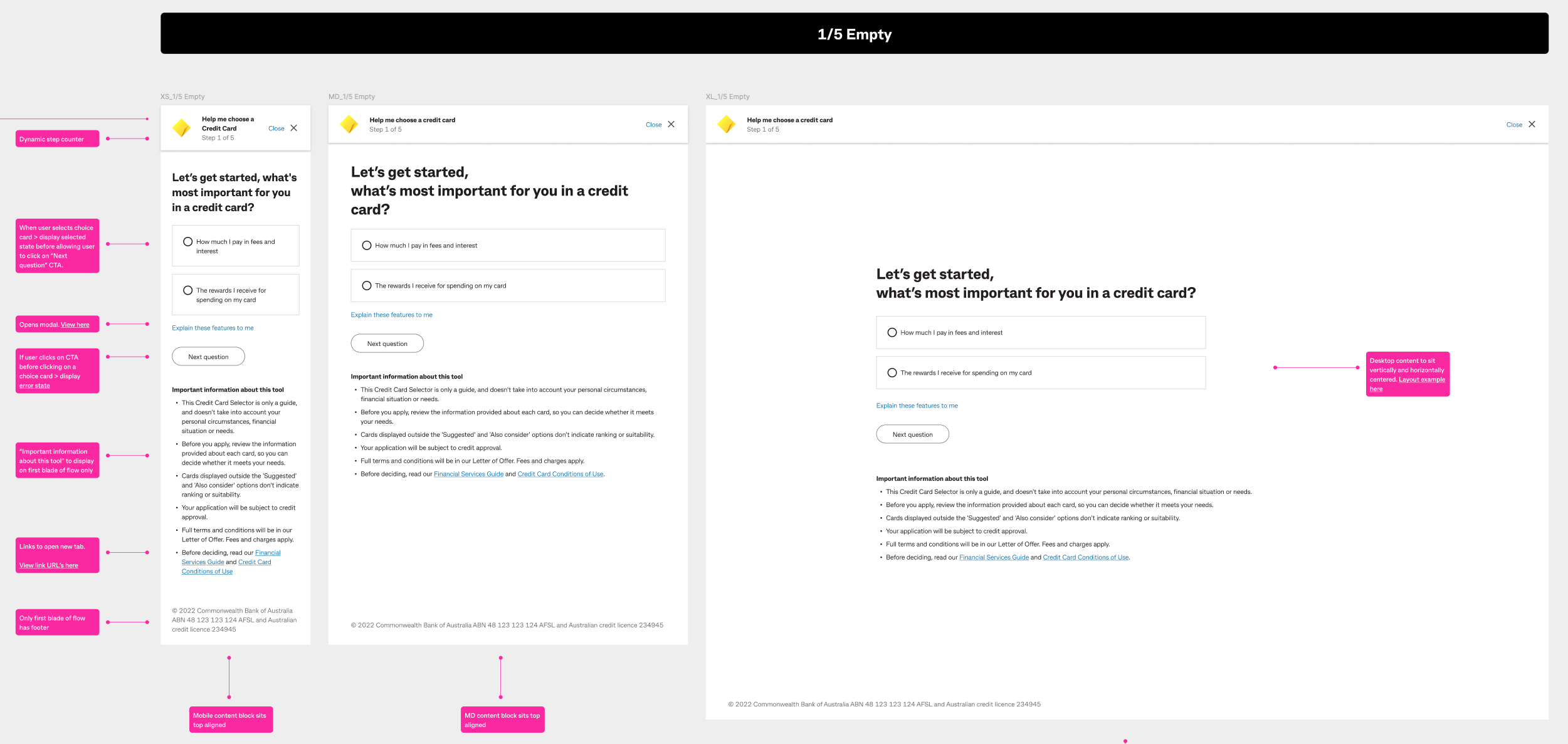

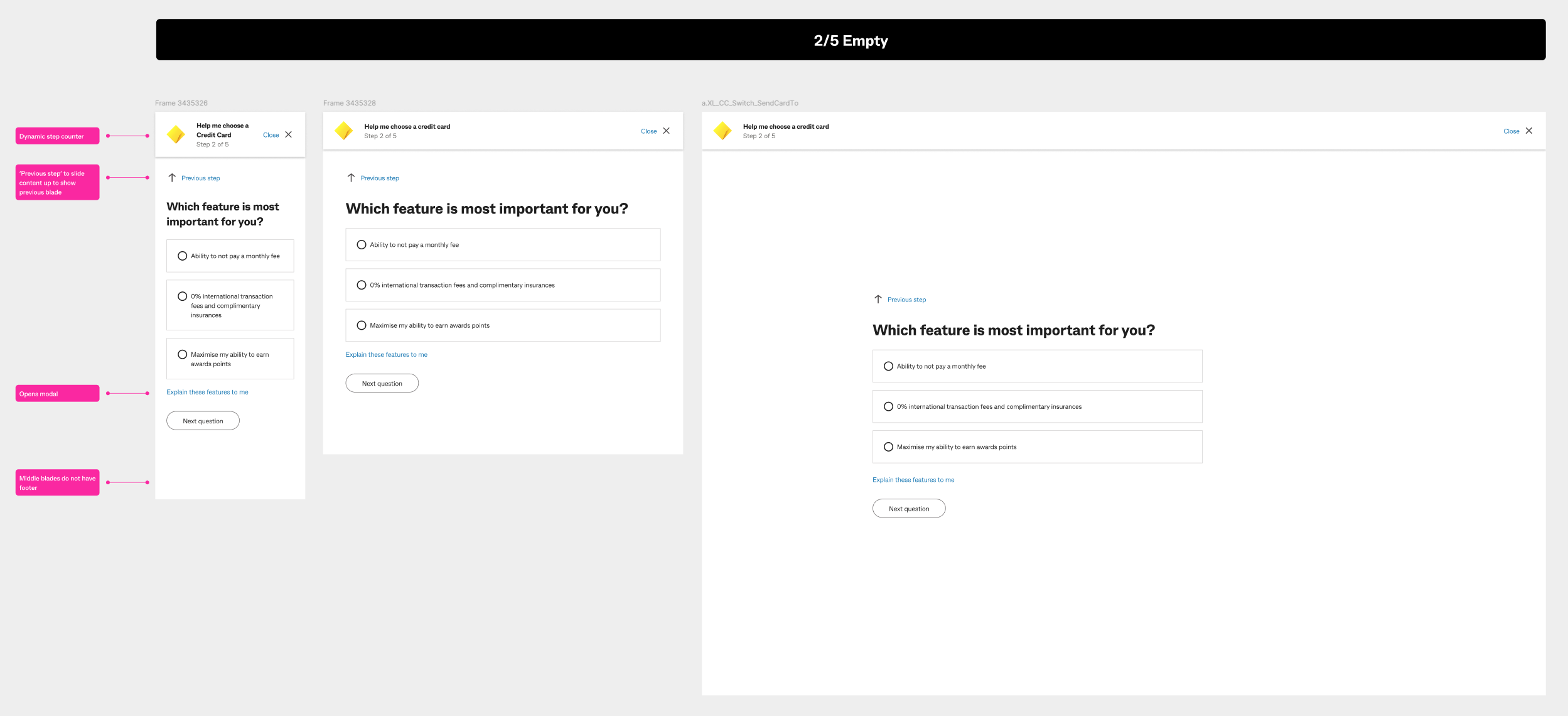

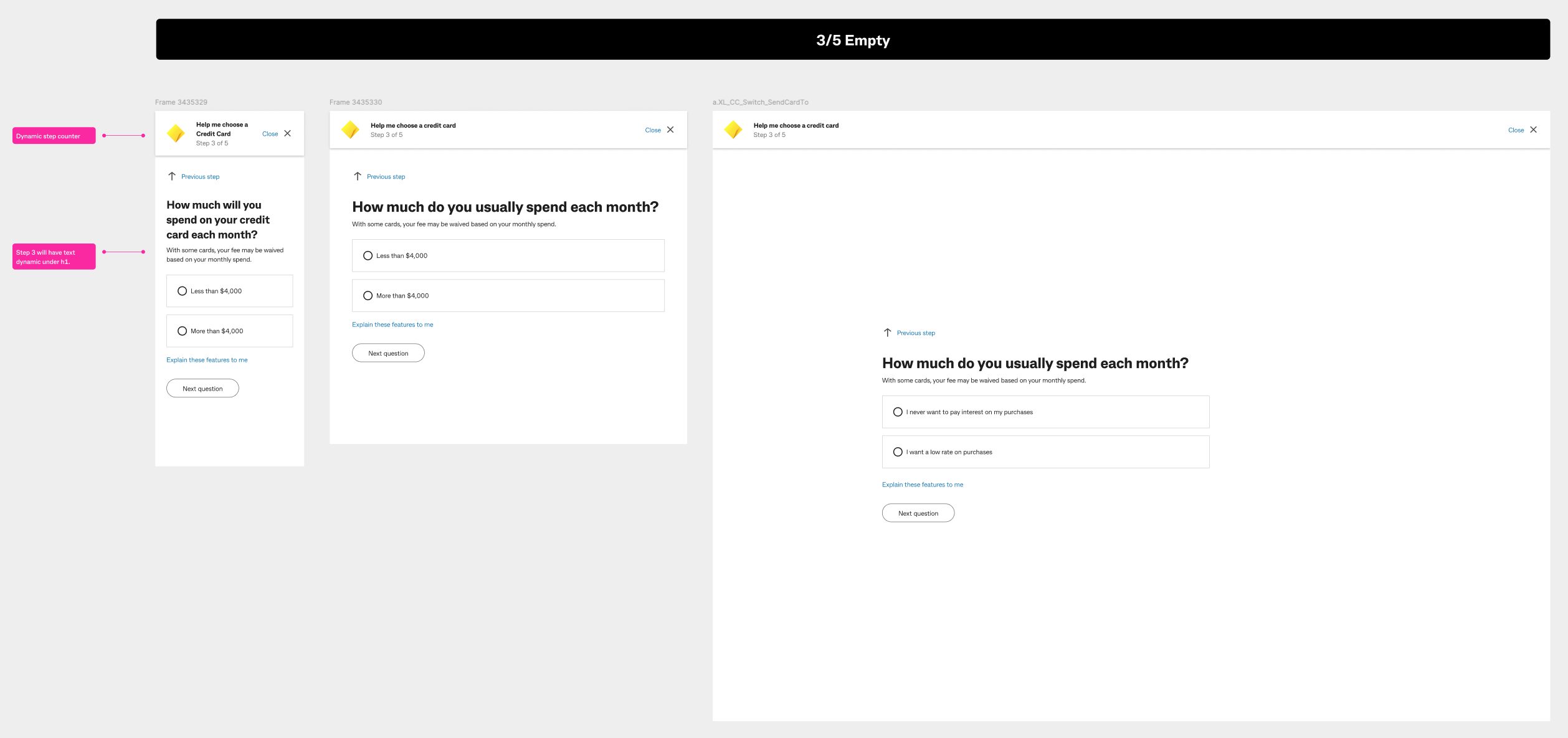

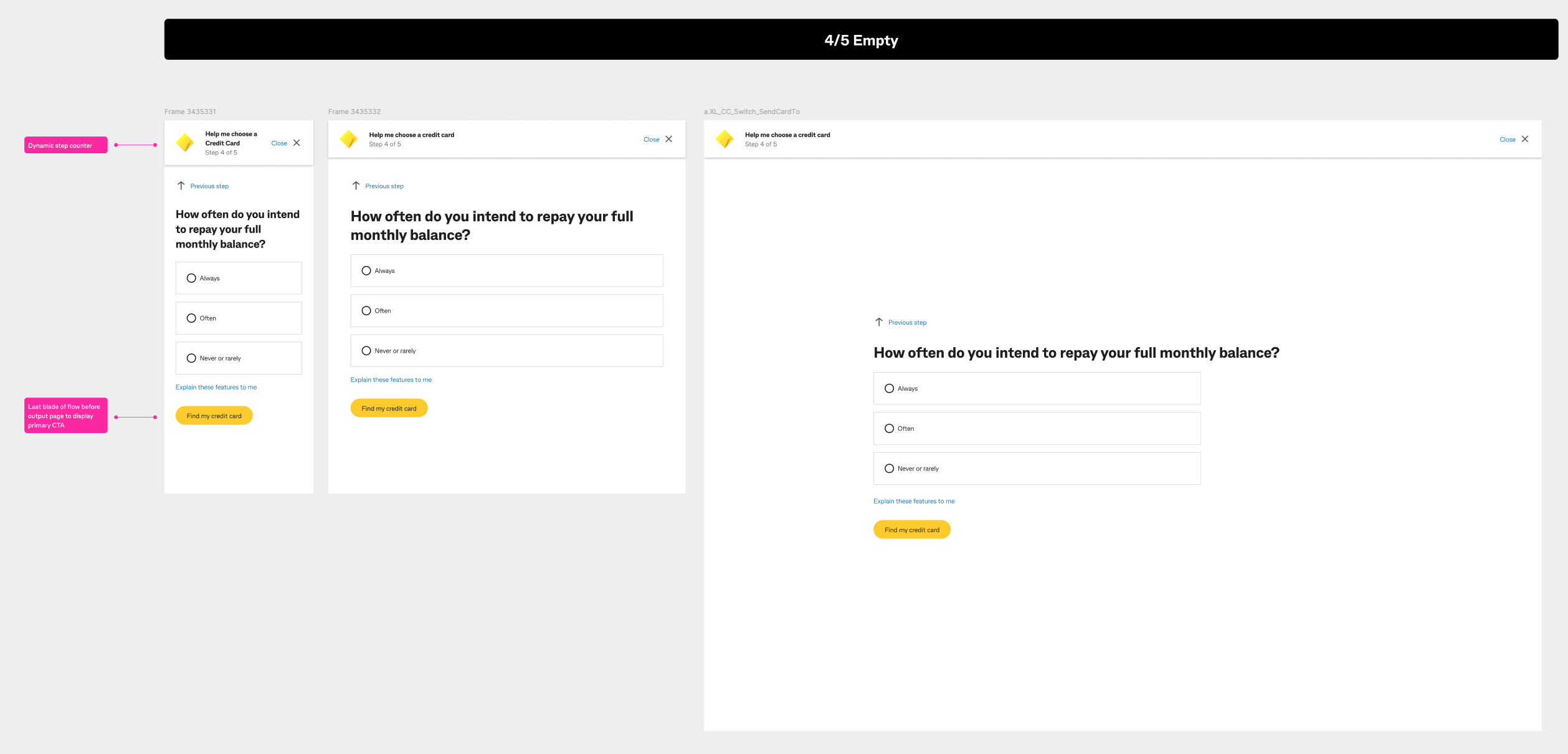

Creating an intuitive, user-friendly interface focusing on customer goals and needs can be achieved through the double-diamond process of designing a customer-centric experience. This included simplifying language, removing jargon, and ensuring the tool is easy to navigate.

Concept testing and Iteration After implementing the redesign, conduct usability tests and gather feedback from users. We made iterative improvements based on user input to ensure the tool remains customer-centric.

Relaunch

Commbank promoted the newly designed credit card selector tool through various channels, such as the Commonwealth Bank website, mobile app, and customer service representatives. Highlight its customer-centric features and benefits.

Evaluation

When evaluating the user experience of a credit card selector tool, there are specific metrics that can help assess the tool's effectiveness and user satisfaction. These metrics are essential for understanding how well users interact with the tool and whether it meets their needs.

- Evaluating whether the redesigned experience led to a higher rate of task completion, suggesting an enhanced user-friendly experience.

- Are our customers completing tasks more quickly than before, indicating an improvement in user experience (UX)?

- Less error rate indicates less usability issues.

- Click-through rate for various credit card options presented by the tool helped user interest in specific cards effectively guides them to relevant options.

- Better Net Promoter Score (NPS) suggested that users find the tool valuable.

- The revamped tool has boosted user retention, signifying its long-term value and usefulness.

- The tool complies with accessibility standards, such as the Web Content Accessibility Guidelines (WCAG), to ensure that it is usable by people with disabilities.

By prioritizing customer needs over product features, Commonwealth Bank can create a credit card selector tool that not only simplifies the decision-making process for customers but also enhances their overall banking experience. This customer-centric approach can lead to higher customer satisfaction and loyalty.