Insight-led transformation of the Health Insurance experience

The brief

The FY24–26 Insurance and retail advice partnerships strategy set a clear ambition: to become the preferred insurance and advice provider for CommBank customers. It focused on four priorities: national recovery leadership, reimagined offerings, world-class digital experience, and streamlined foundations.

In alignment with this direction, the Health insurance optimisation initiative was launched to address four critical problem areas that undermine customer trust, engagement, and long-term value across the health insurance journey:

What's the problem?

Strategic-level problem statements

| Problem area | Strategic priority alignment | |

|---|---|---|

| 1 | Fragmented customer acquisition

Customers face friction and confusion in the early stages of the quote journey, with critical information locked behind authentication walls. Strategic gap: No unified, top-of-funnel experience to build awareness, demonstrate value, and convert prospects across channels. |

Seamless relationships Exclusive experiences Risk vs Commerciality |

| 2 | Limited post-acquisition engagement

After purchase, customers experience poor onboarding and lose sight of ongoing benefits like AIA Vitality, resulting in disengagement and lapse risk. Strategic gap: No structured lifecycle strategy to reinforce value, adapt to evolving needs, or retain customers long-term. |

Personalised lifecycle Seamless relationships |

| 3 | Siloed operating models

Disjointed systems, branding, and servicing between CommBank and AIA create inconsistency and operational inefficiency. Strategic gap: No shared, scalable framework for delivering seamless, end-to-end service across the partnership. |

Strong foundation Risk vs Commerciality |

| 3 | Lack of continuous discovery

Fragmented insights and limited customer validation slow down innovation and responsiveness to changing needs. Strategic gap: No embedded practice for customer-led, data-informed decision-making at scale. |

Seamless relationships Strong foundation |

Specific situation & customer impact

These strategic gaps manifested in concrete customer problems: CommBank's health insurance customers were struggling with a confusing and friction-heavy quote process, resulting in significant drop-offs and low engagement with AIA Vitality wellness benefits.

Despite having a unique partnership with AIA to offer wellness-integrated health insurance, customers weren't seeing the value proposition, leading to poor conversion rates and missed opportunities to differentiate in the competitive health insurance market.

What we heard, saw, and learned

During a five-day design sprint with stakeholders across Product, Design, Engineering, and Marketing, we uncovered a critical truth: Despite offering a highly differentiated product—CommBank Health Insurance bundled with AIA Vitality—customers weren’t seeing the value. And many weren’t even seeing us.

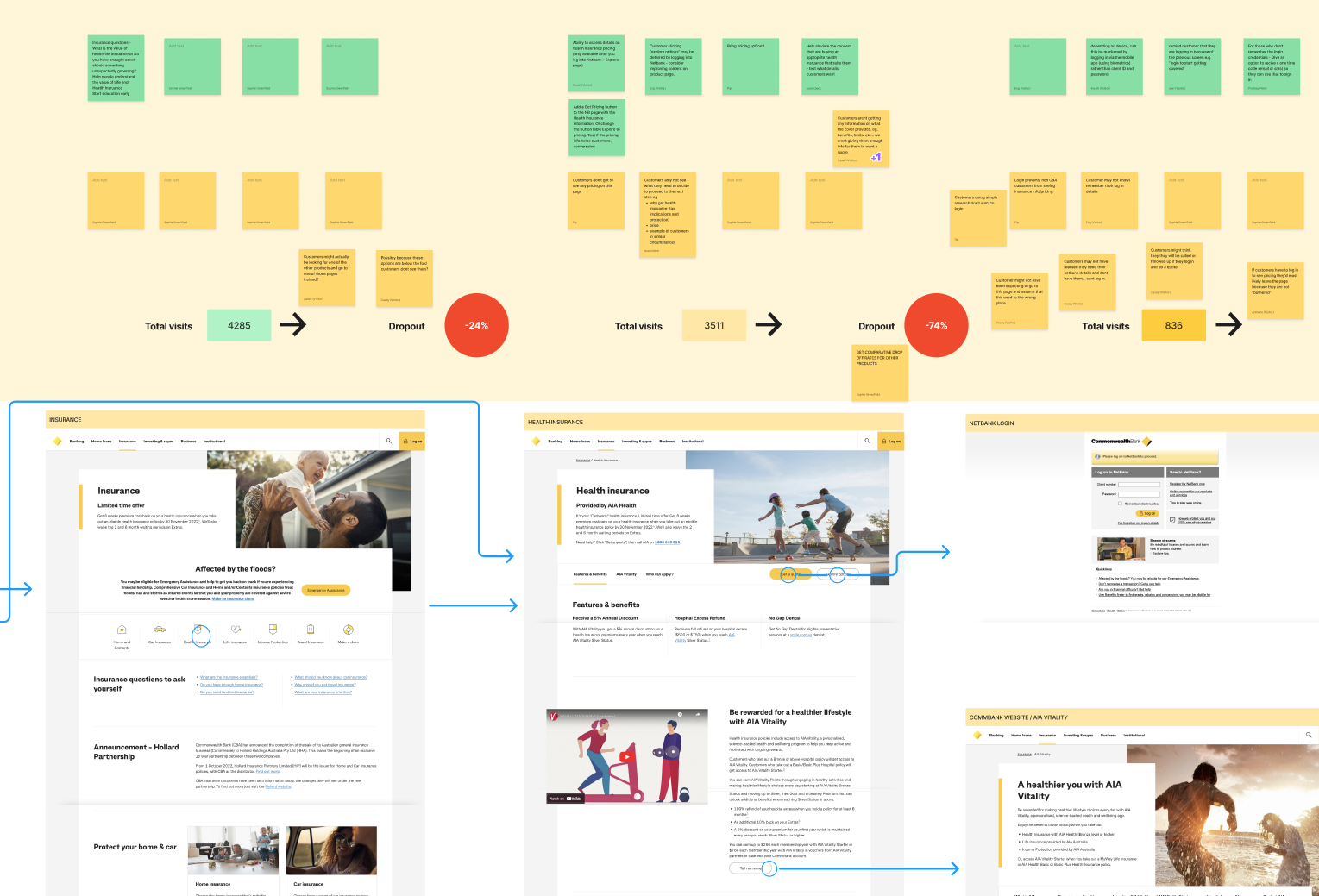

When we combined stakeholder perspectives, customer interviews, and behavioural analytics, a clear picture emerged: We’re losing customers at every stage of the journey due to lack of visibility, high friction, and unclear value.

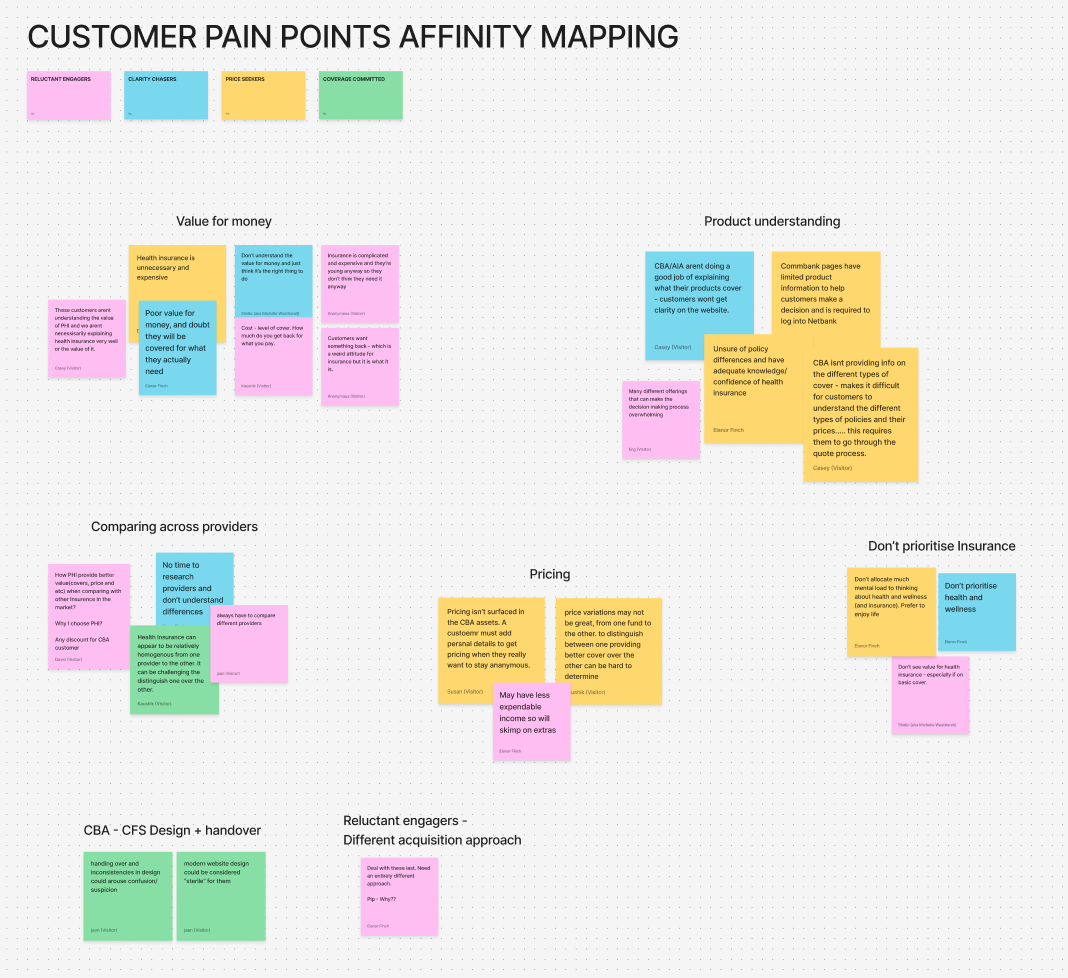

Customer Pain Points

Customers aren’t finding us—or stopping short

At the top of the funnel, awareness is low. Campaigns and NBCs exist, but customers aren’t engaging or recognising the offer as relevant.

“I didn’t even know CommBank had health insurance.”

A 24% drop-off on category pages suggests unclear value and weak calls-to-action, causing users to lose interest before reaching product details—an early missed opportunity to engage and convert.

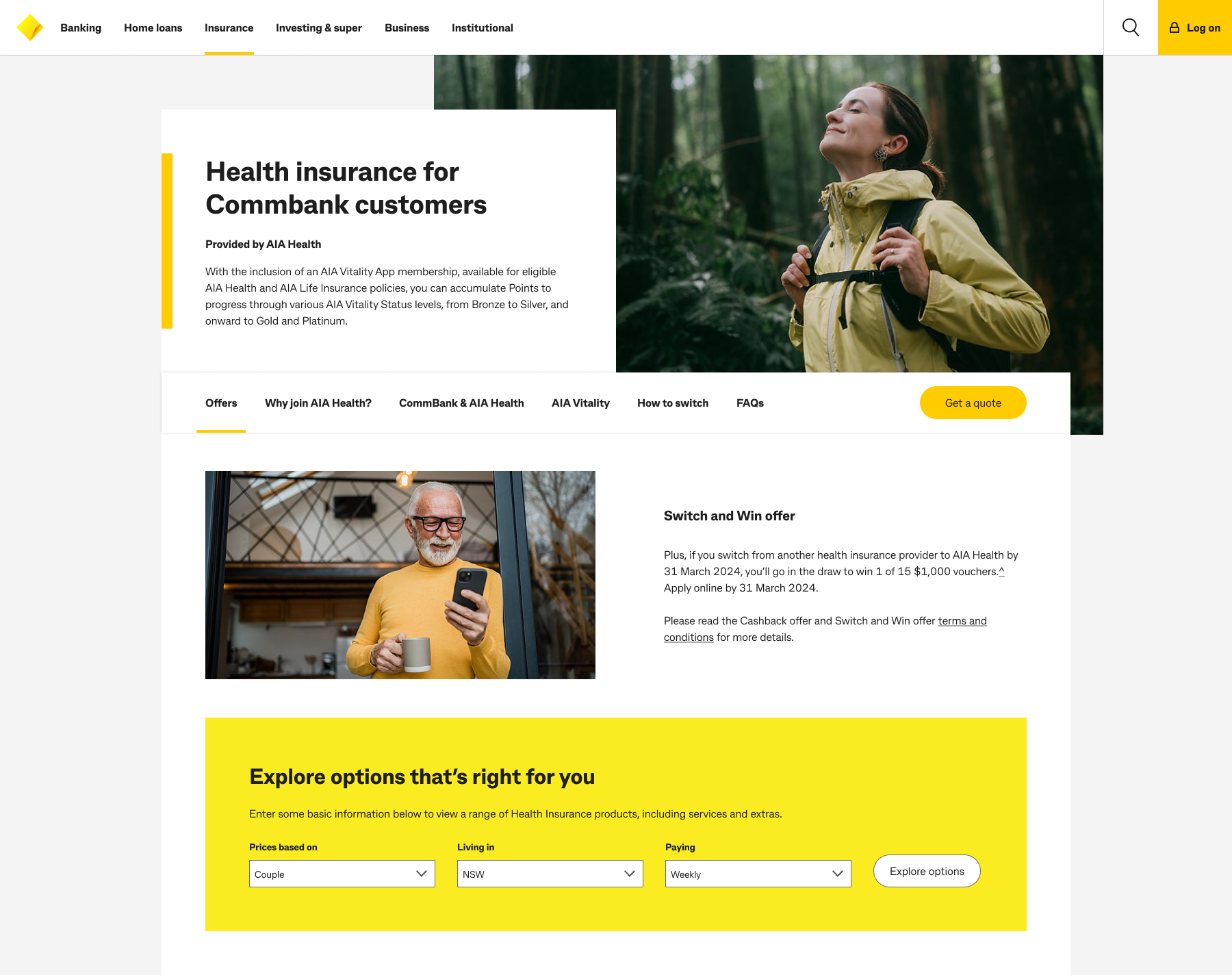

Product pages fail to communicate differentiation

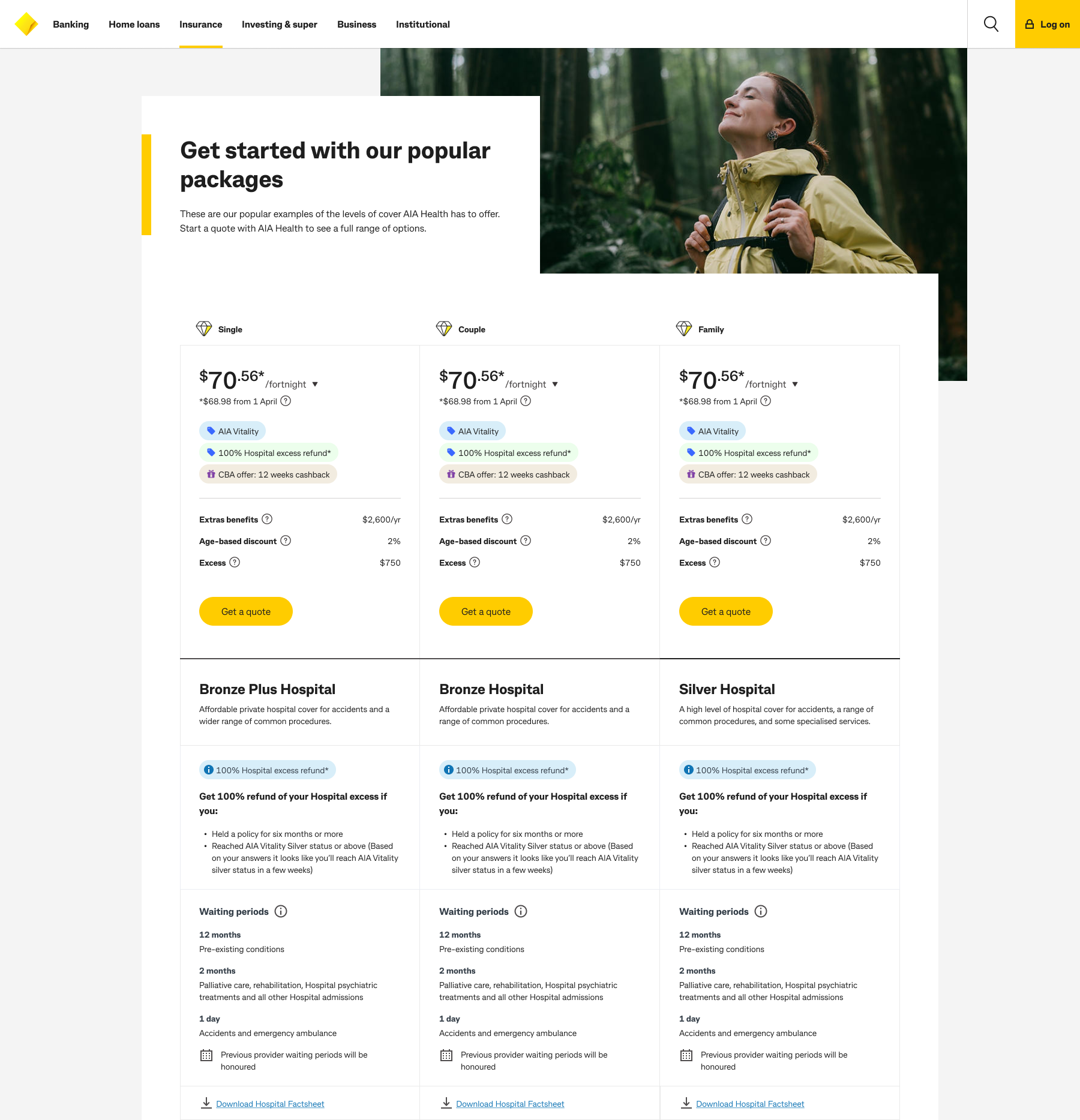

Once on product pages, customers face long paragraphs, limited pricing transparency, and buried information about AIA Vitality. They struggle to understand why this cover is different.

“There’s too much text. I’m not sure what I’m looking at.”

A 74% drop-off on product pages shows users aren't finding what they need to convert. Scroll data reveals most miss the Vitality section—our key differentiator—highlighting a missed opportunity to build confidence and communicate value.

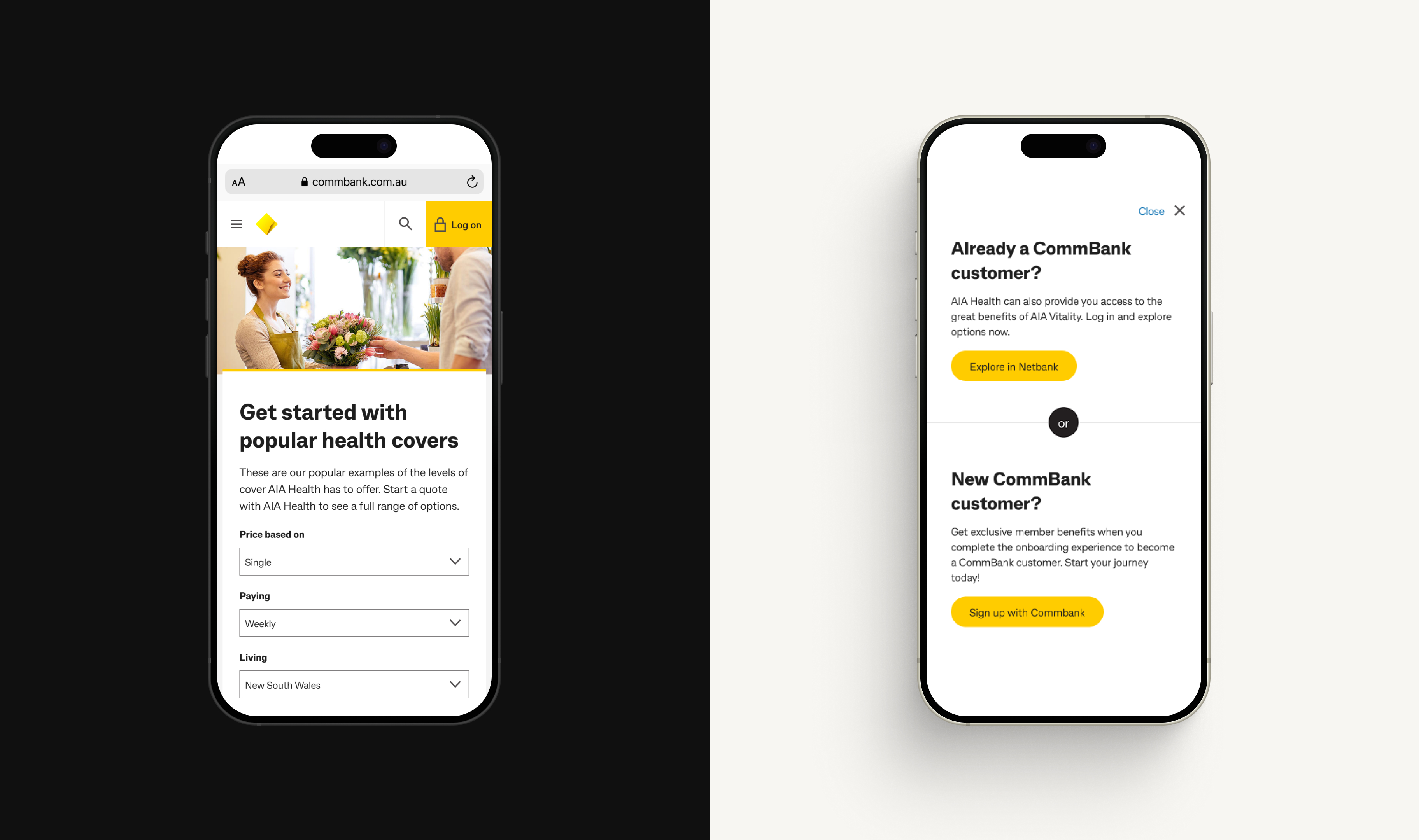

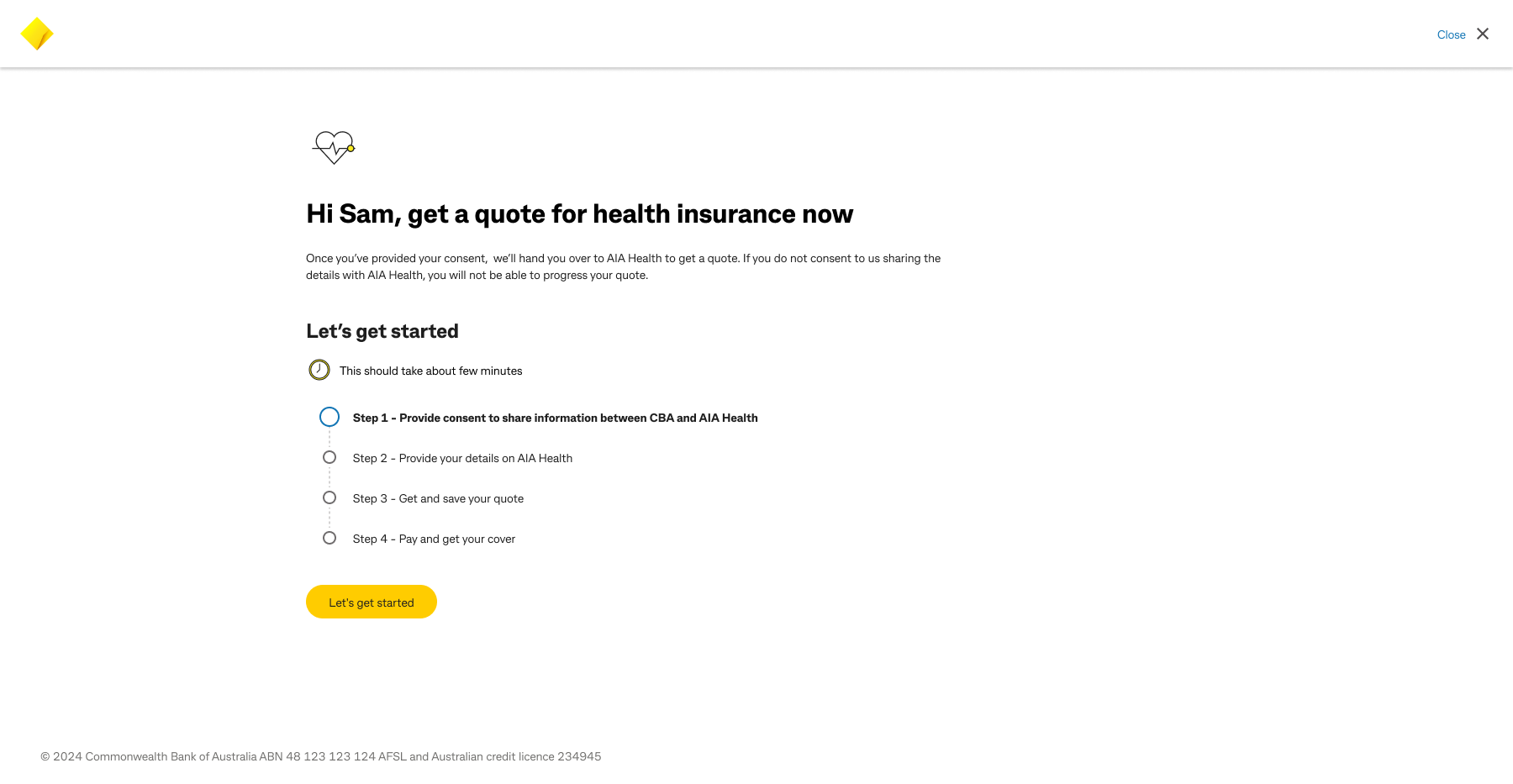

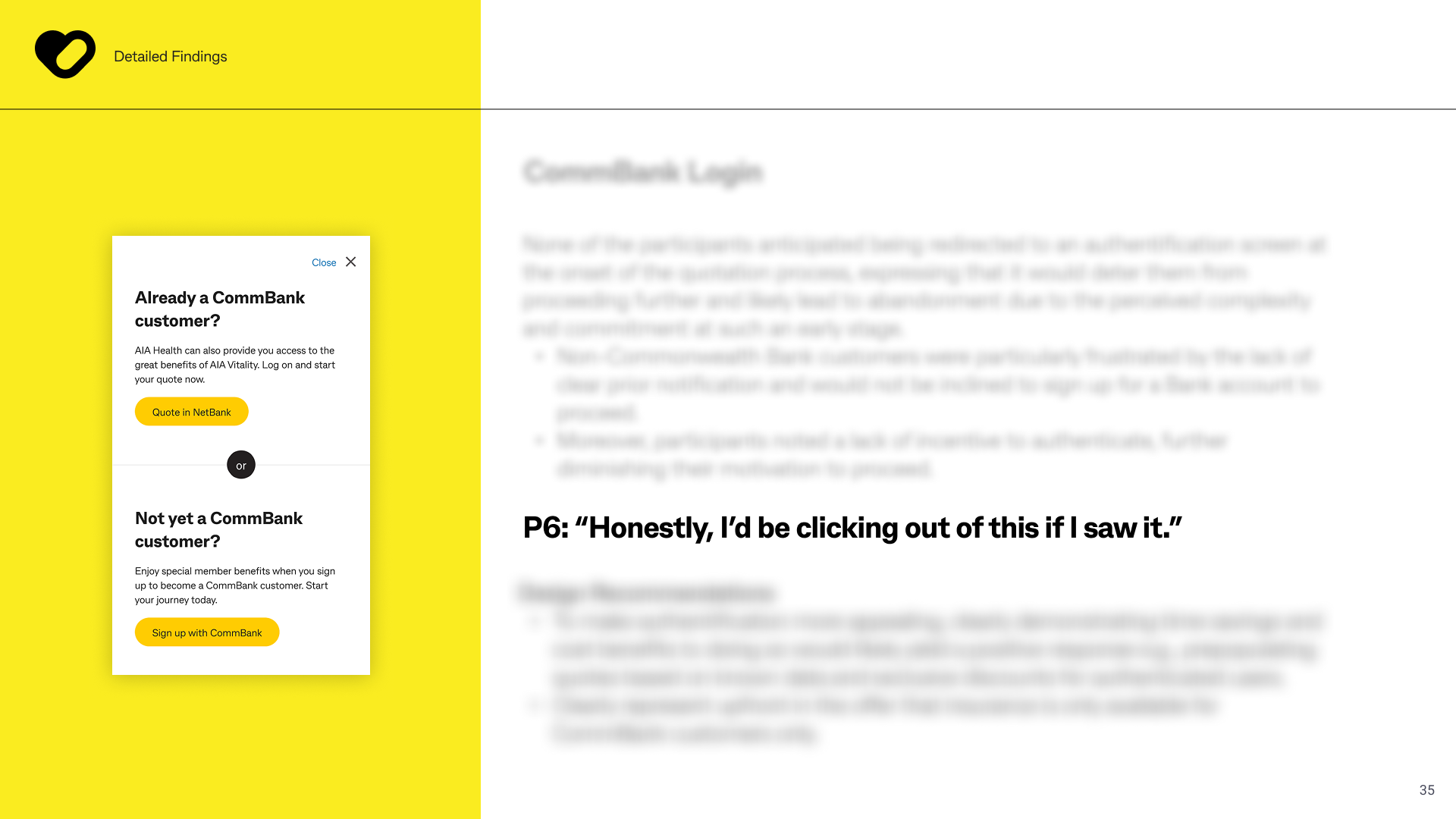

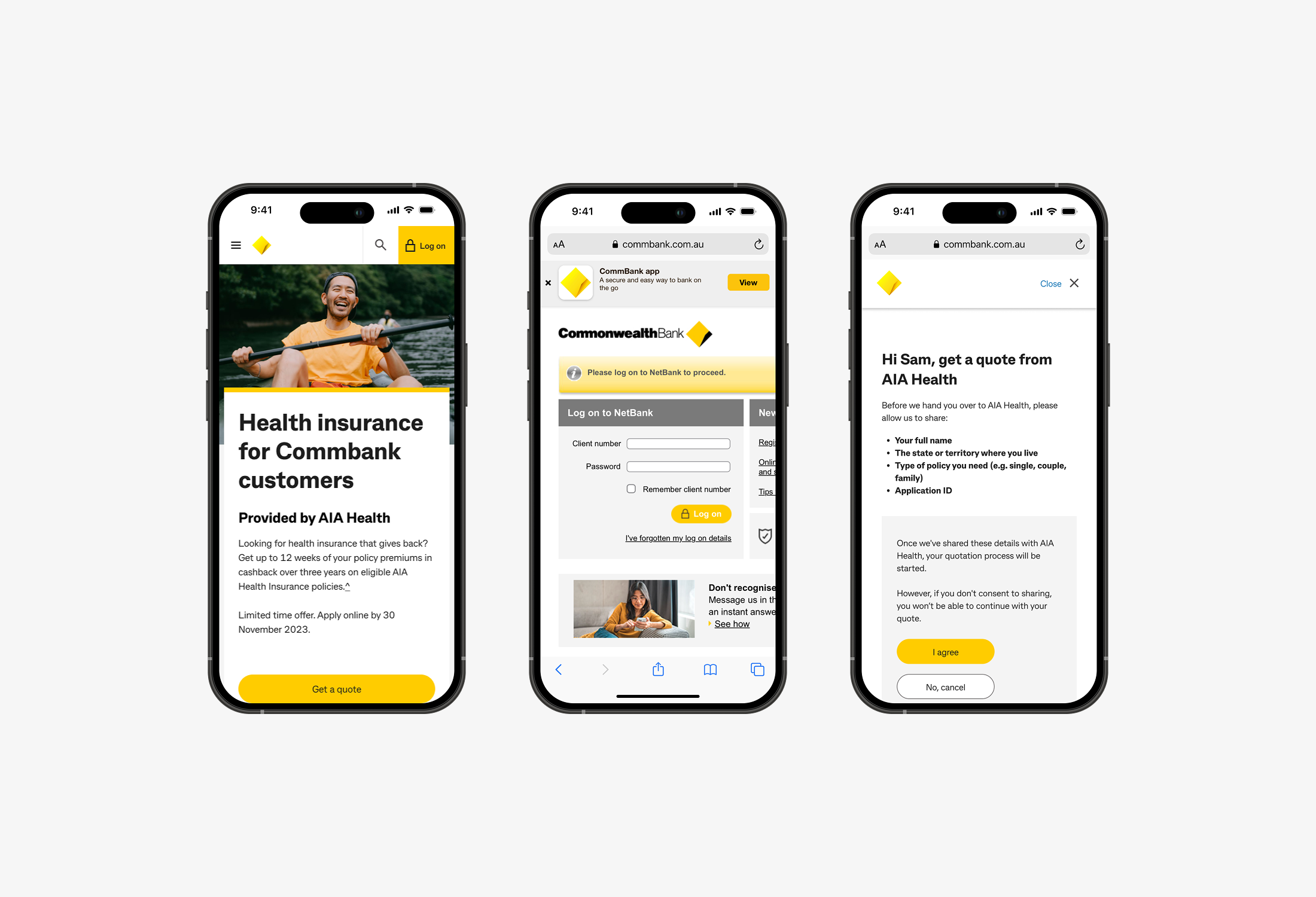

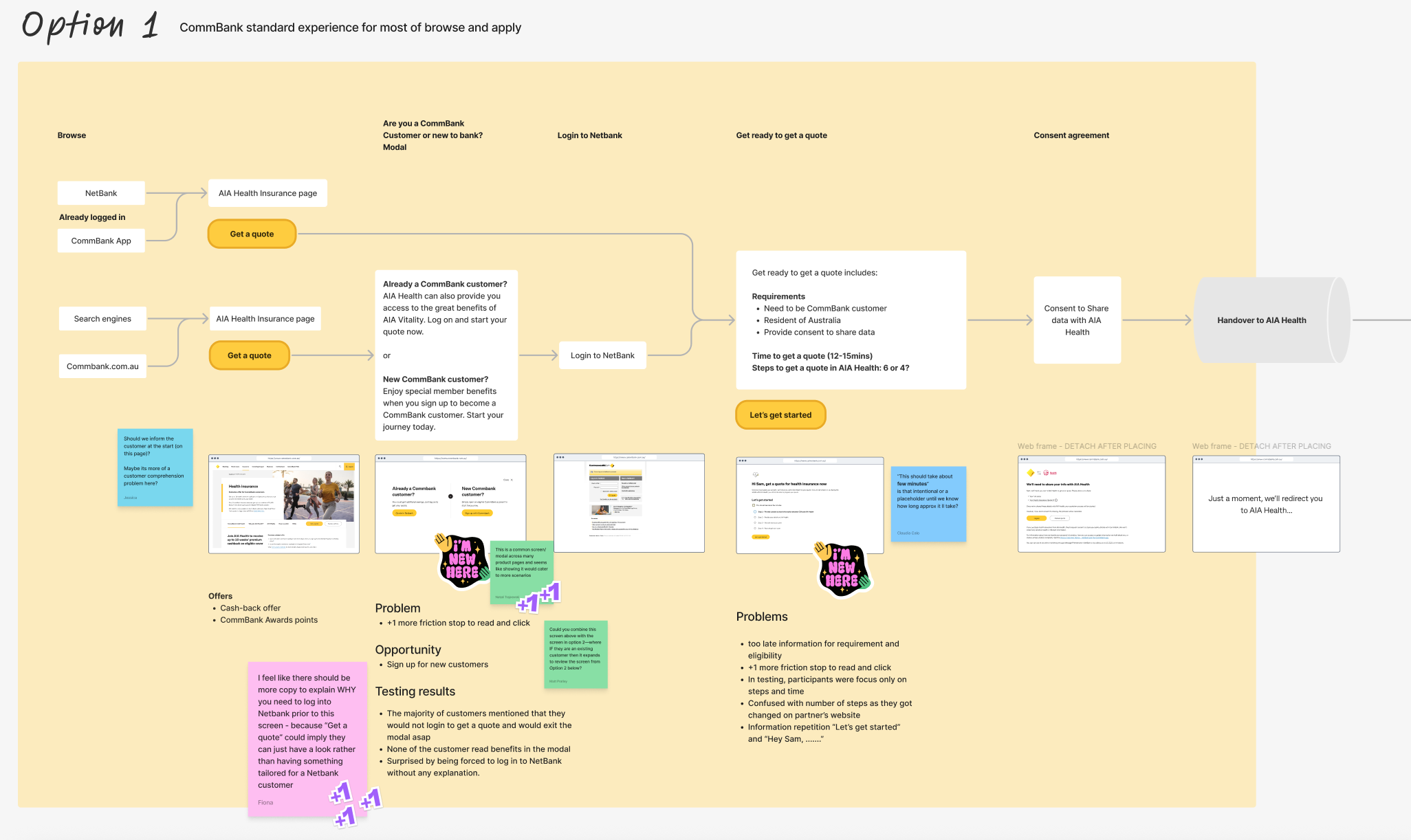

Authentication comes too soon

The quote journey asks for login before delivering value. Without seeing price, benefits, or even understanding what’s included, customers are hesitant to share credentials.

“I’m not ready to log in—I don’t even know if I want this yet.”

A 28% drop-off at login shows we’re losing customers before proving value or building trust—asking for too much, too soon, in a moment where intent is high but still fragile.

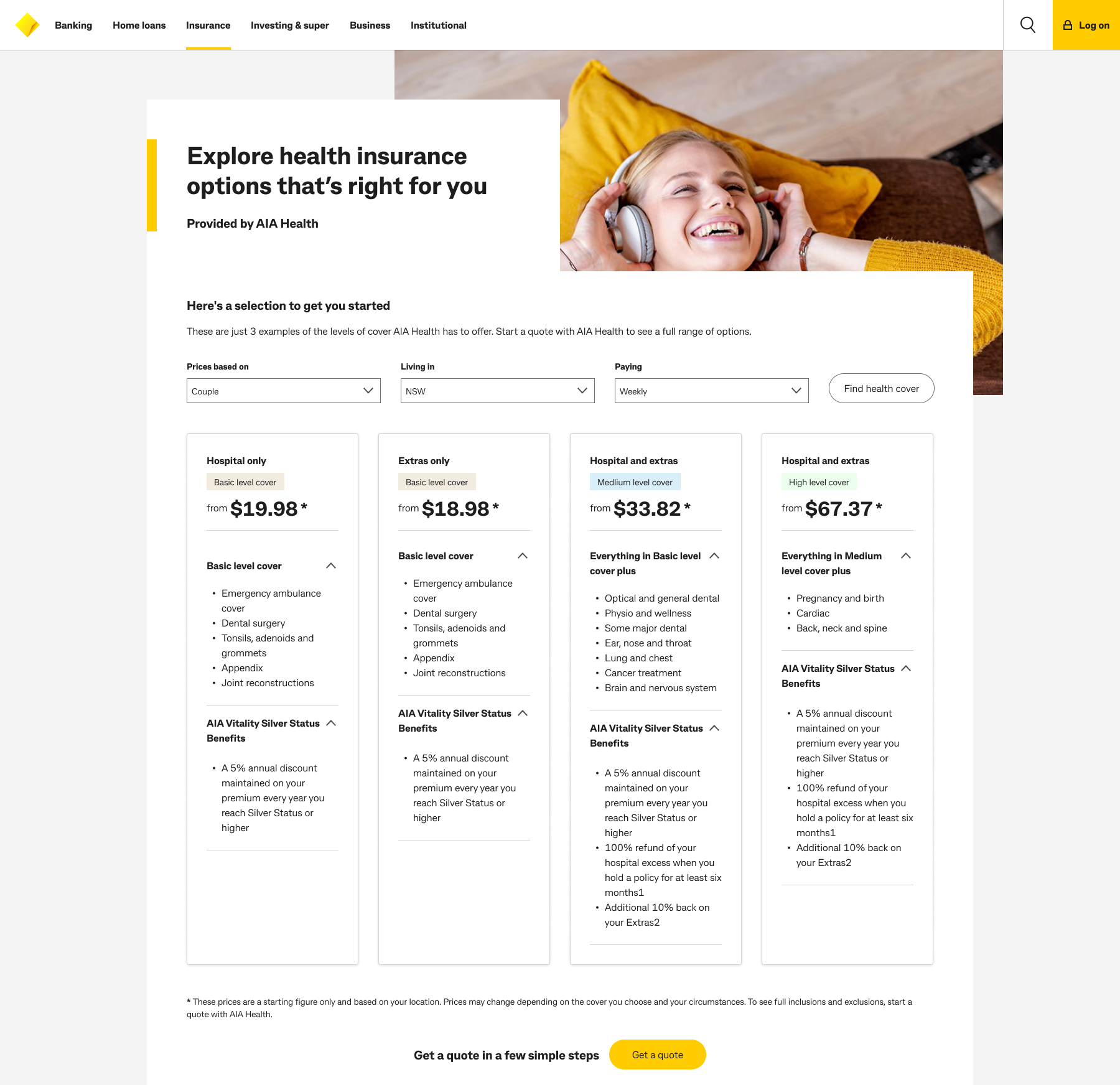

Quote tool complexity blocks progress

The AIA Quote Application Tool (QAT) is a functional barrier. It asks for too much detail upfront, lacks visual feedback, and doesn’t highlight benefits like rewards, discounts, or cover flexibility.

“I just wanted to see a price—this was too much.”

A staggering 64% drop-off at the AIA Quote Application Tool (QAT) highlights a critical friction point—where even motivated customers abandon the journey due to poor usability and unclear next steps, revealing a major gap between intent and execution.

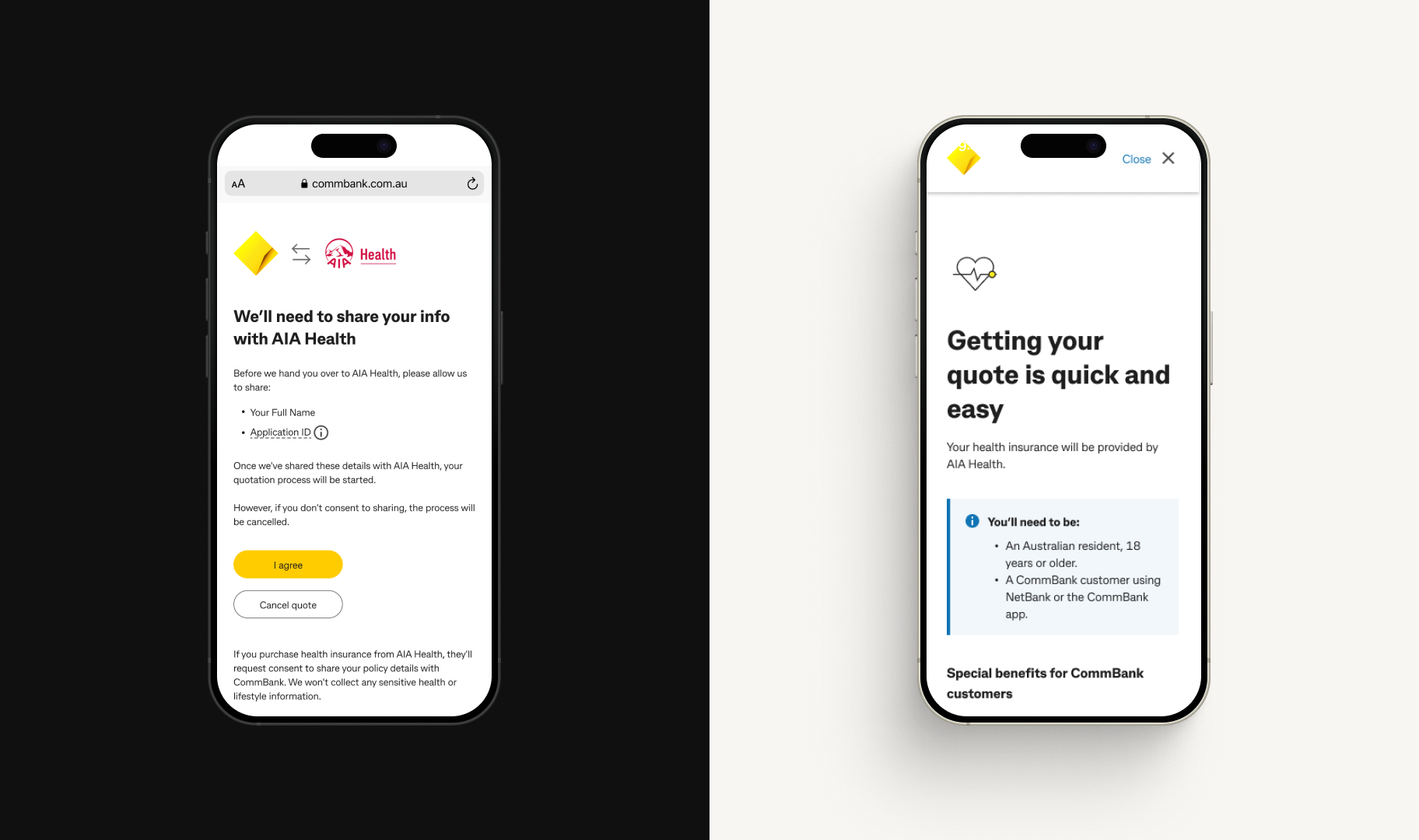

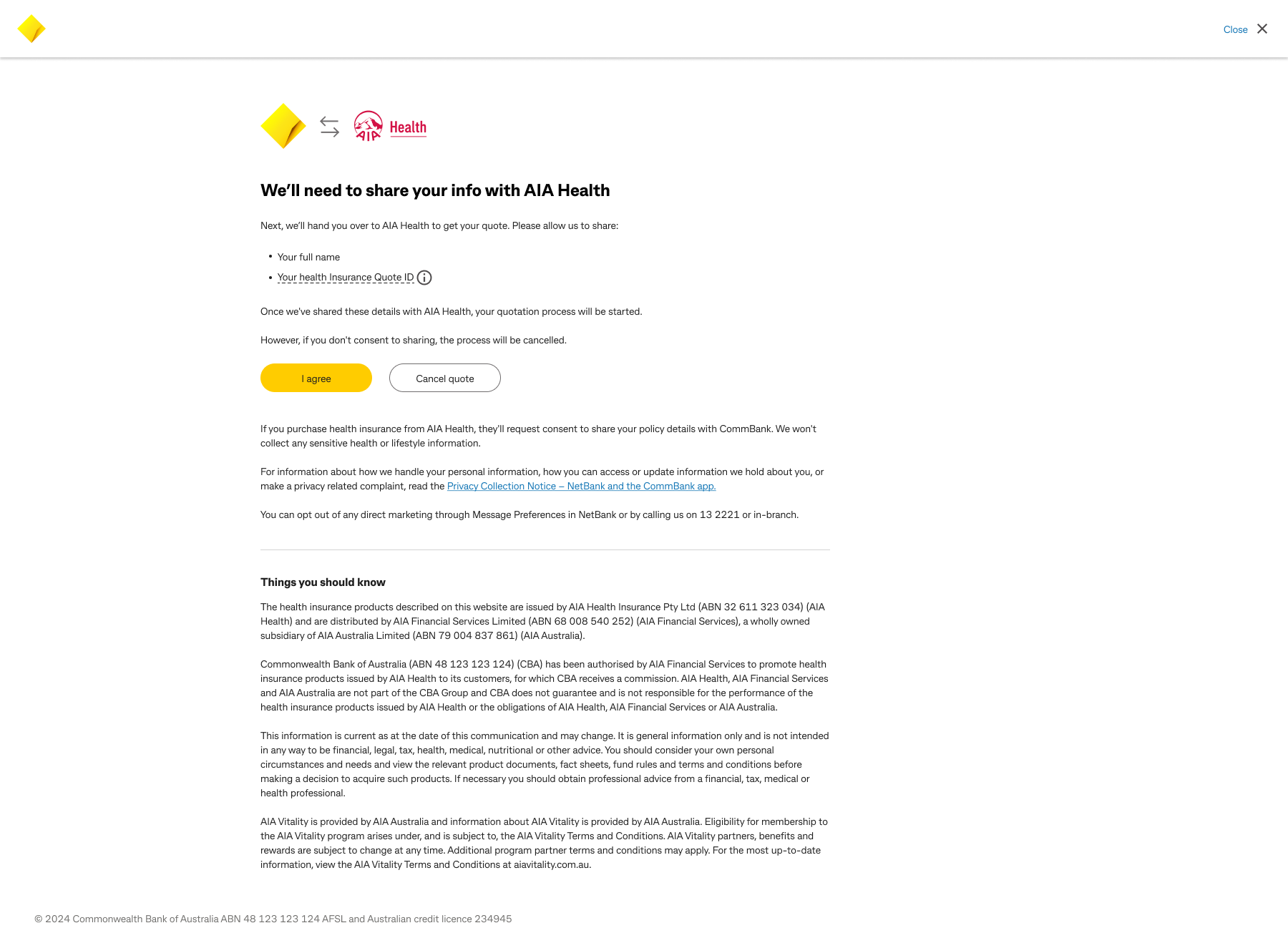

Trust breaks at the final step

At the final conversion step, brand handover is unclear. The UI, tone, and trust signals shift—causing customers to second-guess who they’re signing up with.

“Wait, am I joining AIA or CommBank?”

A staggering 73% drop-off at the ‘Join AIA’ step reveals a critical breakdown at the final moment of conversion—where customer intent is highest. This sharp abandonment signals more than friction; it reflects unresolved confusion, mistrust, and a lack of clarity in value or next steps, ultimately breaking customer confidence when it matters most.

Business impacts

- Lost acquisition opportunities: High drop-offs at key stages (74% on product page, 64% on quote tool, 73% at final join step) significantly reduced conversion rates and customer growth.

- Underperformance of targeted NBCs and campaigns: Low engagement and awareness meant paid campaigns and NetBank Channel placements failed to drive meaningful uptake, reducing ROI on marketing efforts.

- Reduced lifetime value (LTV): Failure to communicate AIA Vitality benefits early meant fewer customers saw the long-term value proposition—impacting retention and cross-sell potential.

- Erosion of brand trust at key decision points: Inconsistent branding and unclear handovers (CommBank → AIA) undermined confidence, leading to abandonment and reputational risk for both partners.

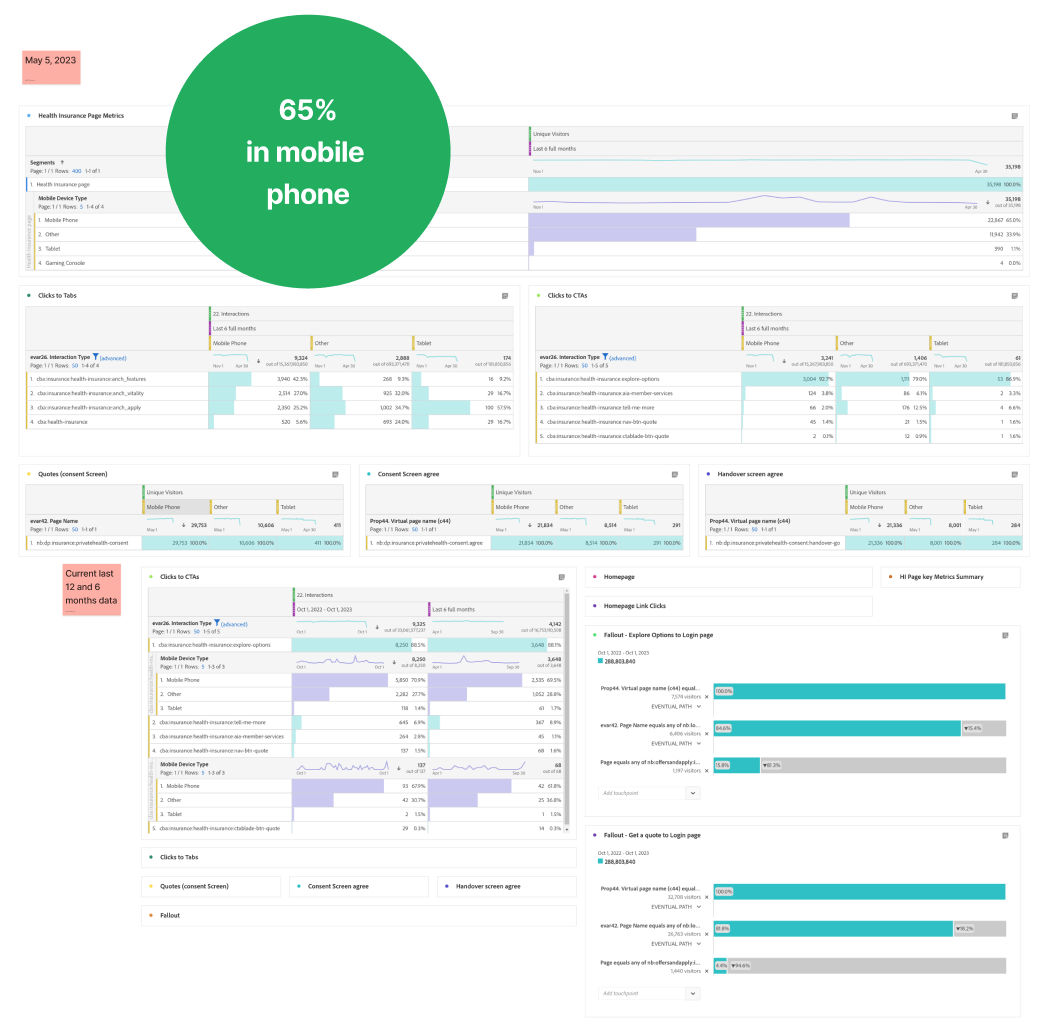

- Poor mobile experience limiting reach: With most traffic on mobile, usability issues in login, quote tools, and form steps directly impacted accessibility and widened the gap with digitally native competitors.

- Decreased competitiveness in a crowded market: Lack of clear product differentiation reduced perceived value compared to multi-quote competitors (like iSelect or Compare the Market), stalling market share growth.

So, are these the real problems?

Through data, observation, and voice-of-customer insights, the root issues became clear:

- Value isn’t visible early enough. Vitality rewards and insurance benefits are buried too deep in the journey.

- Friction appears before trust is earned. We ask customers to authenticate and share data before showing them what’s in it for them.

- The experience lacks clarity and confidence. Confusing flows, sterile UI, and unclear brand ownership all contribute to high exit rates.

Where we go from here...

This isn’t a product issue. It’s a communication, journey, and visibility issue. To fix it, we must:

- Elevate the value early in the journey – NBCs, campaigns, and product pages must tell the full story of CommBank Health + AIA Vitality as an exclusive, rewarding lifestyle offer.

- Show pricing and benefits upfront – Let customers explore before login. Lead with transparency.

- Streamline the quote tool – Focus on speed, clarity, and user-friendly design—especially on mobile.

- Delay friction, increase payoff – Reduce perceived risk by holding back data capture until value is clear.

- Strengthen the handover experience – Reassure customers with unified branding and trust signals at every step.

The opportunity

We have a rare and powerful opportunity—no other bank in Australia offers health insurance that actively rewards customers for living well. But unless we bridge the gaps in perception, trust, and journey friction, that competitive edge risks going unnoticed. Now is the time to reimagine the experience—anchored in customer mindset, needs, and confidence.

By integrating AIA Vitality into eligible health insurance products and refining the quote and onboarding journey, we can transform CommBank’s offering from just another policy to a lifestyle-driven value proposition. This isn’t just about improving the digital flow—it’s about positioning CommBank as a leader in proactive health, increasing acquisition, strengthening brand trust, and boosting long-term retention.

What we amied for?

Our goal was clear: rebuild trust and momentum in the customer journey by removing friction and surfacing value—early, clearly, and confidently.

We set out to reimagine the health insurance acquisition experience through the lens of customer needs and behavioural insight. This meant simplifying the quote process, reducing barriers like forced authentication, and helping customers understand not just the product—but the unique benefits of AIA Vitality—before they committed to sharing personal information.

At its core, the objective was to create a seamless, insight-led experience that would engage, educate, and convert—ultimately positioning CommBank and AIA as partners in both protection and wellness.

What success looks like

We knew success wouldn’t be defined by a single number—it would be felt in every moment a customer moved through the journey with less friction, more clarity, and a renewed sense of trust in what CommBank and AIA could offer together.

To get there, we grounded our work in clear, measurable outcomes that reflected both business goals and customer needs.

Primary success metrics

Early on, the numbers told a clear story customers were dropping off at every stage of the journey. The moment they hit an authentication wall, most turned away. It was like asking someone to commit before they even knew what they were signing up for. That’s when we knew—something had to change.

Our first real breakthrough came when we shifted focus to conversion. We set a bold target: cut the drop-off rate in half. The idea was simple—give people the freedom to explore, to understand the value of what we offer, before asking them to log in or share their details. It was the first step toward rebuilding trust and turning curiosity into commitment.

Beyond conversion, we focused on quote engagement not just starting a quote, but completing it. By reducing cognitive load and making the journey feel more helpful and human, we aimed for a high increase in completed quotes.

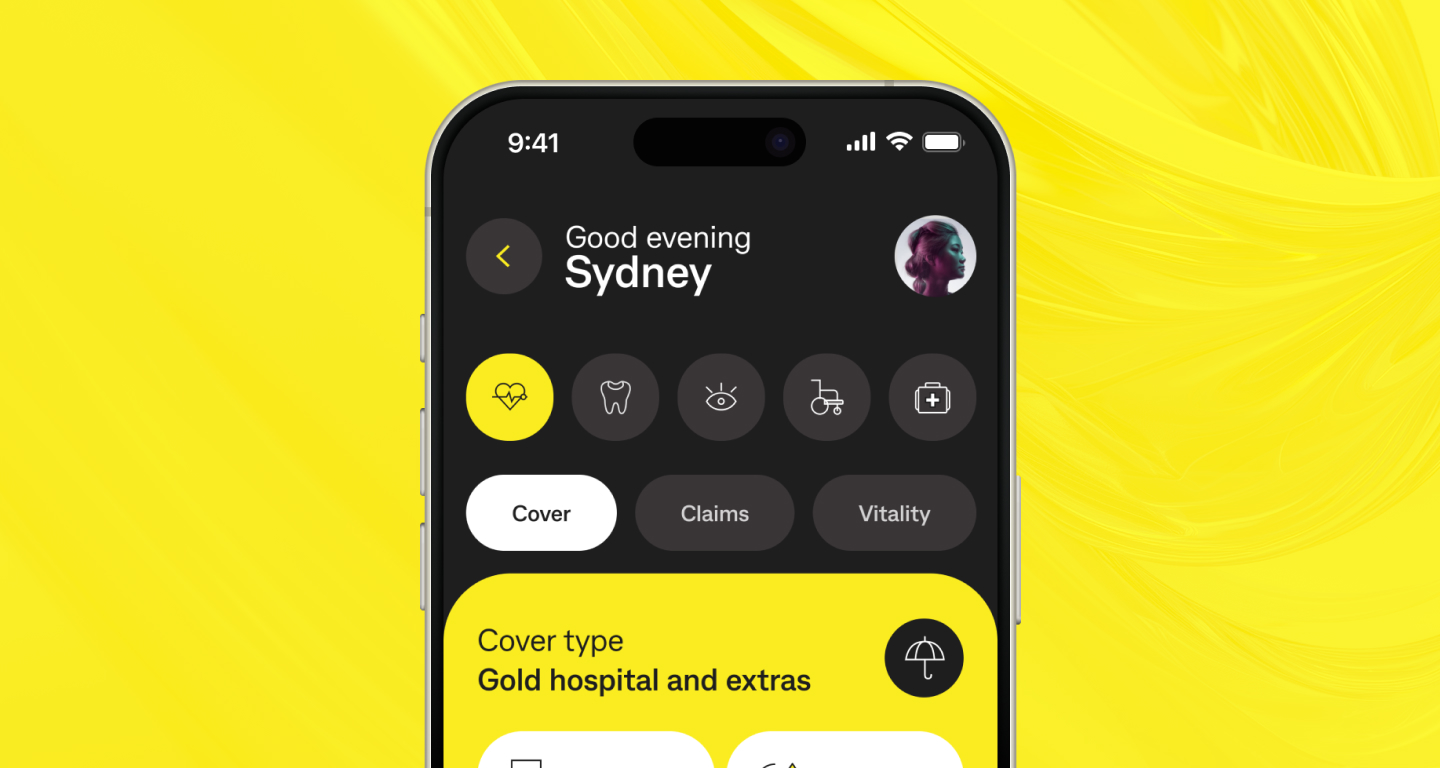

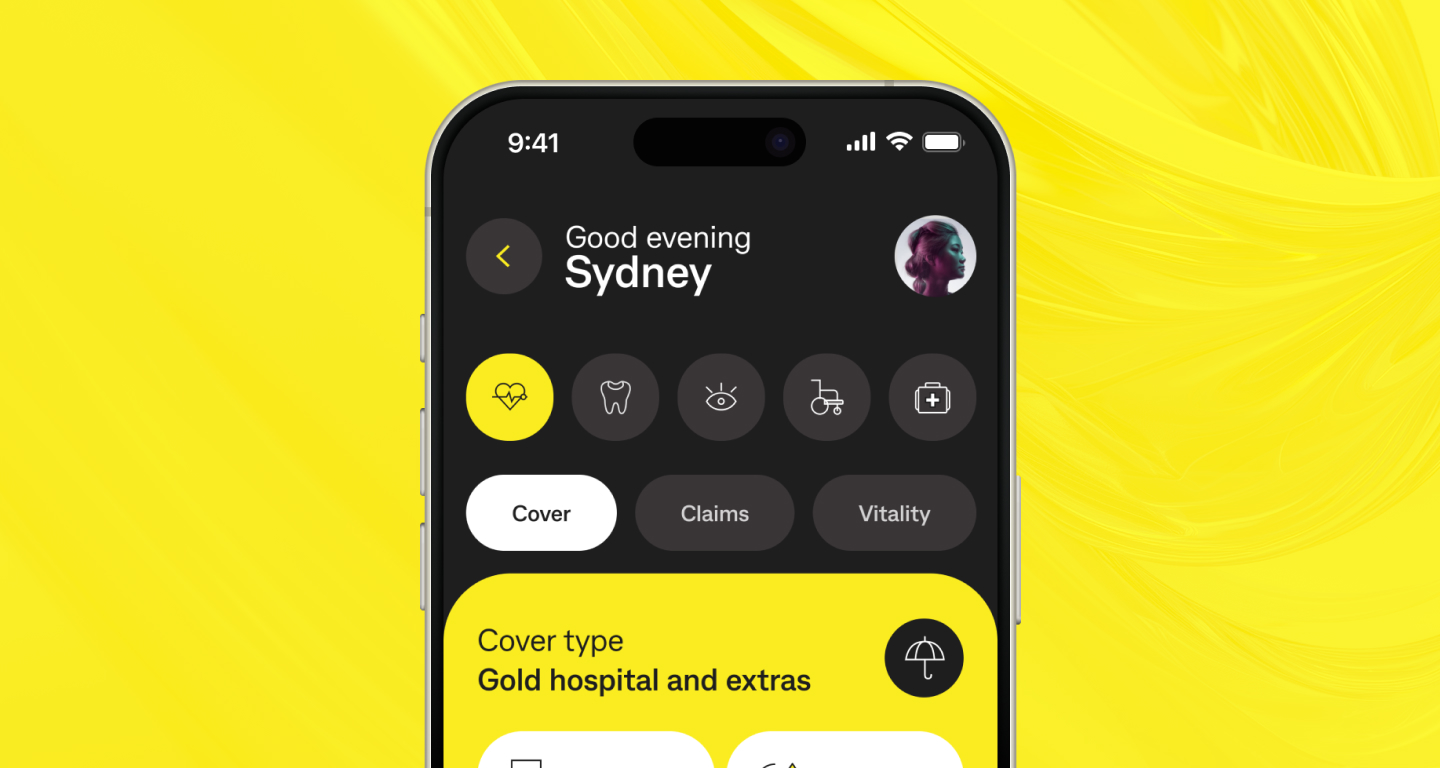

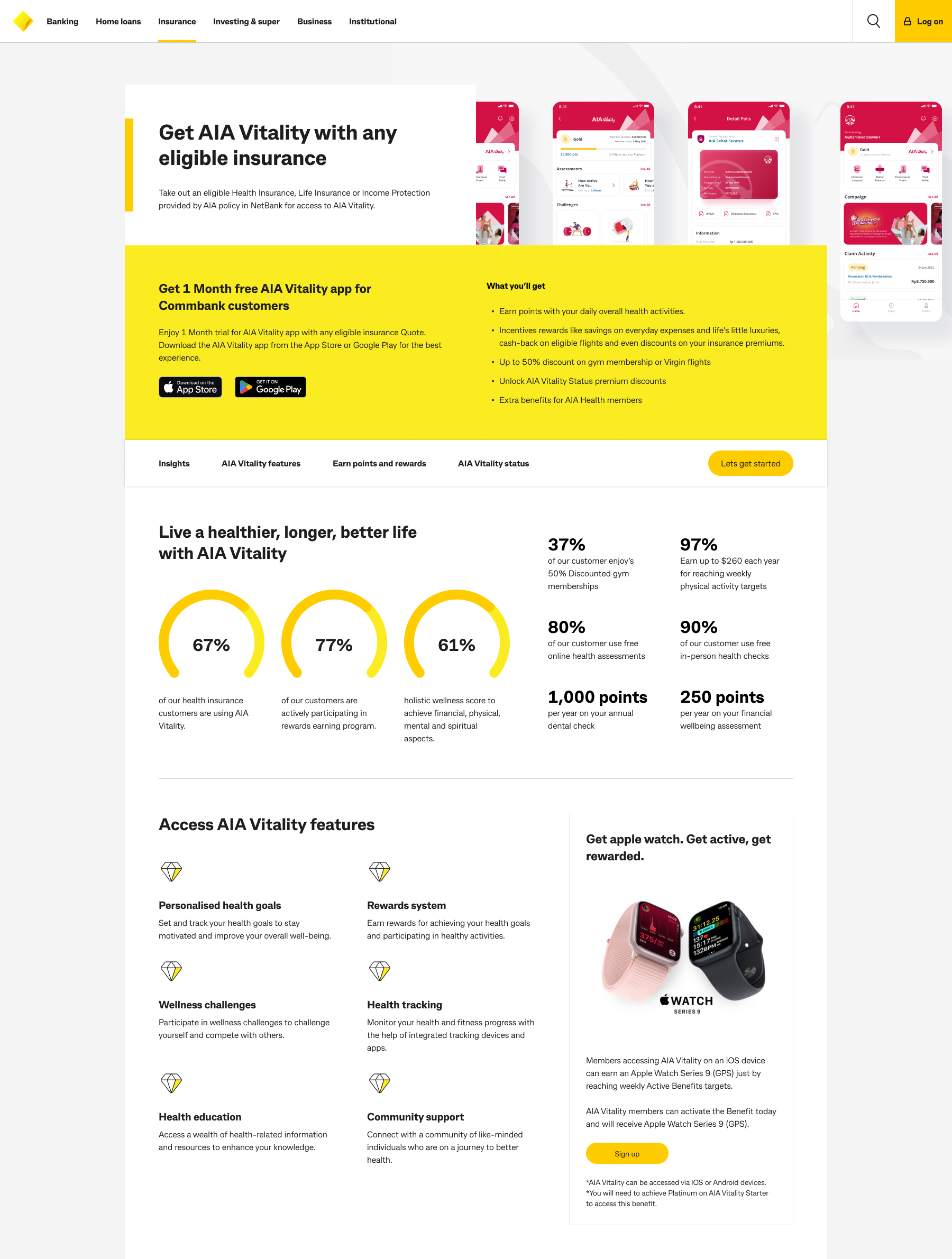

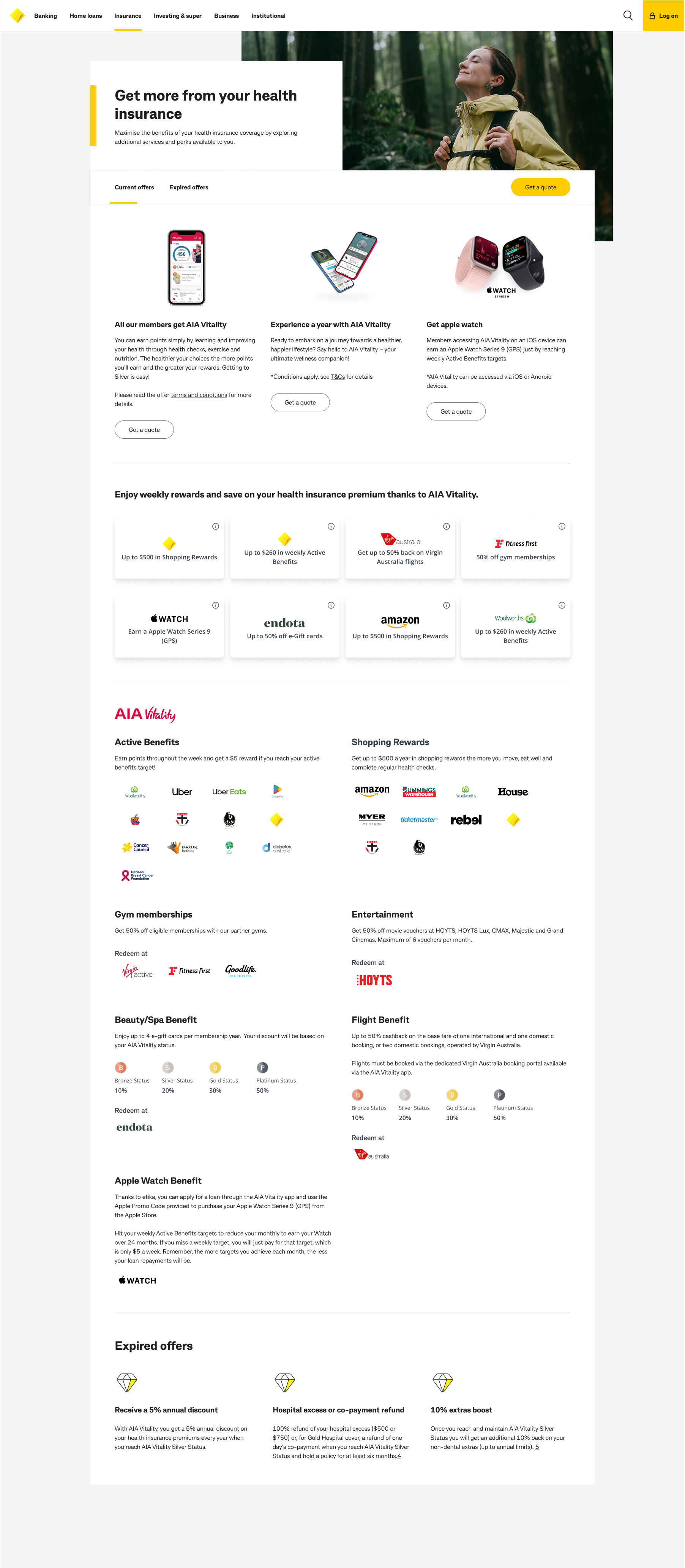

And because this wasn’t just about insurance, but wellness, we set our sights on a significant boost in AIA Vitality enrolments, reflecting our goal to help customers not just get covered—but live better.

Experience targets

Behind the numbers, we knew customer perception would be key. We aimed to lift Health Insurance NPS by 40+ points, driven by clarity, confidence, and ease of use.

We also set a high bar for wellness understanding—with a goal of having 90%+ of customers grasp the value AIA Vitality brings to their health cover.

And lastly, the journey itself had to feel seamless and intuitive, especially on mobile. Our aim: a quote experience that felt frictionless, responsive, and thoughtfully designed from first click to decision.

Strategic business objectives

This wasn’t just about tweaking a journey—it was about reshaping how customers saw CommBank. We were on a mission to shift perception—from a traditional bank to a trusted partner in wellness.

We wanted customers to see CommBank not just as a place for their money, but as a leader in health—a wellness-first insurer that genuinely cared about their long-term wellbeing.

Of course, the strategy had to make commercial sense. By boosting policy acquisition and encouraging deeper engagement through AIA Vitality, we aimed to turn better experiences into real growth.

But we also thought bigger. We set out to build more than a single solution—we designed a scalable, reusable framework. One that wouldn’t just support this initiative, but lay the foundation for future innovations across CommBank’s entire health and insurance ecosystem.

Definition of success

In the end, success wasn’t just a spike in numbers—it was a shift in how people felt.

It meant the confusion was gone. Customers weren’t overwhelmed or stuck behind barriers. Instead, they could explore freely, understand clearly, and take action when they were ready.

They could see the value in AIA Vitality—not as a buzzword, but as something real that supported their health. They felt confident completing a quote, and reassured in choosing CommBank to guide their wellness journey.

Because at the heart of it all, this wasn’t just a redesign. It was a promise: to create an experience shaped by empathy, trust, and what real people actually need.

What did we do?

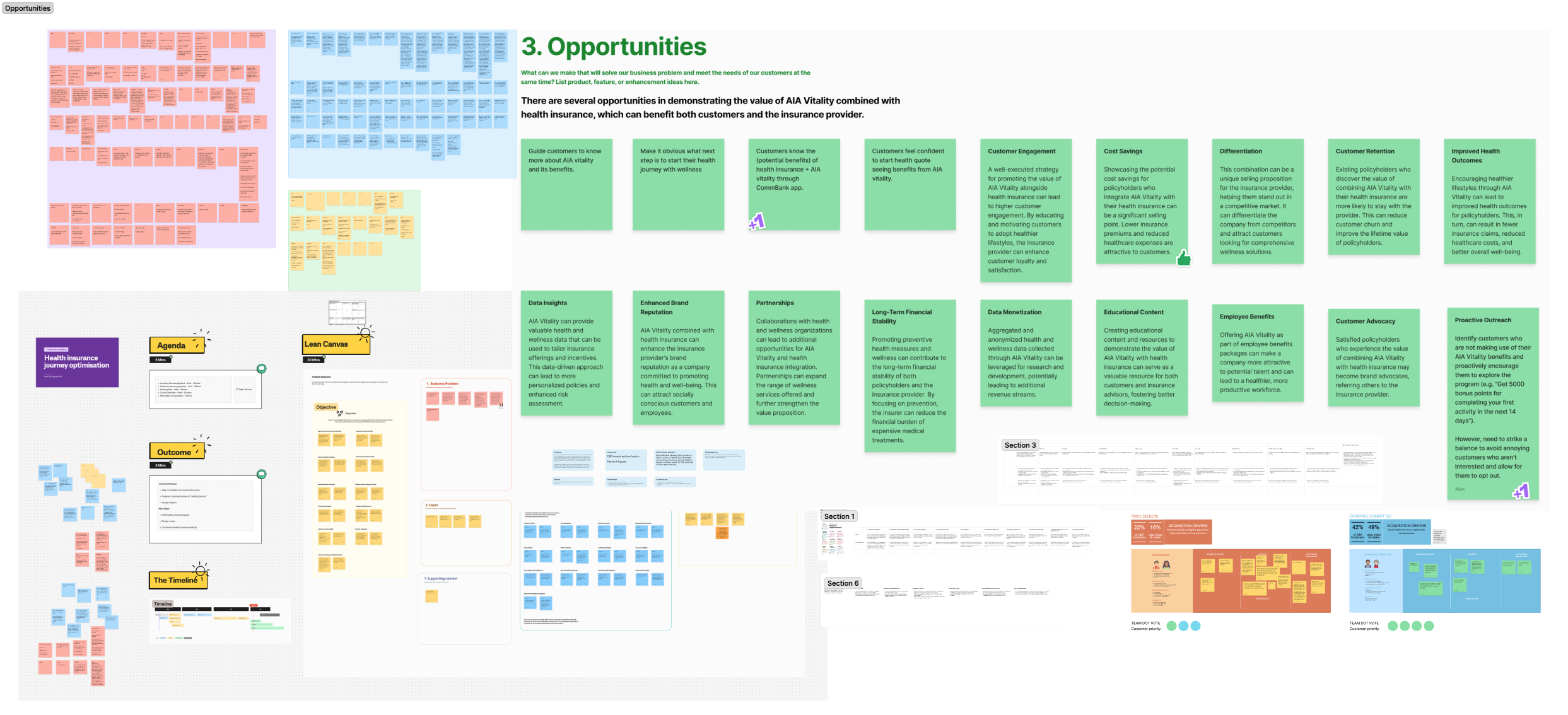

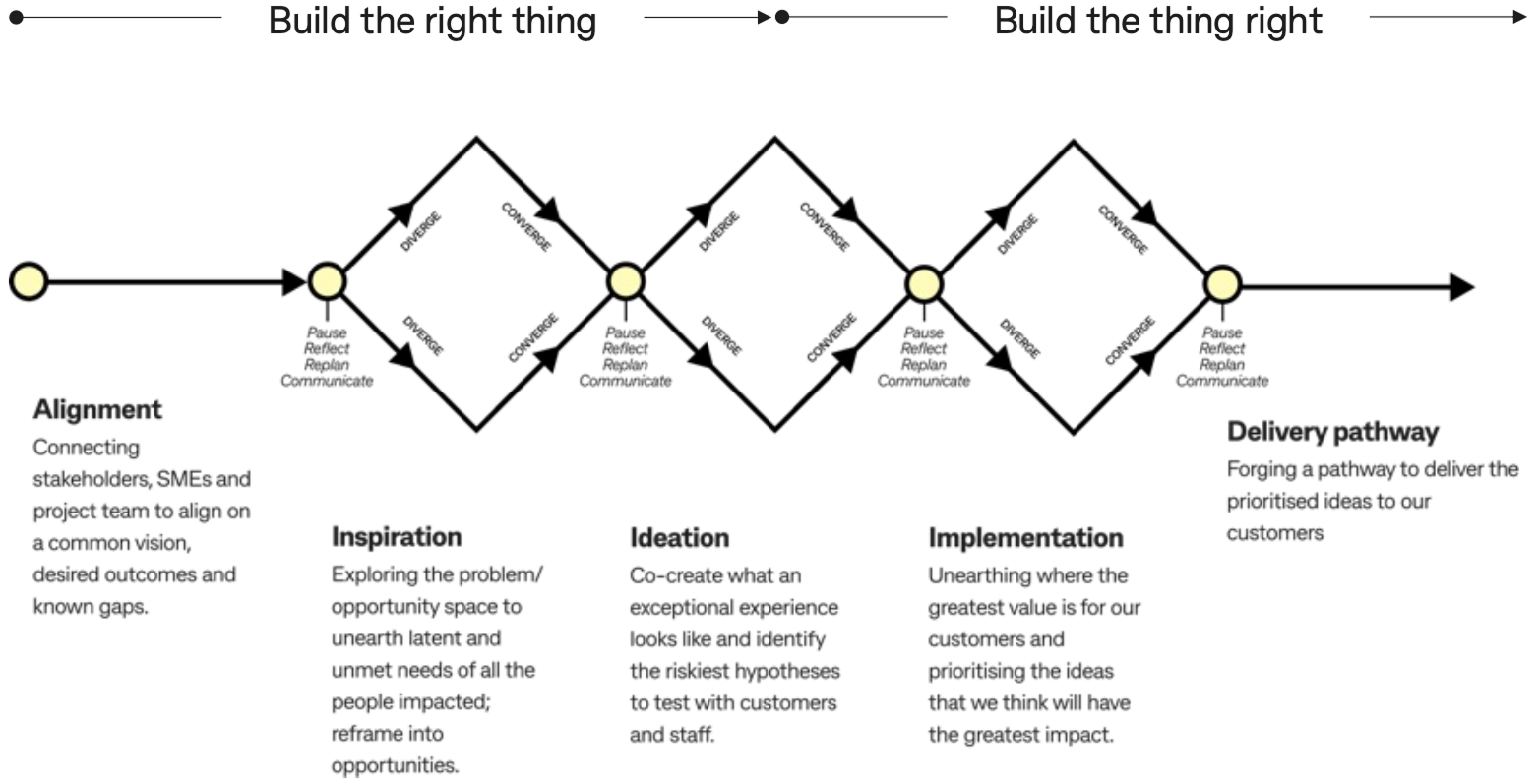

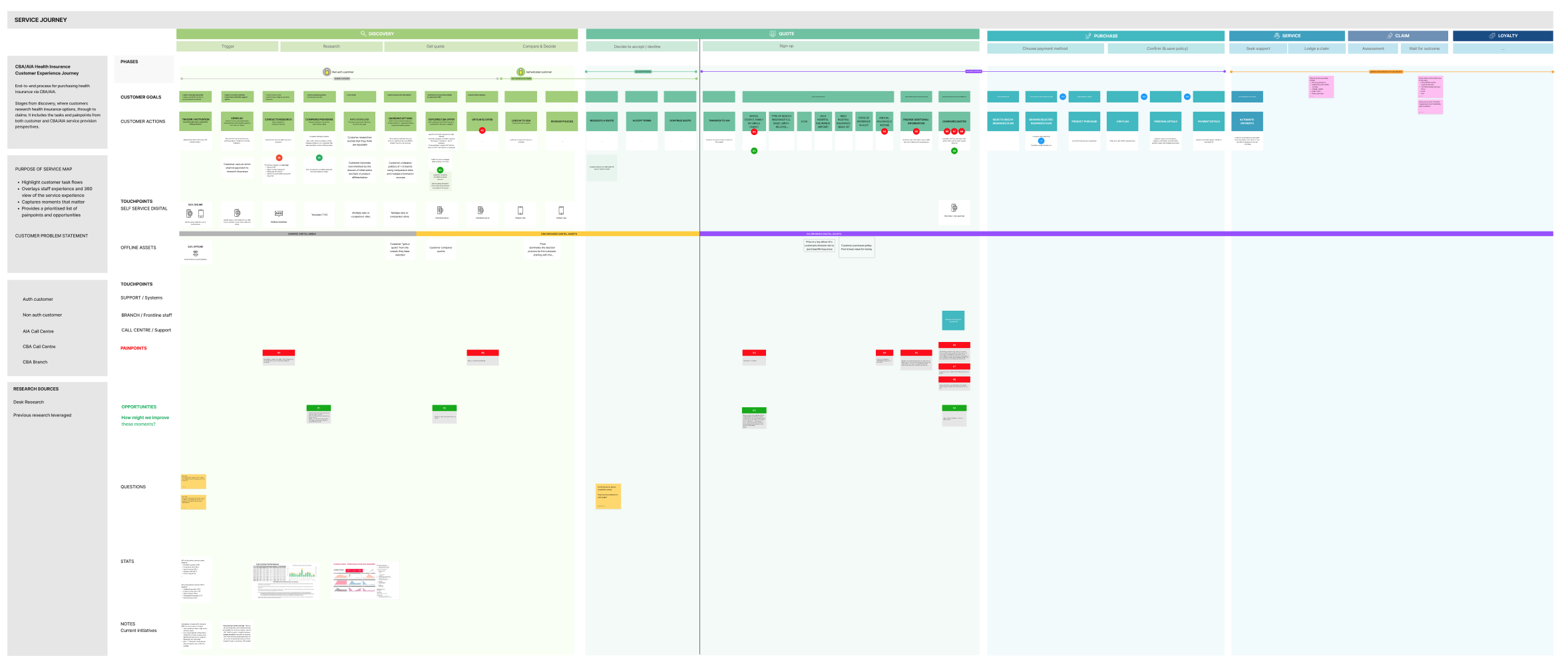

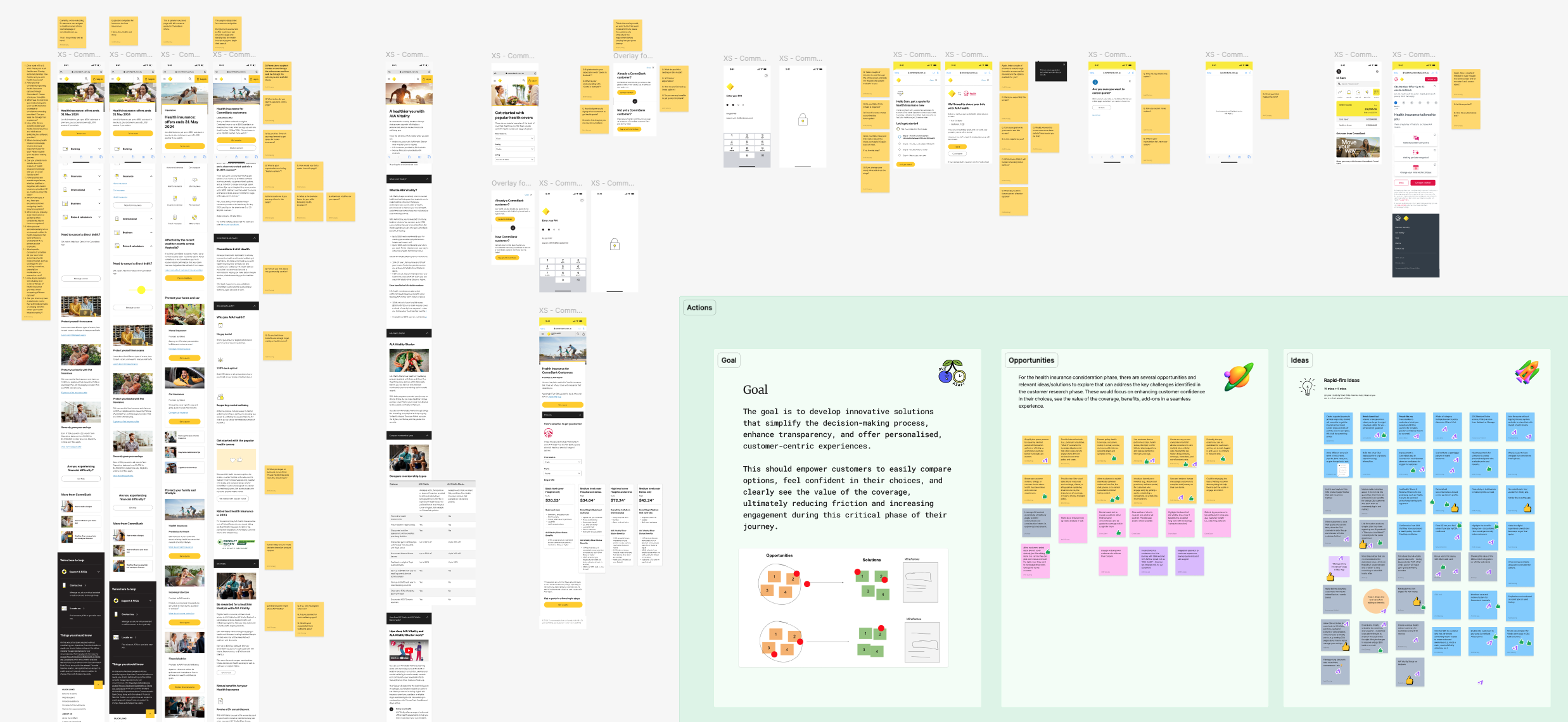

Tackling the fragmented health insurance journey required more than surface-level fixes. I led a deeply collaborative and iterative design process, grounded in human-centered design and CommBank’s Double Diamond framework. At every step, we listened to real customer pain, aligned with cross-functional teams, and validated our ideas through continuous discovery and testing.

Our approach unfolded through three focused design iterations, each one building on the insights and outcomes of the last—systematically reducing friction, improving clarity, and elevating the wellness value proposition.

Fixing the first impression: Redesigning entry points, product clarity and value of wellness

Research & discovery – listening to the problem

Our journey began with a critical question: Why were so many customers abandoning the health insurance experience before even reaching a quote?

To answer that, we kicked off a comprehensive research and discovery phase—designed to move beyond assumptions and uncover the truth behind customer behaviour.

Quantitative analysis: spotting the cracks

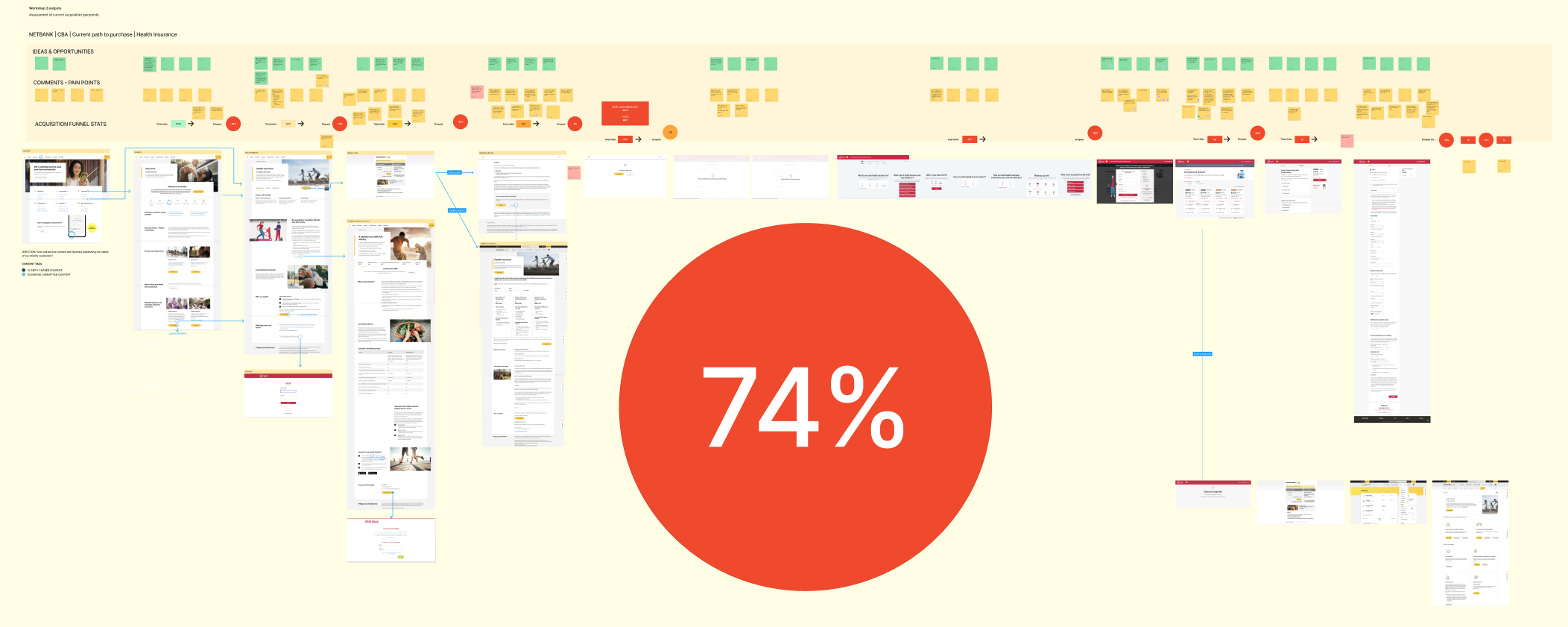

We started with the data. A deep dive into web analytics and funnel tracking showed a staggering 74% drop-off at some point of journey. Most users simply weren’t willing to log in without first understanding the value they’d receive. The quote completion rates were low, and interaction with AIA Vitality content was nearly nonexistent.

We also mapped click paths and drop-off patterns, identifying key friction points across the category page, product page, and quote journey.

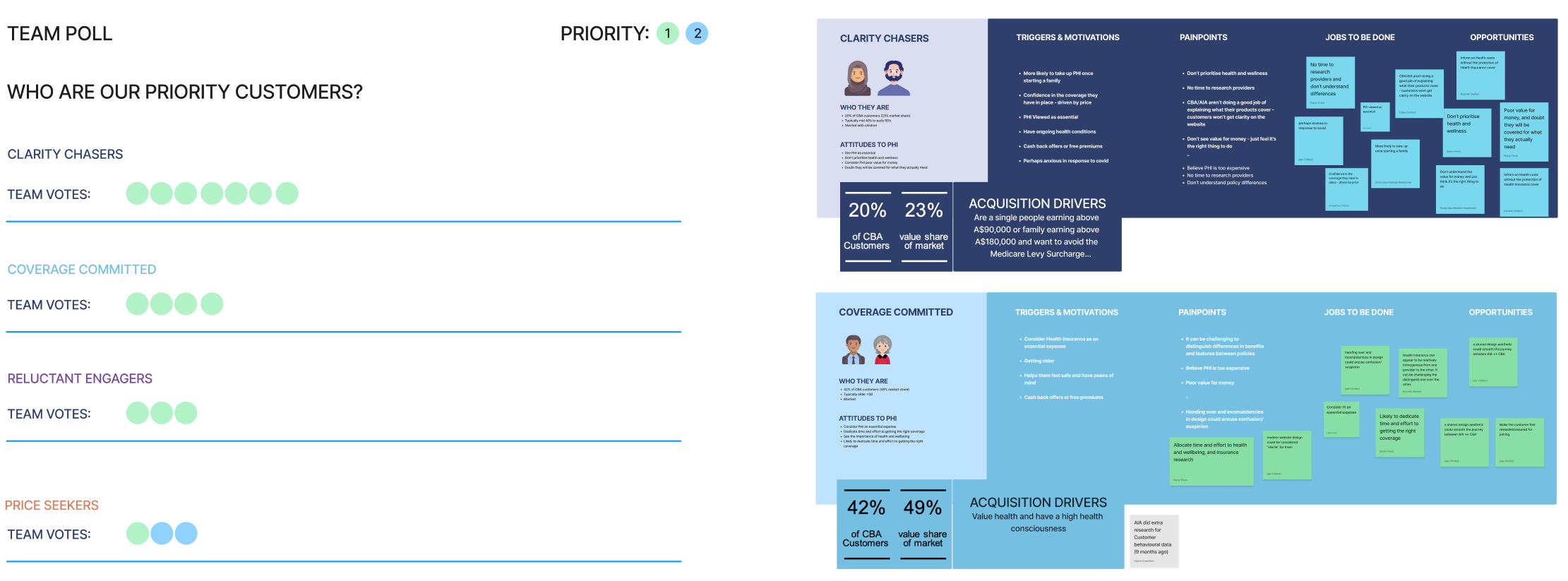

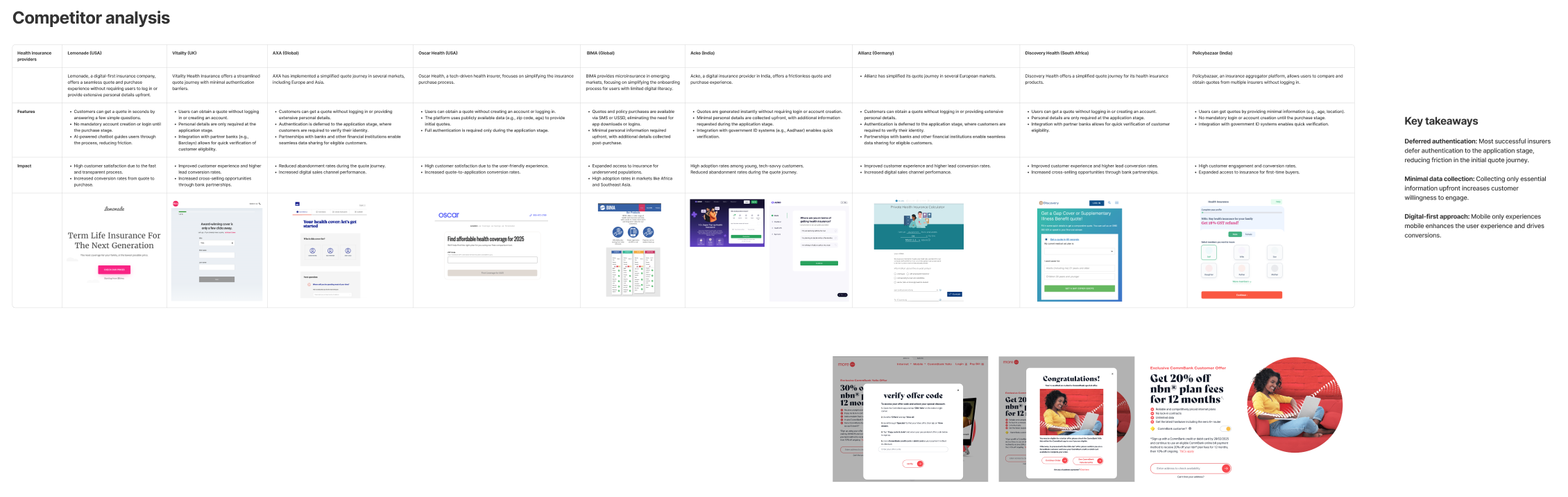

Competitor benchmarking: What the market was doing better

To understand what customers expected—and what competitors were doing right—we conducted a competitive analysis of health insurance providers and aggregator sites. We studied ing, Bupa, Medibank, nib, iSelect, and Compare the Market, noting that:

- Most offered open-access quote tools without forcing early authentication.

- Providers clearly displayed policy comparisons, value summaries, and pricing upfront.

- Aggregators allowed users to compare multiple quotes with a single form, reducing decision fatigue.

The gap between CommBank’s gated experience and competitors’ open, comparison-friendly models was a wake-up call.

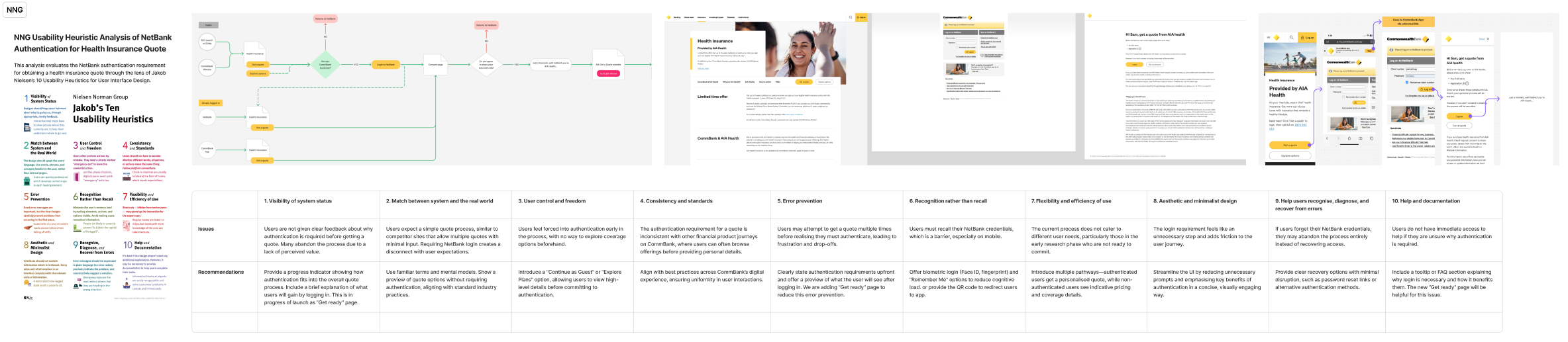

Heuristic evaluation: Where our experience fell short

Next, we ran a heuristics evaluation of the health insurance journey using Nielsen Norman’s 10 usability heuristics. Several key issues emerged:

- Visibility of system status: No clear indicators of quote progress or what steps were required.

- Match between system and real-world expectations: Insurance jargon and lack of clear benefits made the experience feel disconnected.

- User control and freedom: No way to preview coverage or pricing without logging in.

- Aesthetic and minimalist design: Key messages around AIA Vitality were buried and lacked hierarchy.

These usability violations reinforced what customers were already telling us: the journey felt unclear, unrewarding, and demanding too much, too soon.

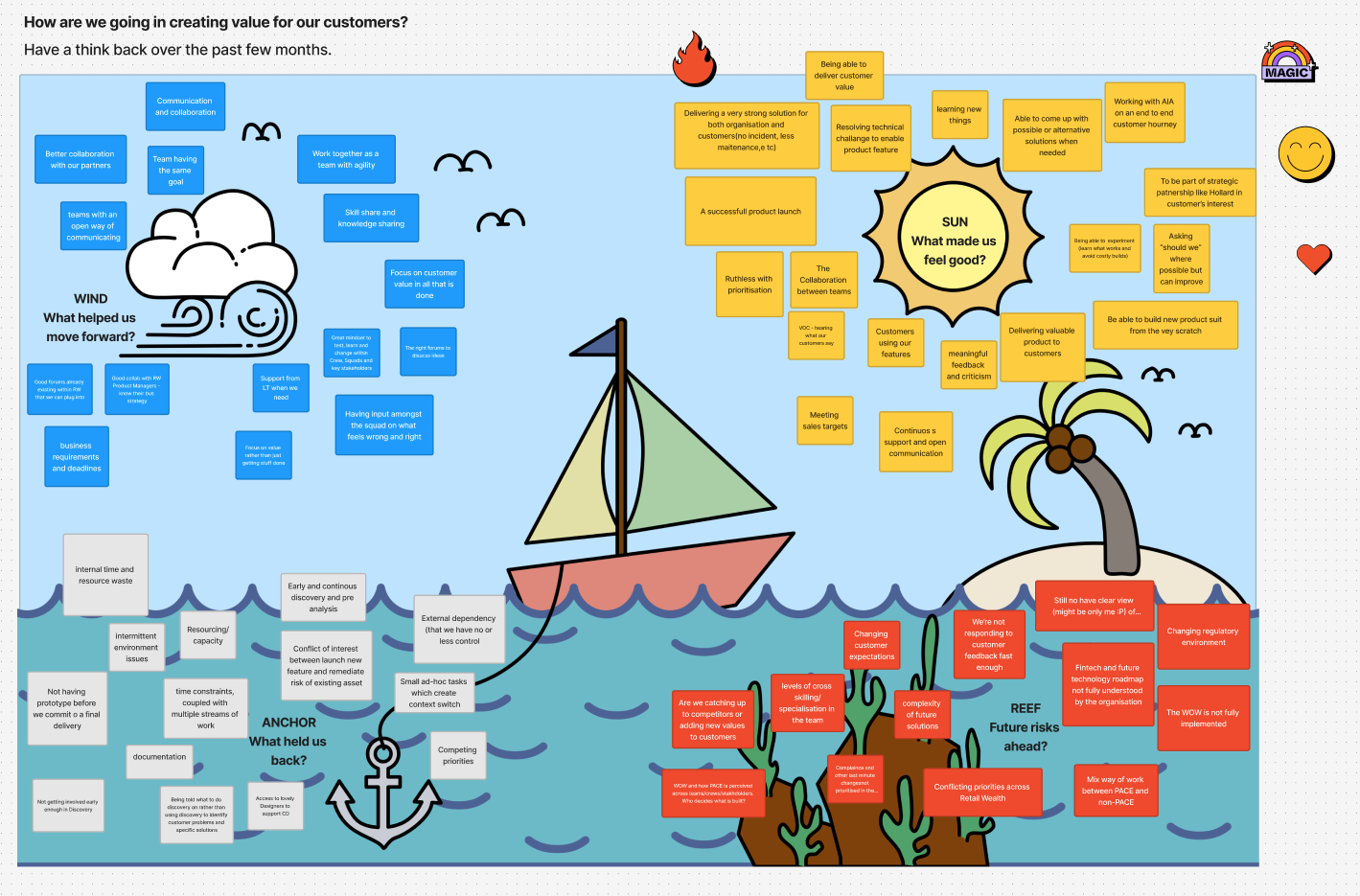

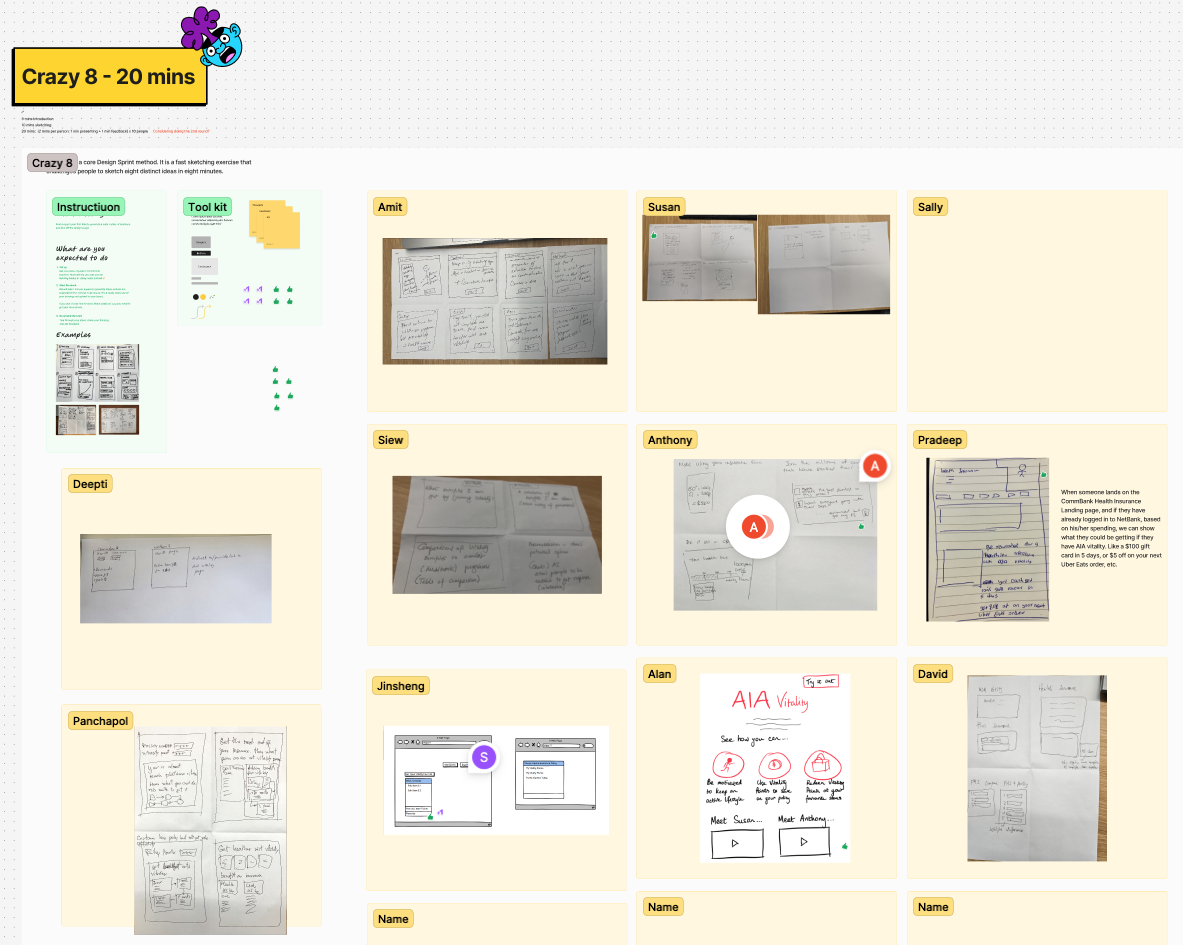

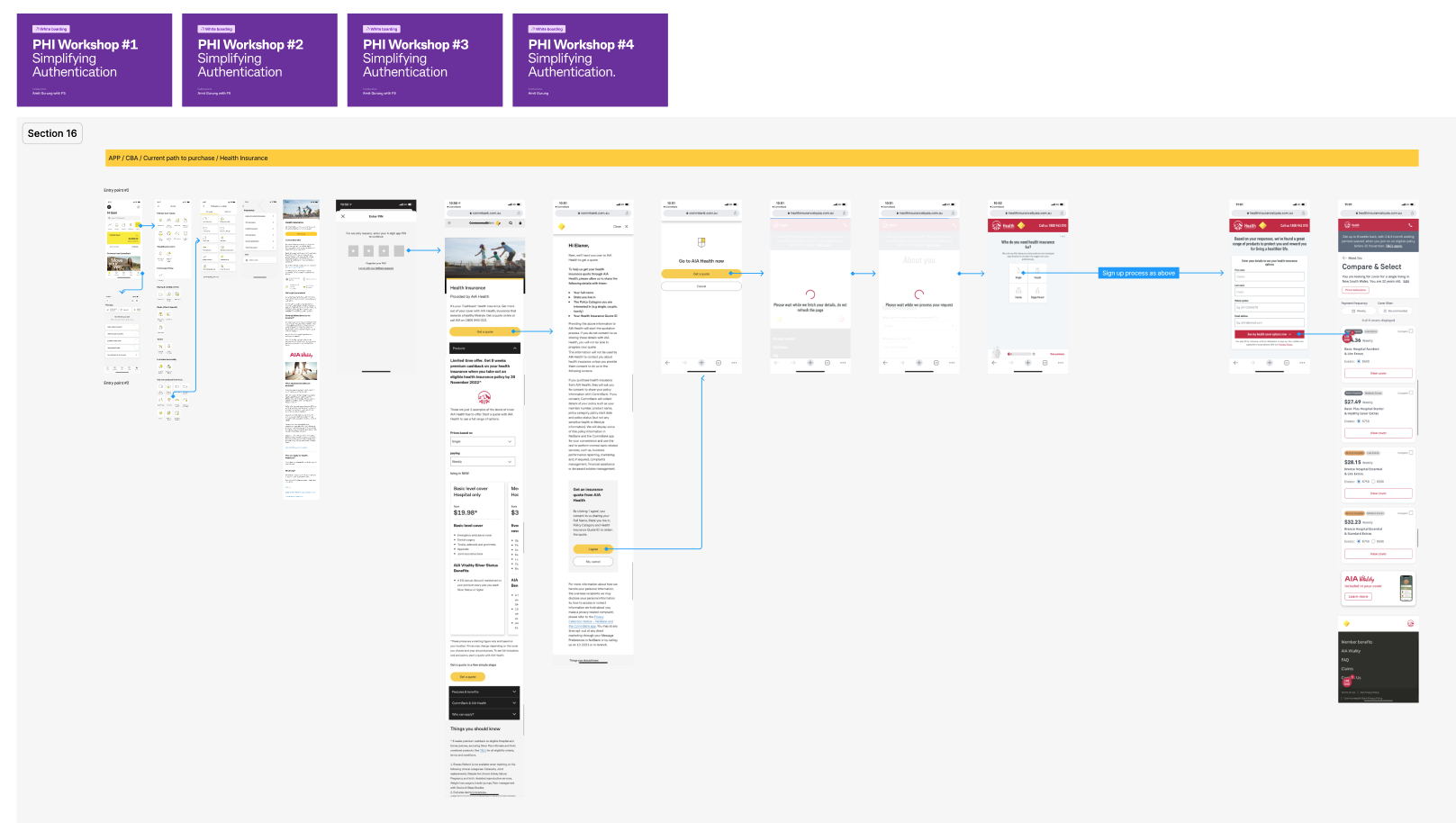

Stakeholder design sprint: Understanding the inside story

To complement customer and competitor insights, we ran a 5-day stakeholder workshop involving product owners, marketers, engineers, legal, and AIA stakeholders. These sessions helped us surface hidden internal blockers—from compliance requirements to legacy tech constraints—that were shaping the current experience.

What emerged was a clear insight: this wasn’t just a UX issue. It was a value clarity and trust issue, compounded by misaligned systems, unclear messaging, and a lack of early perceived benefit.

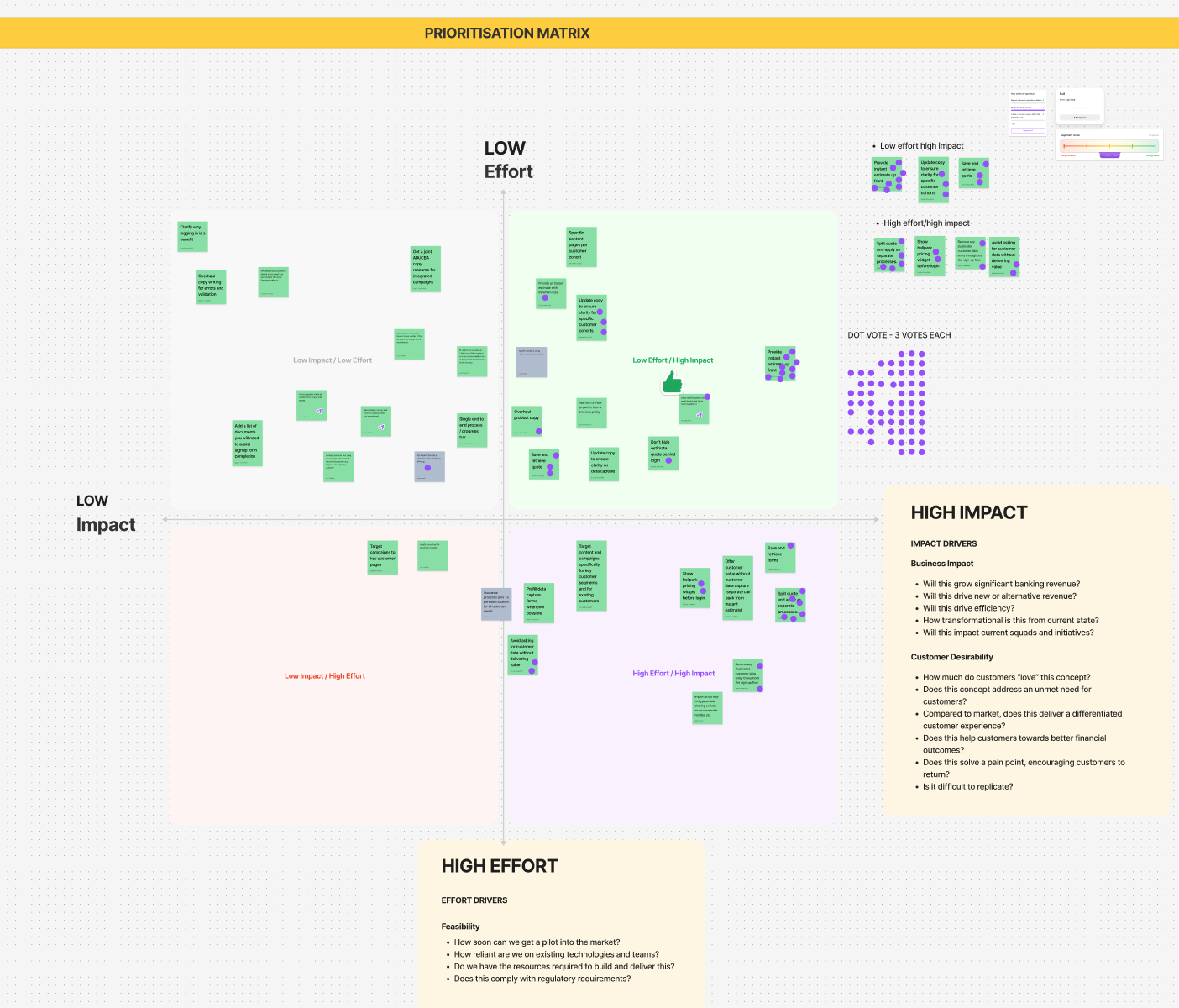

Defining our first iteration

With these findings in hand, we mapped a clear action plan for our first design iteration. We:

- Redesigned the product pages to surface key product inclusions, out-of-pocket costs, and highlight wellness value upfront.

- Simplified NBC logic to improve the visibility and clarity of quote entry points across CommBank digital touchpoints.

- Collaborated with AIA to suggest aligning the QAT (Quote Application Tool) with CommBank's UX standards.

- Reduced unnecessary quote steps, clarified what users needed to provide, and surfaced real value—like AIA Vitality rewards—as the reason to log in.

This wasn’t just about reducing friction—it was about rebuilding confidence, relevance, and trust in the journey from the very first interaction.

Key solutions for first iteration

- Guided health quote experience

We transformed the quote journey into a clear, supportive path—step by step. With intuitive navigation, real-time tips, and visual progress cues, customers felt in control, not overwhelmed.

Why it mattered: More people finished the journey with confidence, not confusion.

- AIA Vitality wellness showcase

Wellness took centre stage. We spotlighted Vitality rewards—like Apple Watch, gym perks, and cashback—early and throughout the journey.

Why it mattered: Customers saw real, everyday value in CommBank health insurance, driving stronger interest and intent to convert.

First round of usability testing

Before designing solutions, we needed to understand what truly mattered to our customers. In this first round of testing, we explored their attitudes toward health insurance, what they valued in a product, how they felt about CommBank’s partnership with AIA, and how well our digital experience supported their needs.

It was about more than usability—it was about trust, clarity, and whether we were even solving the right problems.

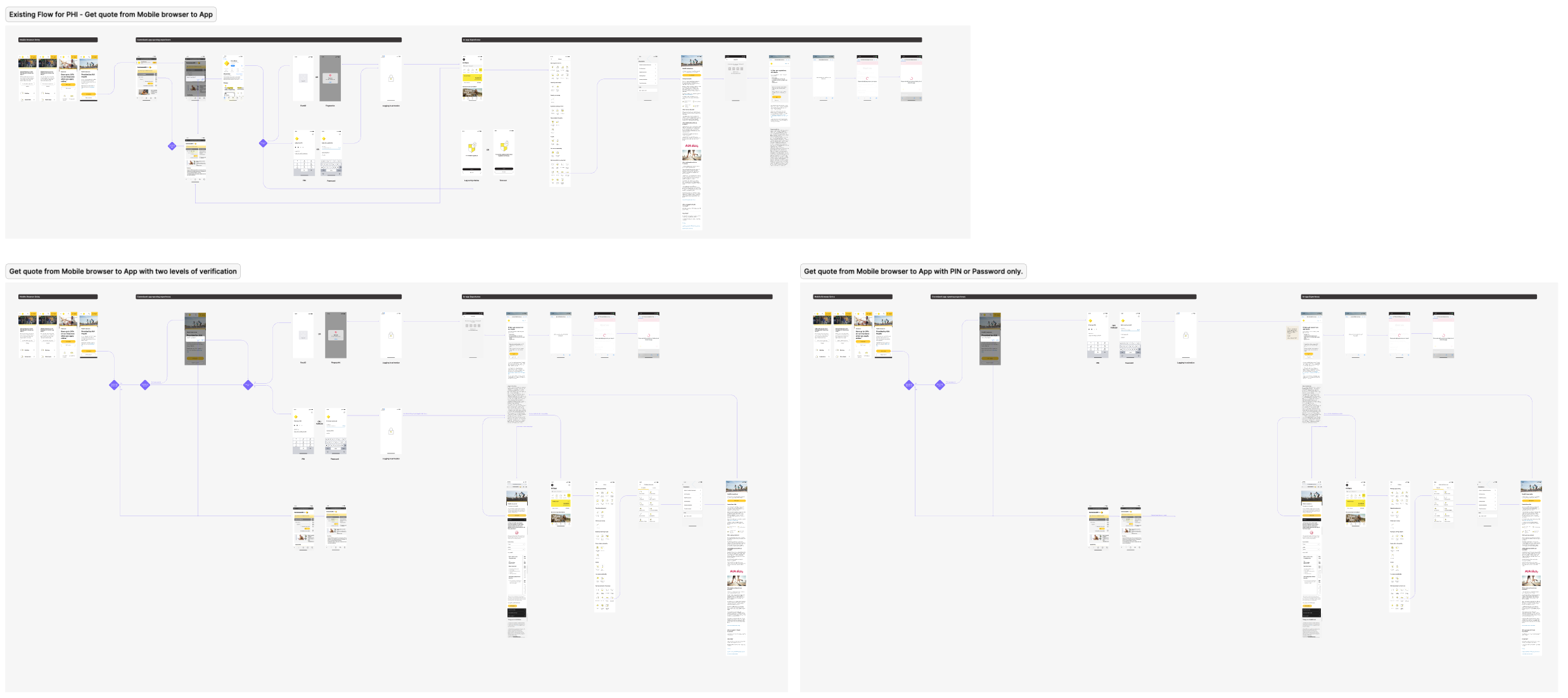

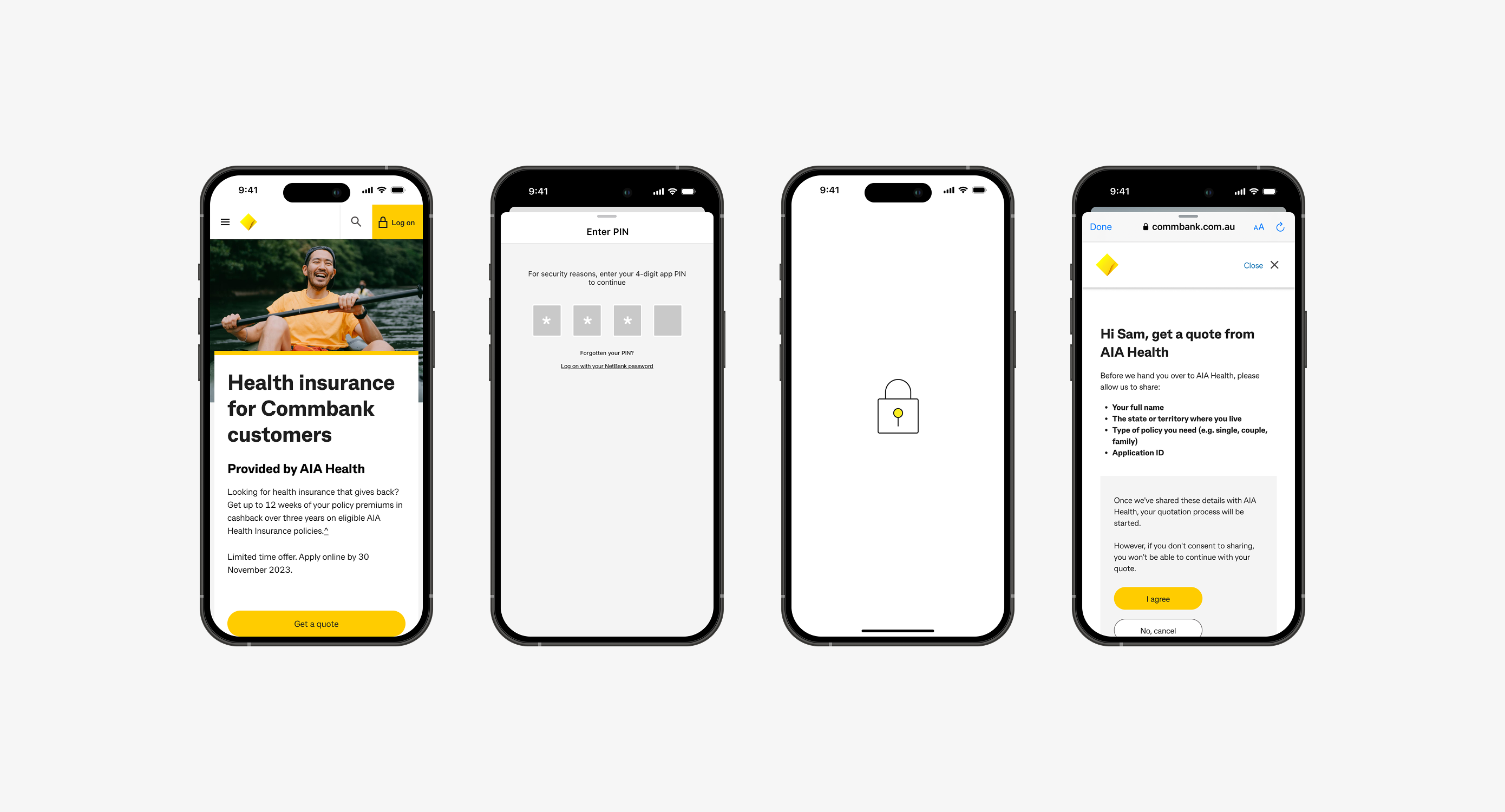

Second iteration – Universal link mobile quote integration

As we gained momentum from the first round, one pain point became impossible to ignore: mobile users were getting lost. Whether arriving from an NBC, an email campaign, or SMS reminder, they were hitting dead ends or being forced to download an app or log in without context.

Research & insight

Customer feedback and analytics told us that the mobile journey was fragmented and inconsistent. Campaign traffic had high intent—but was met with friction at entry. We saw significant drop-offs when users couldn't easily find their way into the quote experience.

Collaboration

Working closely with our developers, product teams, and campaign specialists, we co-created a universal deep link solution—smart enough to detect platform context (browser, app, or NetBank) and route users to the right place.

Design & delivery

We designed a seamless, mobile-first entry experience that worked regardless of where a user came from. No redirects, no blockers—just straight into the quote.

Testing embedded in the real experience

For our second iteration, we made a deliberate choice: rather than testing in a controlled environment, we would validate our solution live in-market. The universal link was deployed into active campaigns—NBCs, SMS, and email—to observe real user behaviour in real-time.

This live testing allowed us to track click-throughs, drop-offs, and successful quote initiations against our baseline. It wasn't just about usability—it was about impact at scale.

By embedding the test in the actual customer journey, we were able to measure success directly against our key metrics—including quote starts, conversion rates, and campaign effectiveness. It proved that a seamless, device-aware entry point made a meaningful difference.

Outcome

The result was a smoother, smarter path to quote initiation—particularly for mobile campaign users. We saw stronger engagement and clearer attribution from NBCs and outbound communications, helping convert previously lost traffic into active journeys.

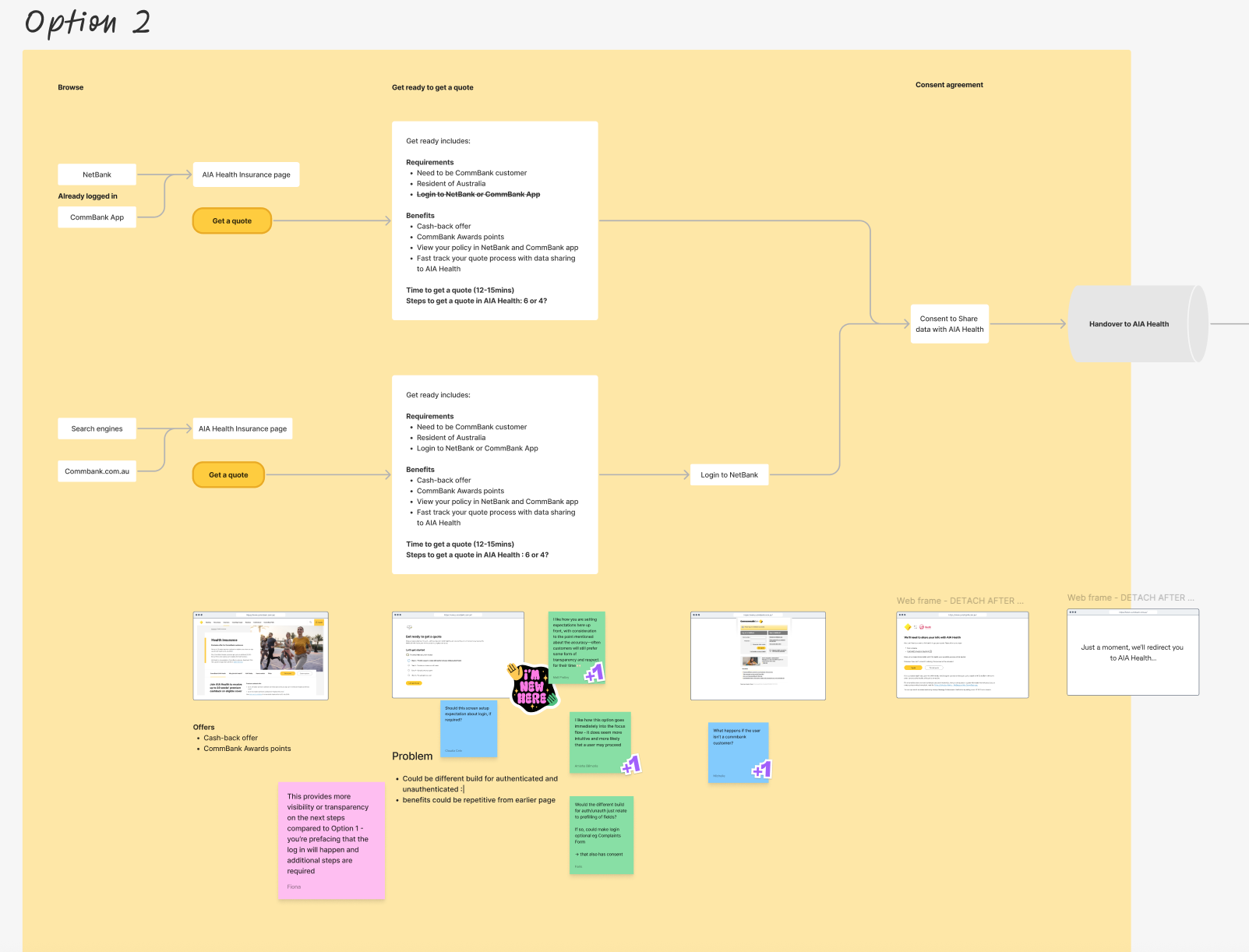

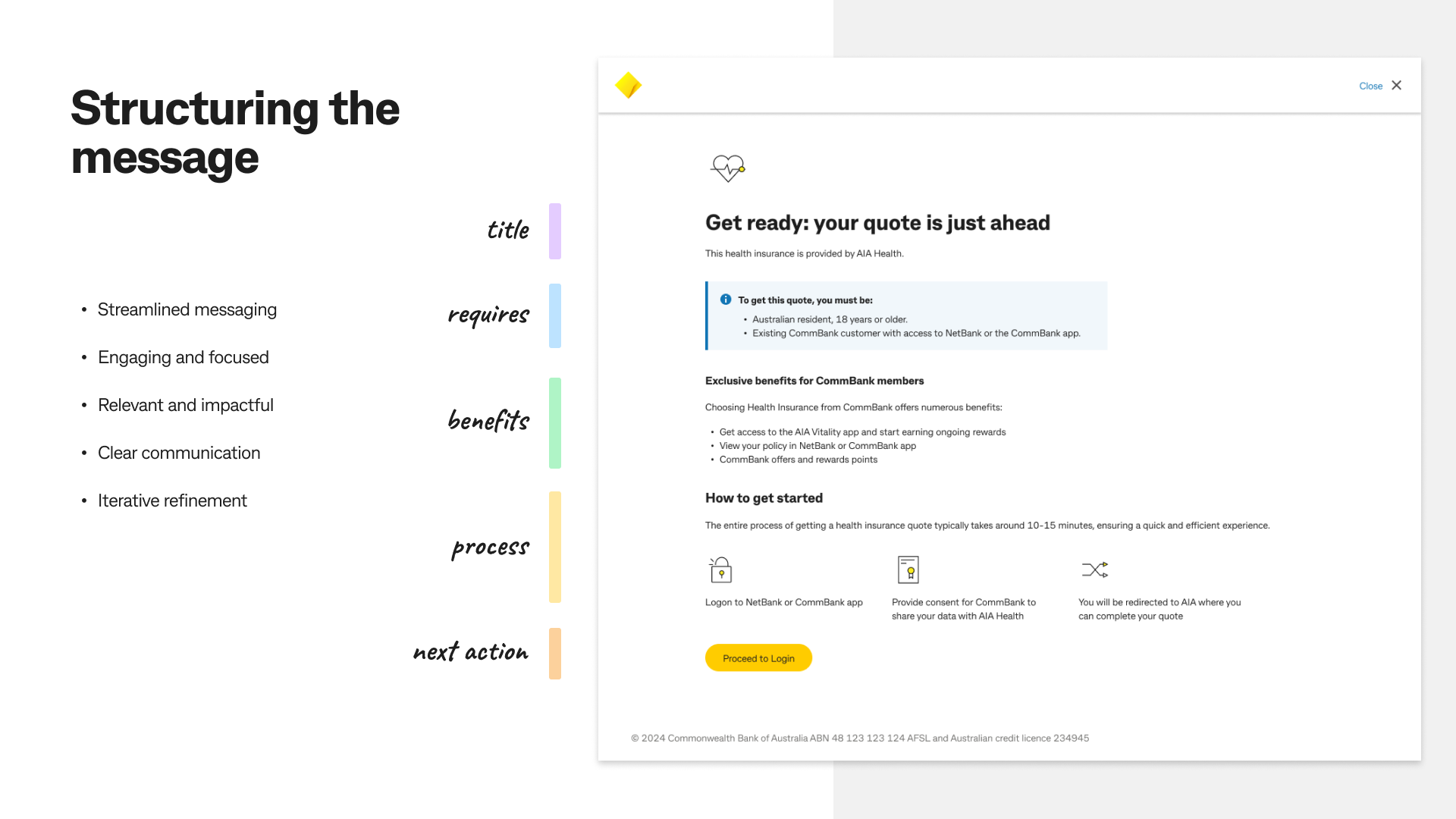

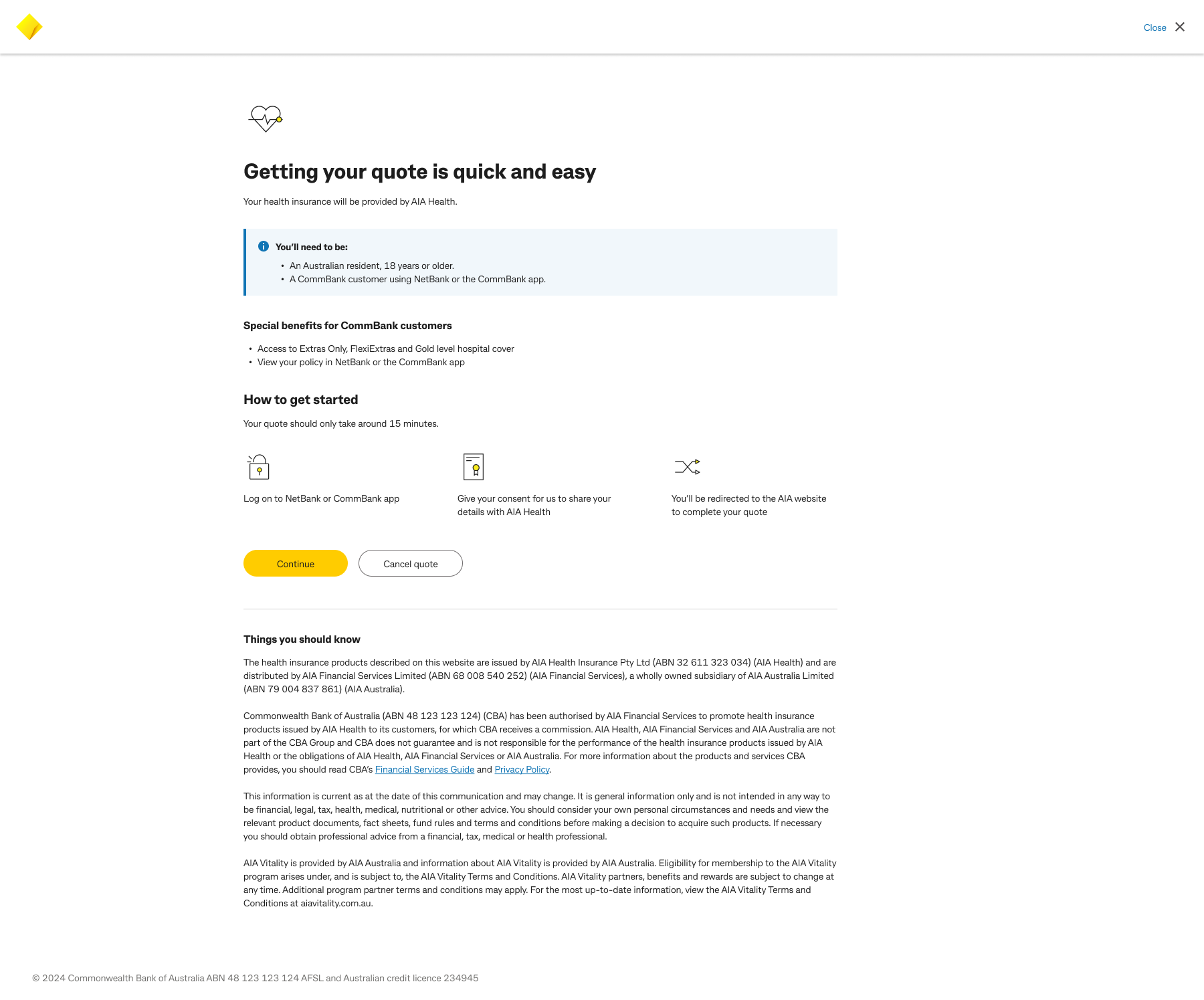

Third Iteration – “Get ready” experience

By now, we had solved much of the mechanical friction—but a different kind of hesitation remained. Customers still didn’t understand why they should proceed. They didn’t know what information they’d need, what they'd get in return, or how long it would take.

So we took a step back—not to change the quote tool itself, but to reframe the moment before it began.

Research & insight

Through customer testing and usability feedback, we learned that people wanted reassurance before committing to a quote. They needed clarity, a sense of control, and above all—a reason to care.

Collaboration

We worked cross-functionally with legal, marketing, and product teams to create something simple but powerful: a “Get ready to get a quote” page. This served as a soft entry point—setting expectations, removing surprises, and reinforcing value.

Design & delivery

The page clearly outlined the next steps, highlighted AIA Vitality benefits, and explained what information would be needed and why. It gave customers time to breathe before they were asked to act.

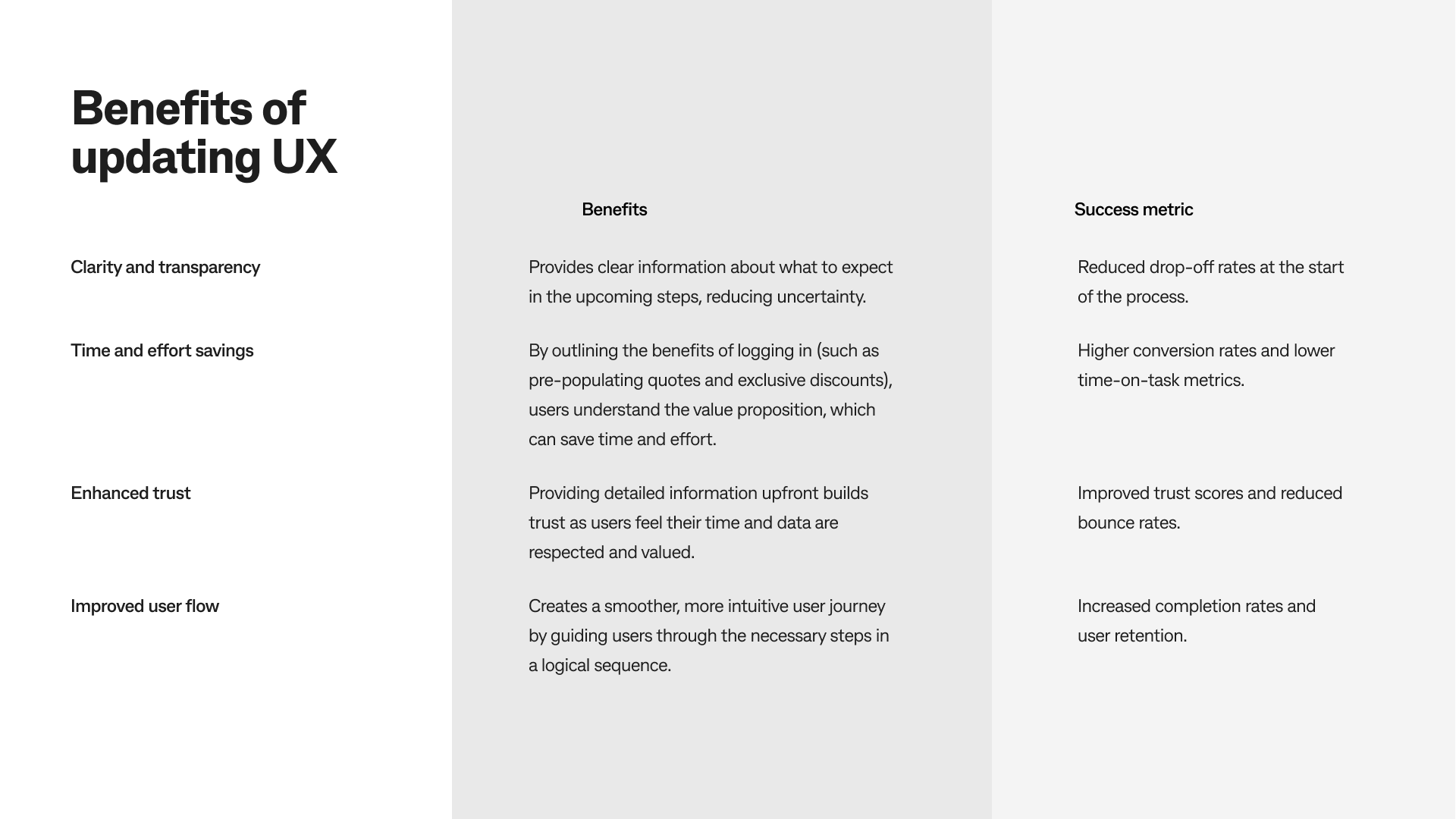

Testing: Driving stakeholder confidence through evidence

The third iteration—the “Get ready” page—was born from behavioural insights, but we knew that for it to stick, we needed more than customer stories. We needed evidence to bring stakeholders on board.

So this round of testing was designed not just to validate design—but to demonstrate strategic impact.

We tested the “Get ready” experience through moderated usability sessions and behavioural tracking, focusing on how it influenced quote intent, comprehension, and drop-off patterns. The results were clear: customers who saw the page felt more prepared and were more likely to continue.

These insights became a powerful tool in our conversations with stakeholders. It helped us secure buy-in for broader rollout and proved that even small, well-timed interventions can unlock real behavioural change.

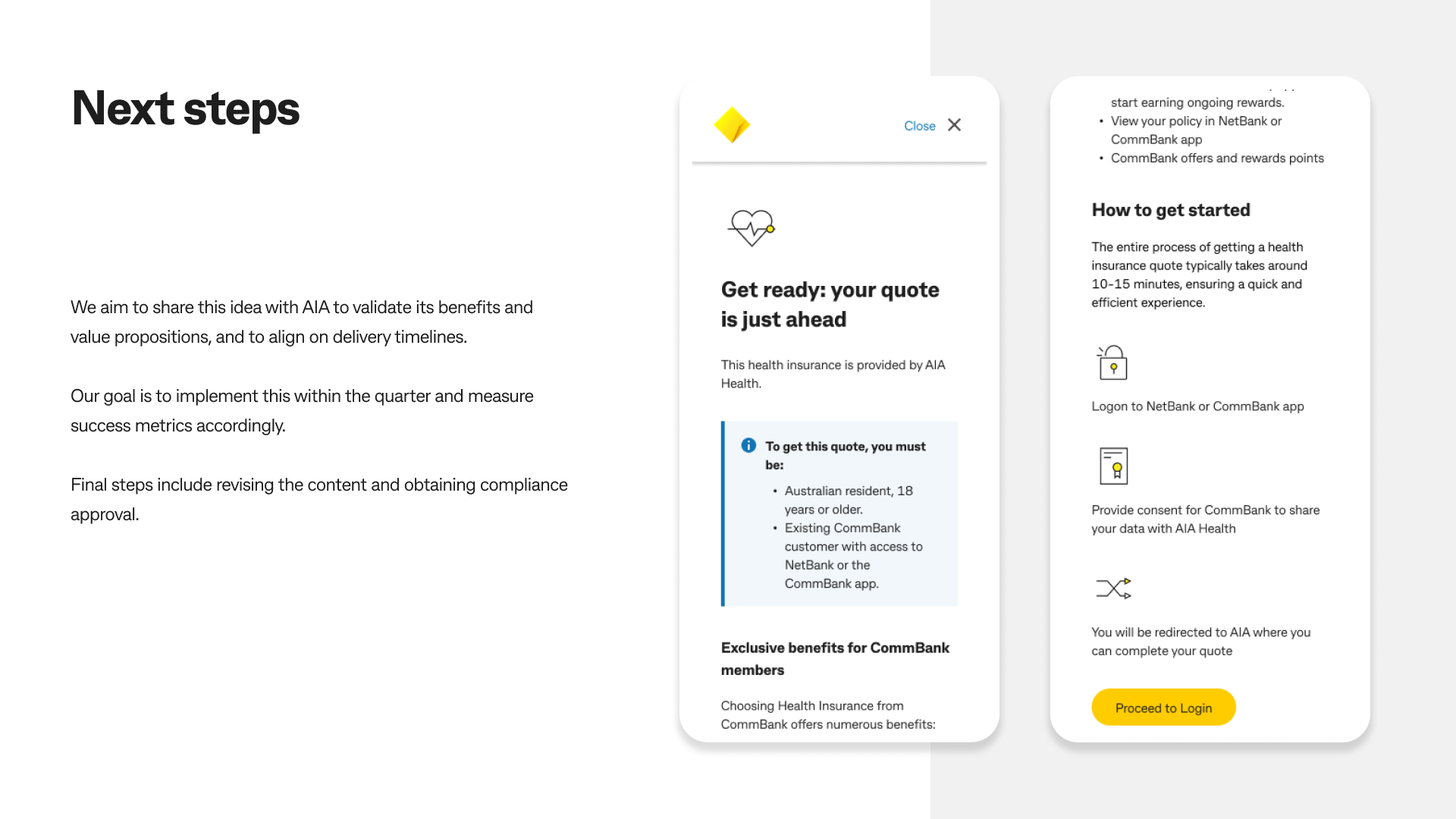

Outcome

Early feedback showed stronger progression from the product page into the quote tool. Customers felt more confident, less rushed, and more informed—turning hesitation into action. The page is now positioned for A/B testing with measurable success indicators.

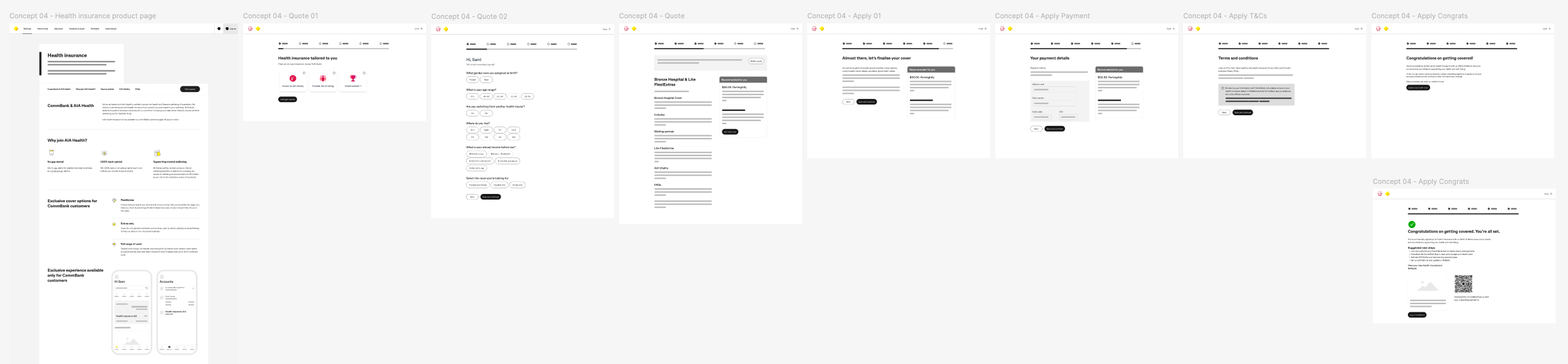

Future iteration – "Simple Authentication"

In the most recent quarter, our discovery journey took a bold new direction.

The partnership posed a new question:

“What if we could open the offering to everyone in Australia—not just CommBank customers?”

It meant allowing anyone—regardless of whether they banked with us—to get a quote and even buy insurance via CommBank's platform. No NetBank login. No consent. No locked doors.

But this wasn’t just a user experience change. It was a strategic realignment at the partnership level. With this move, CommBank would lose the NetBank Channel exclusivity (NBCs), and the experience would pivot from a product-sale model to a referral model.

That raised big questions:

- Would reduced NBC value justify the shift?

- Could we manage the maintenance cost vs. commercial return?

- How do we retain brand trust without controlling the post-purchase experience?

We tackled this iteration with the same HCD rigor.

We mapped the new landscape:

- Friction was still our enemy—only this time, it was consent and sign-up.

- We envisioned a light-touch onboarding flow that didn’t need login to begin.

- We explored backend API-powered journeys where customer identity could be matched and linked post-purchase, maintaining data integrity while freeing the front-end experience.

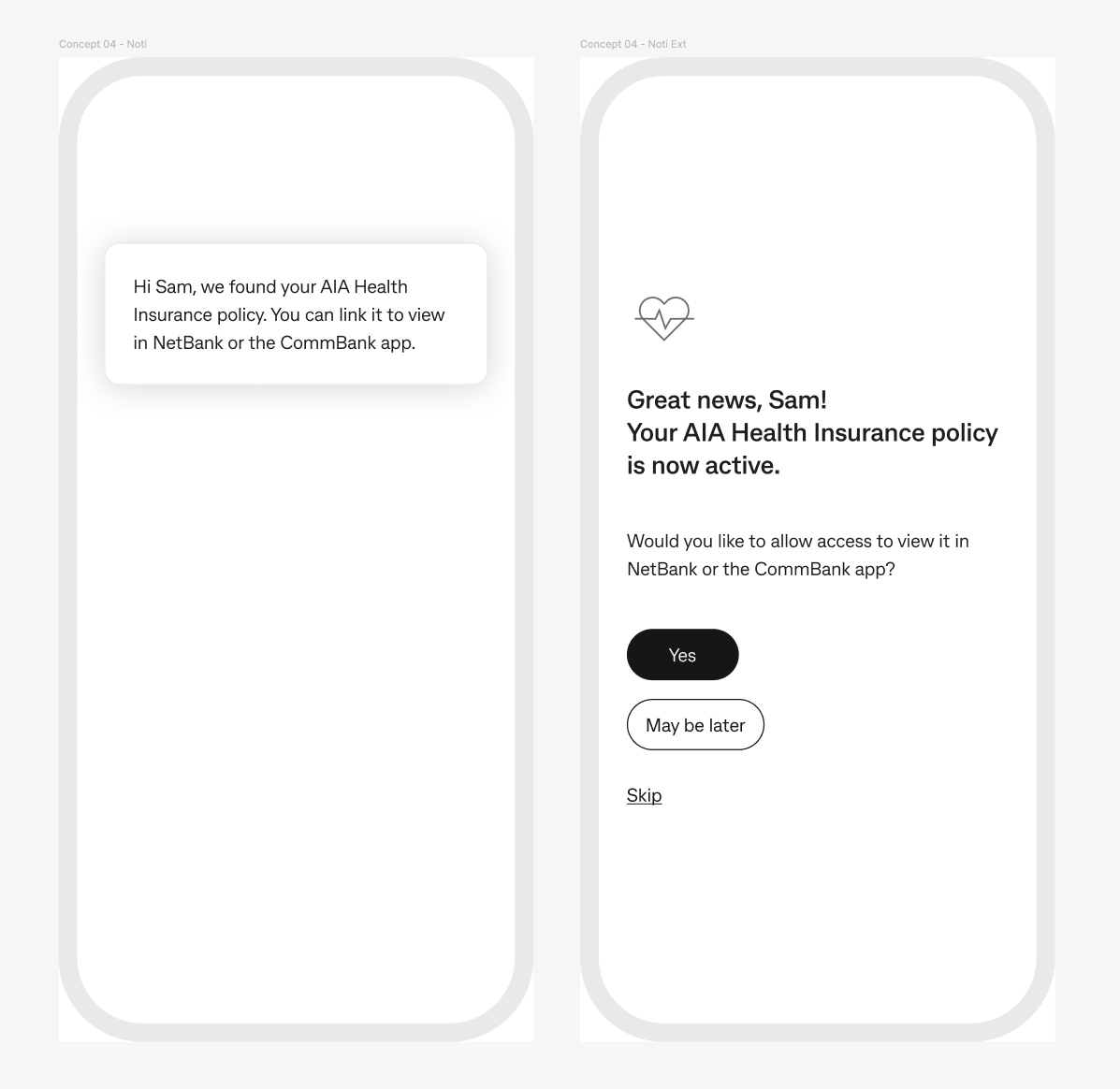

We prototyped:

- To reduce friction and expand reach, we prototyped three quote pathways: login upfront, deferred login post-quote, and a fully accessible no-login option.

- A guided onboarding journey after purchase

- Notifications to initiate linking between CommBank and AIA profiles

- Consent capture reimagined as a contextual step instead of a barrier

This required more than UX—it needed alignment with legal, data, and engineering to explore data-matching technology that could maintain compliance and customer experience.

We're now validating the assumptions through prototype testing and impact modeling.

The outcome: Real results, real momentum

When we set out to redesign the health insurance experience, we weren’t chasing vanity metrics—we wanted to change the way people felt about insurance. We wanted customers to feel informed, empowered, and genuinely cared for. And that shift paid off.

As we rolled out each phase—from clearer value messaging to a more intuitive quote journey—we saw something powerful: customers not only stayed engaged, they leaned in.

Trust rebuilt, confidence restored

Customers responded to clarity and simplicity. +55 points in NPS told us we were on the right track—delivering a journey that finally felt helpful, not overwhelming.

Curiosity turned into action

By streamlining the quote experience and removing friction, we saw a 200%+ increase in quote engagement. More customers explored their options—and more completed the journey.

Our wellness-first approach struck a chord too. With AIA Vitality surfaced early and often, nearly 40% of customers reached Silver or higher status—proof they saw the value and committed to healthier habits.

Campaigns that connected

Our digital campaigns went beyond impressions—they sparked action. NBC placements, offers, and social content drove a 3000%+ spike in engagement, as customers responded to messages that finally made wellness feel tangible.

Momentum across the funnel.

The numbers showed movement everywhere:

- Drop-off from product page to login fell from 74% to 44%—a huge win in simplifying early decisions.

- Top-of-funnel conversions grew from 14.7% to 19.7%, even hitting 40% in peak months.

- Consent rates doubled, as clearer value made customers more comfortable sharing information.

- With new nurture flows, smarter segmentation, and digital enhancements like targeted switcher messaging, we made every touchpoint count.

Awareness reimagined: From quiet to curiosity

At the start, few customers even knew CommBank offered health insurance. But once we redefined the message—and made wellness the heart of the story—people started paying attention.

Traffic didn’t just trickle in—it exploded. We saw a 1,928% surge in visits to CommBank’s health insurance pages, as curiosity turned into real exploration.

The momentum didn’t stop there. Platform traffic jumped 735%, and direct traffic rose 84%, showing that more customers were actively seeking us out—not just stumbling across us.

Then came the social breakthrough. With campaigns that spoke to real life and real value, we saw a 7,432% spike in social traffic—a clear sign our message was landing where it mattered.

Email engagement soared by 667%, and organic search grew 30%, proving that when the story is right, people don’t just click—they connect.

The story here is simple: when we put customer needs at the centre—when we focused on clarity, confidence, and real value—people didn’t just notice. They acted. And in doing so, they helped CommBank move from just another insurer to a partner in their health and wellness journey.

Key takeways

1. Strategic business impact: Shifting the landscape

This wasn’t just a product update—it was a repositioning of CommBank’s role in people’s lives. The commercial results followed. With a sharper journey and more compelling value, conversion rates climbed, and we exceeded targets across sales, ANP, and customer acquisition.

But perhaps the biggest win? We didn’t just solve for today—we built for tomorrow. Our new design system became a scalable blueprint, powering faster launches and consistent success across future health offerings.

2. Customer benefits: Real value, real impact

We introduced more choice and more relevance: From Extras-Only cover to new Hospital plans and boosted benefit limits, customers now had options that fit real life.

We made it easier to understand and easier to afford: Simplified product labels, 100% optical claims, and reduced premiums made cover feel approachable and rewarding. And we didn’t forget mental health—psychology benefits were added to all Extras plans, reflecting what really matters to our customers.

The shift was clear: Nearly 40% of Vitality members reached Silver status or higher, a sign that customers weren’t just buying insurance—they were engaging with their health and wellbeing like never before.

3. Show, don’t just tell—wellness needs to be visual

We learned that simply talking about wellness wasn’t enough. Customers needed to see it, feel it, imagine it in their lives. So we wove AIA Vitality into the experience—through imagery, rewards, and real-life benefits. The result? Engagement spiked, and enrolments followed. When wellness became visible, it became valuable.

4. Mobile-first or fall behind

The biggest drop-offs were happening where most customers started—on mobile. Long forms, clunky flows, and unclear steps were costing us. So we rebuilt the quote journey from the ground up with mobile in mind. With a universal link and a sleek, responsive design, we turned friction into flow—and mobile into our strongest acquisition channel.

5. The “Get ready” page: Replacing uncertainty with confidence

Before customers even entered the quote journey, we introduced something simple yet powerful—a “Get ready” page.

Why? Because we learned that hesitation often came from not knowing what’s ahead. People didn’t want to start a process they didn’t understand or weren’t prepared for. So instead of jumping straight into questions, we offered clarity upfront..

Additionally

Quote friction isn’t just a tech issue—it’s an emotional one. We learned that customers need assurance that they’re making the right health decisions—our job is to reduce anxiety, not just clicks.

Discovery is never done. Health insurance is complex and emotional. Continuous discovery allows us to remain adaptive, customer-led, and competitive.

Reflection

This initiative demonstrated the power of aligning human-centred design with business strategy. By optimising the quote journey and clearly communicating product value—especially AIA Vitality—we created a scalable design system that drove results across acquisition, engagement, and retention. The use of Honeycomb and ReactJS enabled rapid rollout, and cross-functional collaboration ensured that every touchpoint was designed for clarity, confidence, and customer connection.